Ase Home Loans are a crucial aspect of the financial landscape in Southeast Asia. This guide delves into the intricacies of home financing options available to residents and expats in the ASEAN region, aiming to provide a clear understanding of the process and requirements.

Understanding the ASEAN Home Loan Market

The ASEAN region boasts a dynamic and diverse housing market. Understanding the specific regulations and opportunities within each member state is essential for securing a favorable home loan. Factors like interest rates, loan terms, and eligibility criteria vary significantly across countries. This guide will shed light on these nuances, enabling you to make informed decisions. It’s also worth considering the services offered by institutions such as the ASE Credit Union for potential home loan options. You can learn more about their offerings through their dedicated page on ase loans.

Key Considerations for ASEAN Home Loans

Before embarking on your home loan journey, several factors warrant careful consideration. Your financial stability, credit score, and the prevailing market conditions all play a crucial role in determining your eligibility and the terms of the loan. It’s important to conduct thorough research and compare offers from various lenders to find the most suitable option.

- Interest rates: Compare fixed and variable interest rate options, taking into account future market projections.

- Loan tenure: Consider the repayment period and its impact on your monthly installments.

- Down payment: Assess the required down payment and its influence on the loan amount.

- Eligibility criteria: Understand the specific requirements of each lender and country.

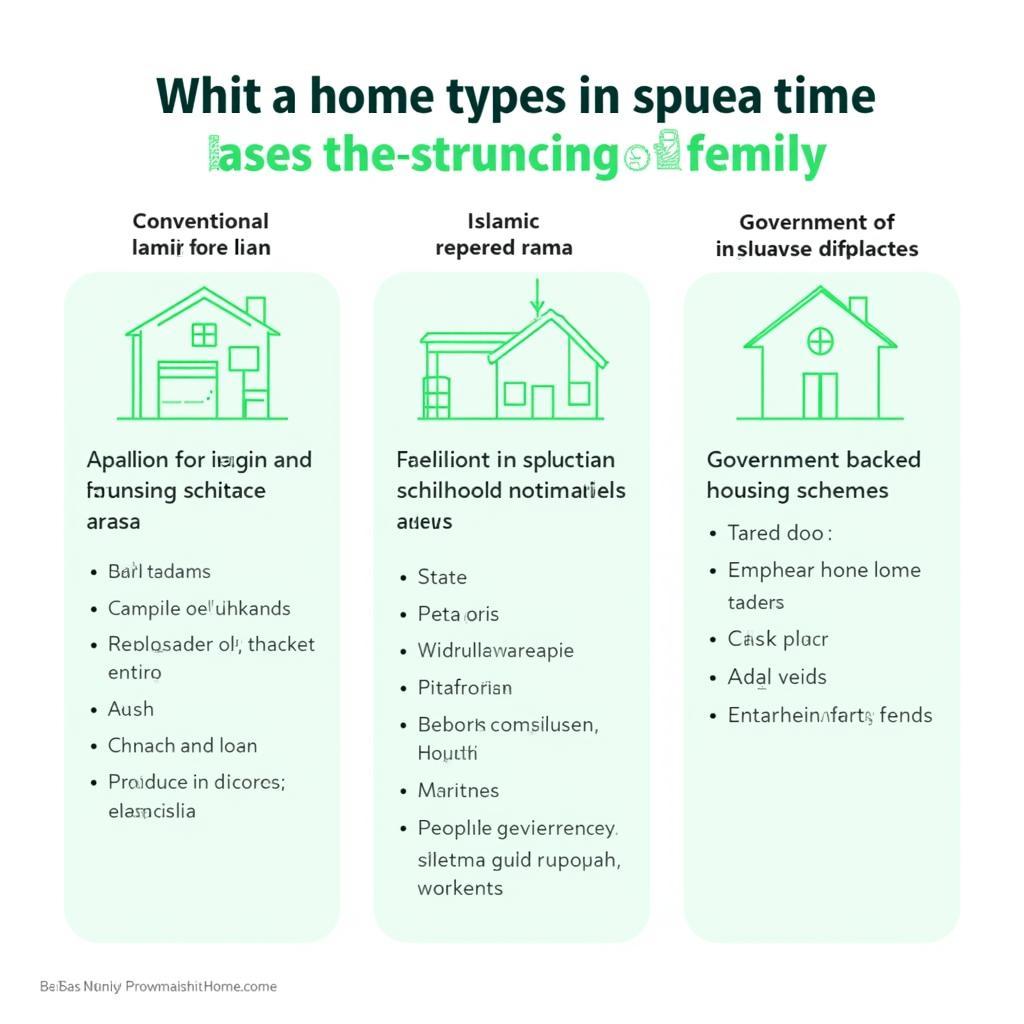

Exploring Home Loan Options in ASEAN

The ASEAN region offers a variety of home loan options tailored to different needs. From conventional bank loans to specialized financing programs, understanding the available options is critical. For example, ASE Credit Union offers home loans, which you can find out more about at ase credit union home loans.

Conventional Bank Loans

Traditional bank loans remain a popular choice for homebuyers. These loans typically involve fixed or variable interest rates and offer various repayment options.

Islamic Home Financing

Islamic home financing adheres to Sharia principles and provides alternatives to conventional interest-based loans. These financing models often involve lease-to-own or profit-sharing arrangements.

Government-backed Housing Schemes

Several ASEAN countries offer government-backed housing schemes designed to make homeownership more accessible, particularly for first-time buyers. These schemes may offer subsidized interest rates or down payment assistance.

Different Types of Home Loans Available in ASEAN

Different Types of Home Loans Available in ASEAN

ASE Home Loan Application Process

Navigating the ase home loan application process requires careful planning and organization. Gathering the necessary documentation and adhering to the lender’s requirements is essential for a smooth and efficient experience. If you are considering ASE Credit Union, you might find it beneficial to check their location in Montgomery at ase credit union in montgomery.

