ASEAN formation and its Luxembourg connection may seem like an unusual pairing, but upon closer inspection, reveal interesting intersections in the world of finance and development. This article delves into this intriguing connection, exploring how Luxembourg contributes to ASEAN’s economic growth and integration.

Luxembourg’s Role in ASEAN Formation and Growth

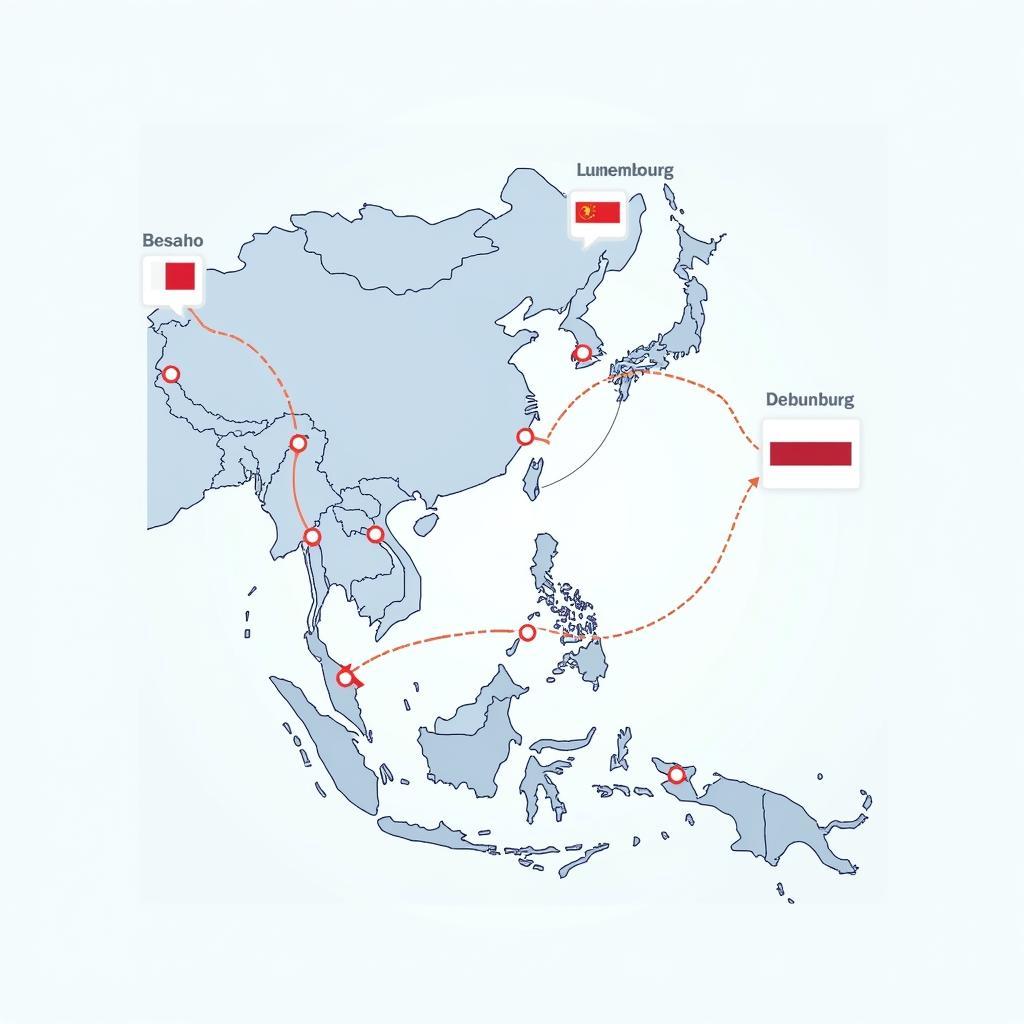

While Luxembourg didn’t play a direct role in the political formation of ASEAN, its financial hub status has become increasingly significant for ASEAN’s economic development. Luxembourg’s expertise in fund management, particularly within the UCITS framework, has attracted investment flows into Southeast Asia, fueling growth and development across various sectors. This small European nation has become a gateway for European investors seeking exposure to the dynamic ASEAN market.  Luxembourg's Financial Links with ASEAN

