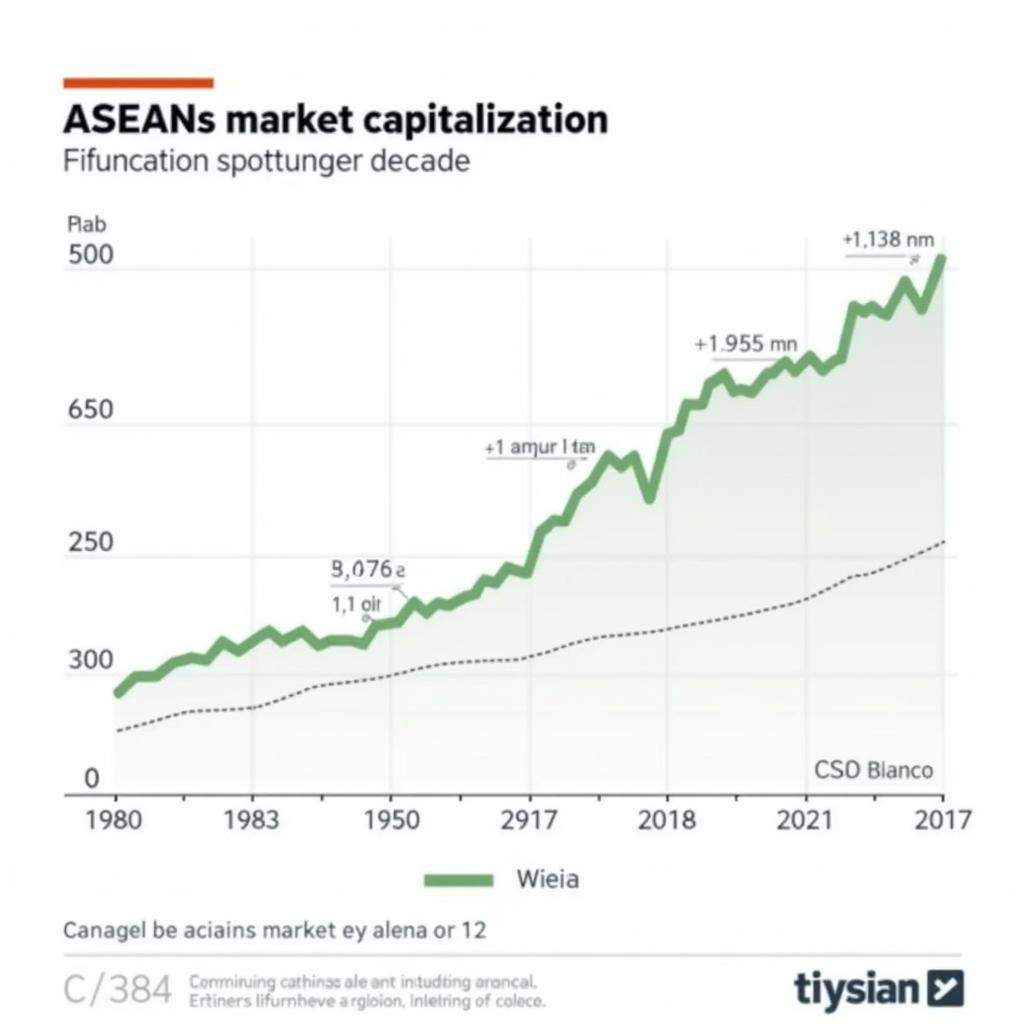

ASEAN group market cap offers a fascinating glimpse into the economic dynamism of Southeast Asia. This burgeoning region presents a compelling investment narrative, and understanding its market capitalization is key to unlocking its potential.

ASEAN Market Cap Growth Chart

ASEAN Market Cap Growth Chart

Decoding “ASEAN Group Market Cap”

What exactly does “ASEAN group market cap” signify? It refers to the total market value of all publicly listed companies within the Association of Southeast Asian Nations (ASEAN). This figure represents the combined worth of these companies and serves as a barometer of the region’s economic health and investor sentiment. Analyzing the ASEAN group market cap offers valuable insights into the region’s growth trajectory and potential investment opportunities. For instance, a rising market cap often signals increased investor confidence and a positive economic outlook. 10th asean senior management development program offers insights into the region’s economic development.

Factors Influencing ASEAN Group Market Cap

Several key factors contribute to the fluctuations and overall trend of the ASEAN group market cap. These include macroeconomic indicators such as GDP growth, inflation rates, and interest rates. Geopolitical stability, regulatory frameworks, and global market trends also play a significant role. Understanding these drivers is crucial for investors seeking to navigate the ASEAN market.

Investment Opportunities and Challenges

The ASEAN group market cap reflects a vibrant and rapidly evolving economic landscape. This presents both exciting opportunities and unique challenges for investors. While the region’s growth potential is undeniable, navigating diverse regulatory environments and understanding local market nuances can be complex. Understanding how many countries are in ASEAN (ada berapakah negara asean) is a good starting point for understanding the region’s diversity.

Navigating the ASEAN Investment Landscape

Thorough due diligence and a long-term investment horizon are essential for success in the ASEAN market. Diversification across different sectors and countries within ASEAN can mitigate risks and maximize returns. Partnering with local experts and staying informed about regional developments are also crucial.

“A deep understanding of local market dynamics is essential for successful investment in ASEAN,” says Anya Sharma, a Southeast Asia market analyst at Global Investment Strategies. “The region’s diversity offers a wealth of opportunities, but requires careful navigation.”

The Future of ASEAN Group Market Cap

The ASEAN group market cap is poised for continued growth, driven by a young and expanding consumer base, increasing urbanization, and technological advancements. As the region further integrates economically, it is expected to attract greater foreign investment and play an increasingly important role in the global economy. However, challenges such as infrastructure gaps and geopolitical uncertainties remain.

“ASEAN’s future economic trajectory is promising, but addressing infrastructure bottlenecks and fostering greater regional cooperation will be critical for sustained growth,” adds Michael Nguyen, Senior Economist at ASEAN Economic Research Institute. ase financial advisory group provides valuable insights into the region’s financial landscape.

Conclusion

Understanding the ASEAN group market cap is crucial for grasping the region’s economic potential and making informed investment decisions. By carefully considering the factors influencing market capitalization, navigating the investment landscape strategically, and staying informed about regional developments, investors can unlock the exciting opportunities presented by this dynamic region. ase 93 bobigny telephone offers a glimpse into the region’s connectivity. ase testing center in portland or might be relevant for those seeking professional development opportunities within the region. Remember, thorough research and a long-term perspective are key to maximizing returns in the ASEAN market.

FAQ

- What does ASEAN group market cap represent?

- What are the key drivers of ASEAN market cap?

- What are the investment opportunities and challenges in ASEAN?

- How can I navigate the ASEAN investment landscape effectively?

- What is the future outlook for ASEAN group market cap?

- How does geopolitical stability affect the ASEAN market?

- What are some key sectors for investment in ASEAN?

When you need support, please contact Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com Or visit: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer service team.