Required Documentation

- Proof of identity and residency

- Income statements and employment verification

- Credit history report

- Property valuation report

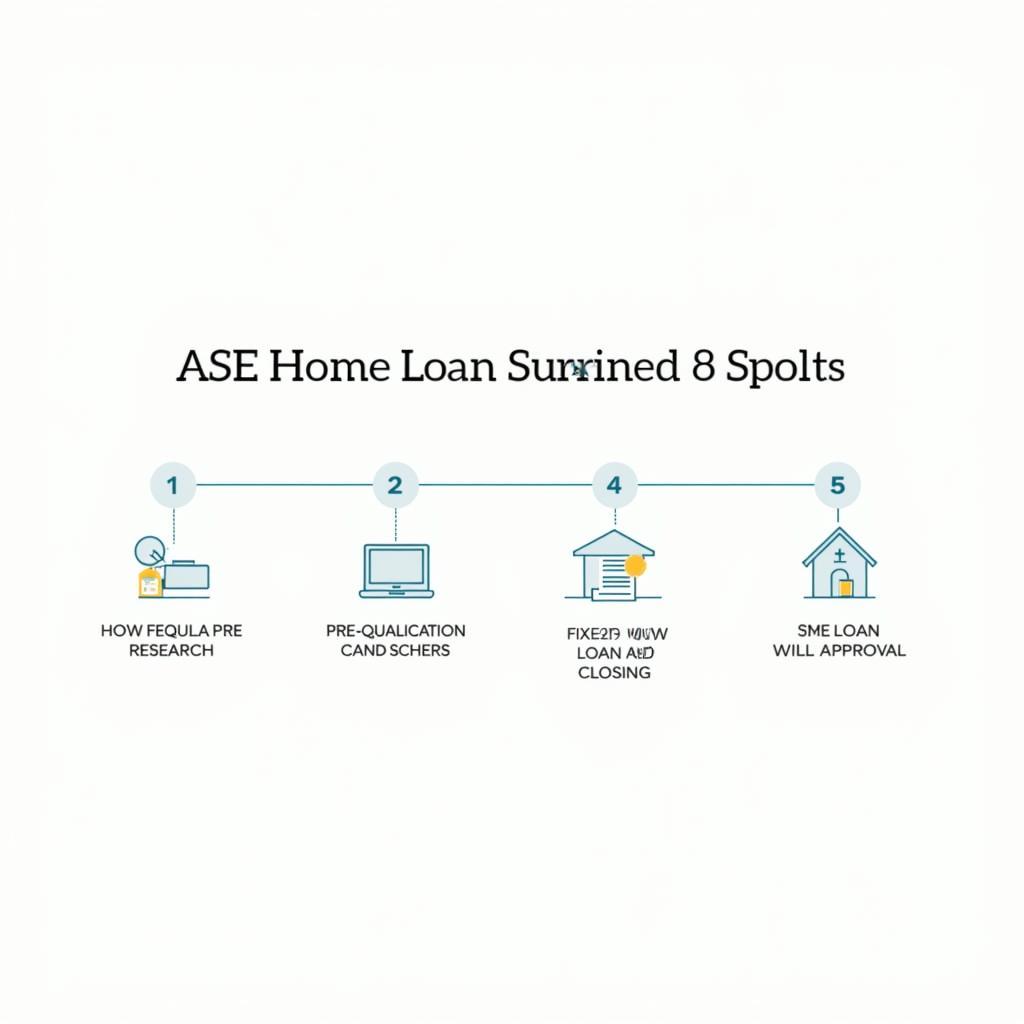

Steps to Apply

- Research and compare lenders.

- Pre-qualify for a loan.

- Submit a formal application with all required documents.

- Await loan approval and processing.

- Sign the loan agreement and finalize the transaction.

“Understanding the local regulations and financial landscape is paramount when applying for a home loan in ASEAN,” advises Maria Santos, a Senior Financial Advisor at Global Finance Solutions. “Thorough research and professional guidance can significantly streamline the process and ensure a successful outcome.”

Conclusion

Securing an ase home loan requires a comprehensive understanding of the ASEAN housing market and the specific regulations within each country. By carefully evaluating your financial situation, exploring available options, and gathering the necessary documentation, you can navigate the process effectively and achieve your homeownership goals. Remember that exploring options like ase credit union free atm can provide additional financial benefits.

ASE Home Loan Application Process

ASE Home Loan Application Process

“The ASEAN region offers diverse opportunities for homebuyers,” adds David Lee, a Real Estate Consultant at ASEAN Property Investments. “Choosing the right loan product and lender is crucial for a positive experience.”

FAQ

- What are the typical interest rates for home loans in ASEAN? (Interest rates vary considerably across ASEAN countries, influenced by local market conditions and economic factors.)

- What is the maximum loan tenure I can avail? (Loan tenure typically ranges from 15 to 30 years, depending on the lender and the borrower’s profile.)

- Are there any government-backed housing schemes available for foreigners in ASEAN? (Eligibility for government-backed housing schemes varies by country, with some programs extending benefits to foreign residents.)

- What is the process for pre-qualifying for a home loan? (Pre-qualification involves submitting basic financial information to a lender to obtain an estimated loan amount and interest rate.)

- Can I use my overseas income to qualify for a home loan in ASEAN? (Some lenders consider overseas income for loan qualification, subject to specific documentation and verification requirements.)

- What are the potential risks associated with taking out a home loan in ASEAN? (Risks include fluctuations in interest rates, currency exchange risks for foreign borrowers, and property market volatility.)

- What are the best resources for researching home loan options in ASEAN? (Resources include online comparison platforms, financial advisor consultations, and government housing agencies.)

When needing assistance, please contact us at Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com or visit our address: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer service team.