Luxembourg's Financial Links with ASEAN

Funding ASEAN’s Infrastructure Development

Luxembourg’s fund industry plays a crucial role in channeling investments towards infrastructure projects in ASEAN. This is particularly vital given the region’s ambitious infrastructure development plans. By providing a platform for investors to participate in these projects, Luxembourg contributes to the physical connectivity and economic integration of ASEAN nations. This financial support facilitates the construction of roads, ports, railways, and energy infrastructure, driving economic activity and fostering regional cooperation.

Facilitating Cross-Border Investments

Luxembourg’s regulatory framework makes it an attractive domicile for investment funds targeting ASEAN markets. The ease of setting up and managing funds, combined with the country’s double taxation treaties with several ASEAN member states, reduces barriers to cross-border investment. This streamlined process encourages greater capital flows between Europe and Southeast Asia, benefiting both regions.

Why Luxembourg for ASEAN Investments?

Many investors choose Luxembourg as their base for investing in ASEAN due to several compelling reasons. Its robust legal and regulatory environment provides stability and security, reassuring investors. Furthermore, its multilingual and multicultural workforce facilitates communication and understanding between European and ASEAN businesses.

A Stable and Secure Investment Environment

Luxembourg offers a stable political and economic environment, providing investors with a secure platform for their investments. The country’s strong legal framework and robust financial regulations minimize risks and provide a transparent and predictable investment landscape. This stability is particularly appealing in the context of emerging markets like some within ASEAN.

Expertise in Fund Management

Luxembourg boasts a long-standing reputation as a global leader in fund management. Its expertise in structuring and administering funds, combined with its specialized financial services infrastructure, attracts investors seeking professional and efficient management of their ASEAN investments. This expertise contributes to maximizing returns and mitigating risks for investors.

ASEAN and Luxembourg: A Future of Collaboration

The partnership between ASEAN and Luxembourg continues to evolve, with further collaboration anticipated in the areas of sustainable finance and digital innovation. Luxembourg’s experience in green finance can support ASEAN’s transition towards a more sustainable development model. ase moselle

Sustainable Finance and Green Investments

As ASEAN nations increasingly prioritize sustainable development, Luxembourg’s expertise in green finance becomes increasingly relevant. Luxembourg’s established ecosystem for sustainable investments can facilitate the flow of capital towards green projects in ASEAN, supporting the region’s efforts to address climate change and promote environmental sustainability.

Digital Innovation and Fintech

Luxembourg’s focus on fintech and digital innovation aligns with ASEAN’s ambition to become a digital economy. Collaboration in these areas can foster the development of innovative financial solutions that address the specific needs of the ASEAN market. This cooperation can drive financial inclusion and enhance the efficiency of financial services across the region.

Conclusion

The connection between ASEAN formation and Luxembourg may not be immediately apparent, but its importance lies in the financial sphere. Luxembourg serves as a vital link between European investors and the dynamic ASEAN market, facilitating investment, fostering growth, and supporting sustainable development. As both ASEAN and Luxembourg continue to evolve, their collaboration holds significant potential for future economic prosperity and mutual benefit.

FAQ

- What is Luxembourg’s primary role in ASEAN’s economic development? (Facilitating investment and financial flows.)

- Why do investors choose Luxembourg for ASEAN investments? (Stable regulatory environment and fund management expertise.)

- How does Luxembourg support ASEAN’s infrastructure development? (Channeling investments through specialized funds.)

- What are the future areas of collaboration between ASEAN and Luxembourg? (Sustainable finance and digital innovation.)

- What are the advantages of Luxembourg’s double taxation treaties with ASEAN members? (Reduced barriers to cross-border investment.)

- How does Luxembourg contribute to ASEAN’s sustainable development goals? (Promoting green finance and investments.)

- What is the significance of Luxembourg’s expertise in Fintech for ASEAN? (Supporting the development of a digital economy.)

When you need assistance, please contact us at Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com Or visit our address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer service team.