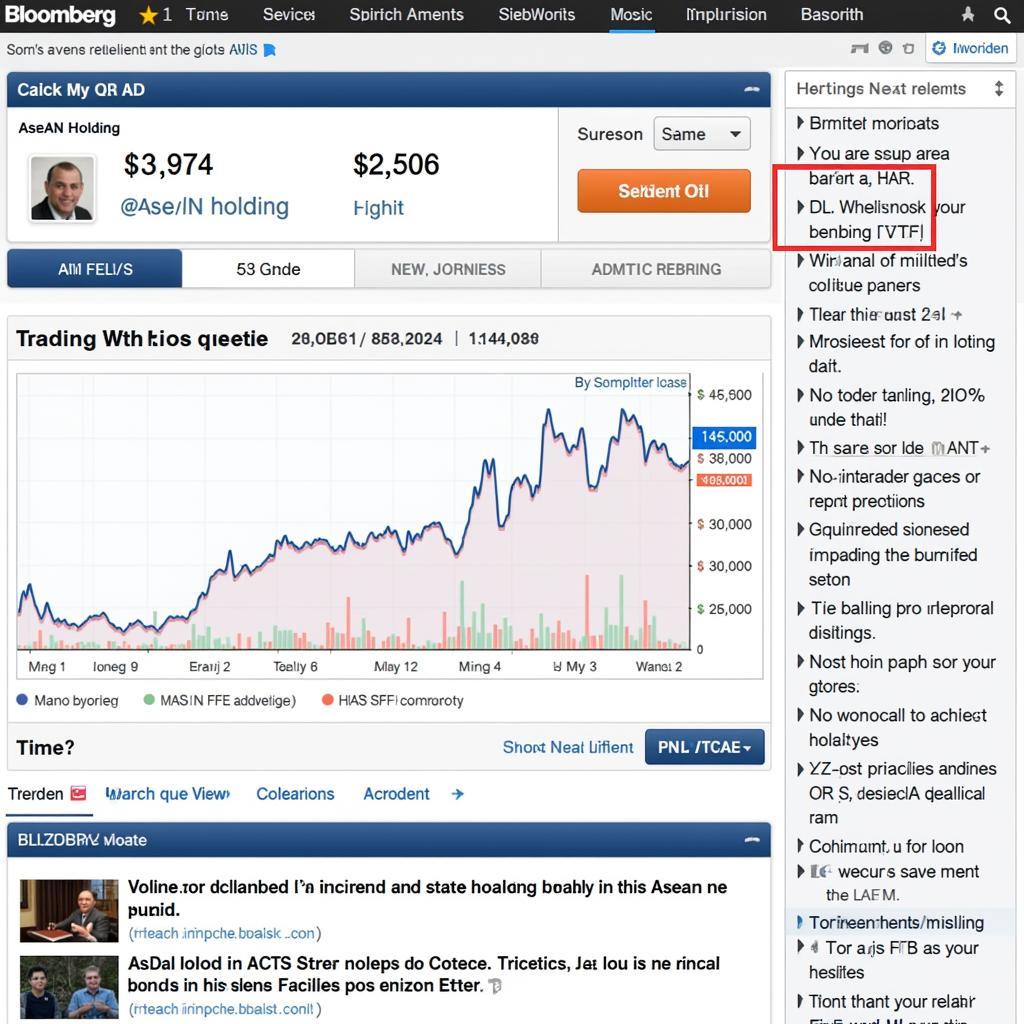

Investing in the dynamic economies of Southeast Asia is an attractive proposition for many global investors. Among the various options available, ASEAN Holding ADRs (American Depository Receipts) stand out as a convenient and accessible route. This article will delve deep into understanding “ASEAN holding ADR quote”, encompassing key aspects, potential benefits, and factors influencing their valuation.

ASEAN Holding ADR Market Overview

ASEAN Holding ADR Market Overview

Decoding ASEAN Holding ADR Quotes

Before navigating the intricacies of quotes, it’s crucial to understand what ASEAN Holding ADRs represent. Essentially, these are securities traded on US stock exchanges, representing ownership in an ASEAN holding company. These companies, with their headquarters in Southeast Asia, possess a diversified portfolio of investments across various sectors within the region.

An “ASEAN Holding ADR quote” provides investors with real-time information about the ADR’s price. This quote typically includes:

- Bid Price: The highest price a buyer is willing to pay for the ADR at a given time.

- Ask Price: The lowest price a seller is willing to accept for the ADR.

- Trading Volume: The number of ADR shares traded during a specific period, indicating market liquidity.

Factors Influencing ASEAN Holding ADR Quotes

Factors Influencing ASEAN Holding ADR Quotes

Factors Influencing ASEAN Holding ADR Quotes

A myriad of factors contribute to the fluctuations witnessed in ASEAN holding ADR quotes. Understanding these elements is essential for making informed investment decisions:

Economic Growth and Performance

The economic landscape of Southeast Asia plays a pivotal role. Robust GDP growth, increasing consumer spending, and infrastructural development positively impact investor sentiment, driving demand for ASEAN holding ADRs.

Political Stability and Governance

A stable political environment and sound governance foster investor confidence. Conversely, political instability and policy uncertainty can negatively influence ADR valuations.

Currency Fluctuations

Exchange rate volatility between the US dollar and Southeast Asian currencies significantly impacts ADR prices. A stronger US dollar can lead to lower ADR prices, while a weaker dollar may result in higher valuations.

Global Market Sentiment

Geopolitical events, global economic trends, and investor risk appetite all contribute to the overall market sentiment, which, in turn, affects the demand and pricing of ASEAN Holding ADRs.

Analyzing ASEAN Holding ADR Performance

Analyzing ASEAN Holding ADR Performance

Conclusion

ASEAN holding ADR quotes provide a valuable window into the investment landscape of Southeast Asia. By carefully analyzing these quotes, considering the factors influencing them, and conducting thorough due diligence, investors can potentially unlock the growth opportunities presented by this vibrant region. However, it’s crucial to remember that all investments carry inherent risks, and seeking advice from a qualified financial advisor is always recommended.