The ASEAN Index ETF offers a compelling way to invest in the dynamic Southeast Asian market. This article delves into the key aspects of the Ase Index Etf, providing valuable insights for both seasoned investors and those new to the region’s potential. We’ll explore the benefits, risks, and crucial factors to consider when investing in this exciting asset class.

What is an ASEAN Index ETF?

An ASEAN Index ETF (Exchange Traded Fund) tracks the performance of a specific index representing the ASEAN (Association of Southeast Asian Nations) market. This allows investors to gain exposure to a diversified portfolio of companies across multiple Southeast Asian countries, offering a convenient and cost-effective way to participate in the region’s growth. These ETFs typically cover a broad range of sectors, providing a holistic view of the ASEAN economic landscape. Thinking of investing in an ase index etf? Understanding the underlying index is crucial. For instance, some ETFs might focus on large-cap companies, while others might include small and mid-cap stocks.

Investing in an ETF means you’re essentially buying shares of a fund that holds a basket of assets, mirroring the composition of the chosen index. This differs from investing directly in individual companies listed on ASEAN stock exchanges.

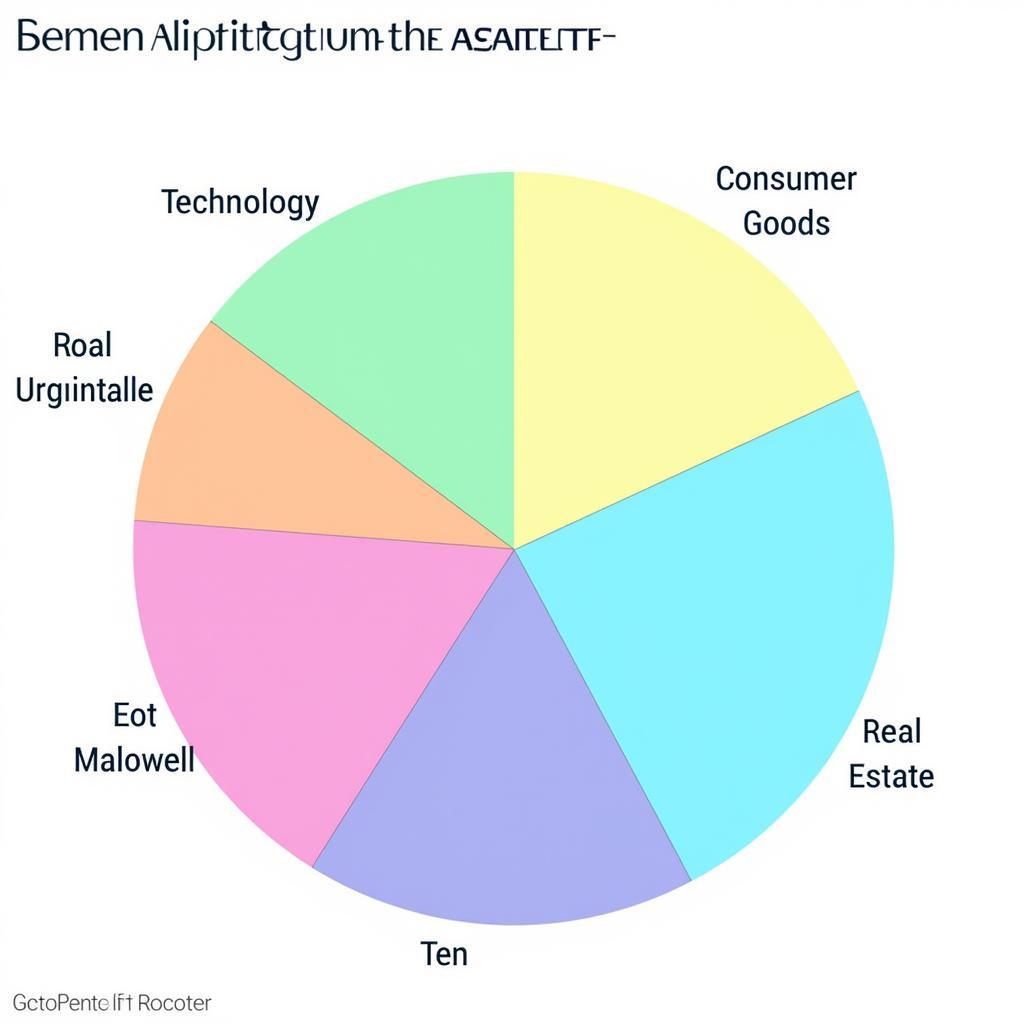

ASEAN ETF Sector Diversification

ASEAN ETF Sector Diversification

Why Invest in an ASEAN Index ETF?

Several factors make the ase index etf an attractive investment option. The region boasts a burgeoning middle class, rapid urbanization, and increasing digital adoption, all contributing to strong economic growth. Furthermore, ASEAN governments are actively promoting investment and economic integration, creating a favorable environment for businesses to thrive.

- Diversification: Investing in an ase index etf spreads your investment across multiple countries and sectors, mitigating risk compared to investing in individual stocks.

- Growth Potential: ASEAN’s dynamic economies offer significant growth opportunities, making it an attractive investment destination.

- Cost-Effective: ETFs generally have lower expense ratios compared to actively managed funds, making them a cost-effective investment vehicle.

- Liquidity: ETFs are traded on stock exchanges, providing high liquidity and ease of buying and selling.

“ASEAN’s demographic dividend and increasing regional integration present a unique opportunity for investors,” says Anya Sharma, Head of Southeast Asia Equity Research at Global Investment Partners.

Key Considerations Before Investing

While the ase index etf presents compelling opportunities, it’s crucial to consider potential risks and conduct thorough research. Factors like currency fluctuations, political risks, and regulatory changes can impact investment returns. Understanding the specific asea etf you’re considering, including its holdings and expense ratio, is vital.

- Index Composition: Understand the specific index the ETF tracks and the countries and sectors it represents. Check out resources like an asea etf fact sheet for detailed information.

- Expense Ratio: Compare expense ratios of different ETFs to ensure you’re getting the best value for your investment.

- Currency Risk: ASEAN currencies can fluctuate against your home currency, impacting your returns.

- Political and Economic Risks: Be aware of the political and economic landscapes of the countries represented in the index.

“Due diligence is paramount when investing in emerging markets. A thorough asea etf review can provide valuable insights,” advises Kenji Tan, Portfolio Manager at Asia Pacific Investments.

Conclusion

The ase index etf offers a compelling avenue for participating in the growth story of Southeast Asia. By understanding the key features, benefits, and risks associated with these investment vehicles, investors can make informed decisions and potentially reap significant rewards. For more information on the ASEAN market, you can explore resources like the ase index price and related data on ase dax.

FAQ

- What are the major stock exchanges in ASEAN?

- How do I choose the right ASEAN Index ETF?

- What are the tax implications of investing in an ASEAN ETF?

- What are the alternatives to investing in an ASEAN Index ETF?

- How can I track the performance of my ASEAN Index ETF investment?

- What are the typical trading hours for ASEAN ETFs?

- How do geopolitical events affect ASEAN markets?

For any support, contact Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com Or visit us at: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.