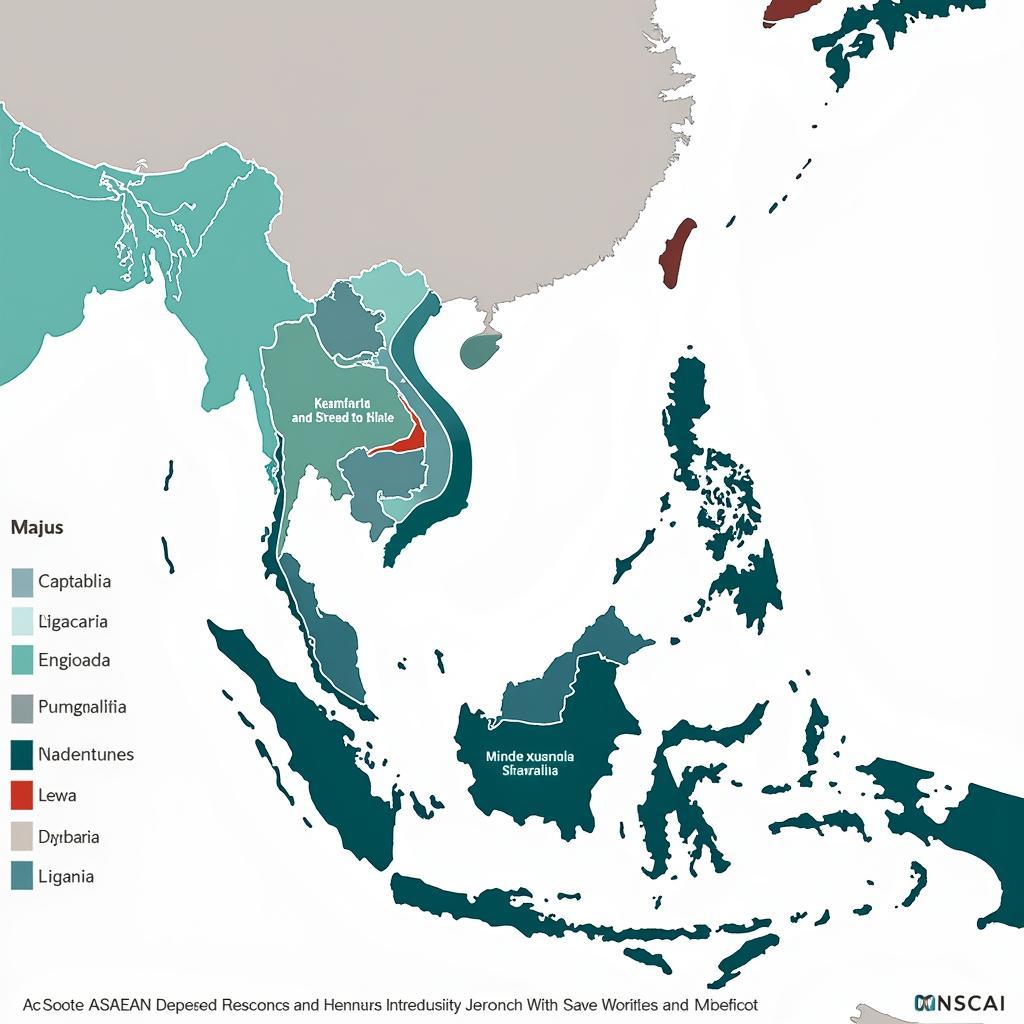

The ASEAN Index Composition refers to the specific criteria and methodology used to select and weight companies listed on stock exchanges within the Association of Southeast Asian Nations (ASEAN) member states. This index serves as a key benchmark for investors seeking to track the performance of the region’s equity markets.

What Factors Influence the ASEAN Index Composition?

Several factors play a crucial role in determining which companies are included in the ASEAN Index and their respective weightings:

- Market Capitalization: Generally, companies with larger market capitalizations have a higher weighting in the index. This reflects their greater influence on overall market movements.

- Liquidity: The index favors companies with actively traded shares, ensuring ease of buying and selling for investors.

- Financial Performance: Companies demonstrating strong financial health, such as consistent profitability and solid growth prospects, are more likely to be included.

- Sector Representation: The index aims to represent a diversified mix of sectors, mirroring the economic landscape of the ASEAN region.

The Importance of the ASEAN Index for Investors

ASEAN Stock Market Trends

ASEAN Stock Market Trends

Understanding the ASEAN Index Composition is crucial for investors for several reasons:

- Benchmarking Performance: The index serves as a standard against which investors can compare the performance of their ASEAN-focused investment portfolios.

- Identifying Investment Opportunities: By analyzing the index composition, investors can gain insights into the leading companies and sectors driving growth in the region.

- Diversification Benefits: Investing in a basket of companies represented in the index allows investors to spread risk across multiple countries and industries within ASEAN.

Key Considerations for Investors

Navigating the ASEAN Investment Landscape

Navigating the ASEAN Investment Landscape

When considering investments related to the ASEAN Index, it’s essential to keep these points in mind:

- Volatility: Emerging markets like those in ASEAN can experience higher volatility compared to developed markets.

- Political and Economic Risks: Investors should be aware of the political and economic dynamics of individual ASEAN member states.

- Currency Fluctuations: Exchange rate fluctuations can impact returns for investors holding assets denominated in different currencies.

The Future of the ASEAN Index

The ASEAN Index is expected to continue evolving alongside the region’s economic growth and development. Factors such as:

- Increased Integration: Ongoing efforts to deepen economic integration within ASEAN are likely to lead to greater cross-border investment and capital flows.

- Technological Advancements: Rapid technological advancements in areas such as e-commerce and fintech are creating new opportunities for growth in the region.

- Rising Middle Class: The expanding middle class in ASEAN is driving consumer spending and fueling demand across various sectors.

ASEAN Economic Growth Trajectory

ASEAN Economic Growth Trajectory

These trends are likely to shape the future composition of the ASEAN Index, potentially leading to the inclusion of more companies from emerging sectors and industries.

Conclusion

The ASEAN Index Composition provides investors with valuable insights into the dynamics of Southeast Asian equity markets. By understanding the factors influencing the index and carefully considering the associated risks, investors can make informed decisions to capitalize on the growth opportunities presented by this dynamic region. For personalized guidance and support in navigating the ASEAN investment landscape, don’t hesitate to reach out to our expert team. Contact us at Phone Number: 0369020373, Email: [email protected] or visit us at Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. Our dedicated customer service team is available 24/7 to assist you.