The ASEAN region is quickly becoming a hotbed for investors from around the globe. Understanding the “ASEAN investor” and what draws them to the region is key to tapping into this lucrative market. This article delves into the factors attracting investors to ASEAN, the challenges they face, and the potential rewards that await.

What Makes ASEAN Attractive to Investors?

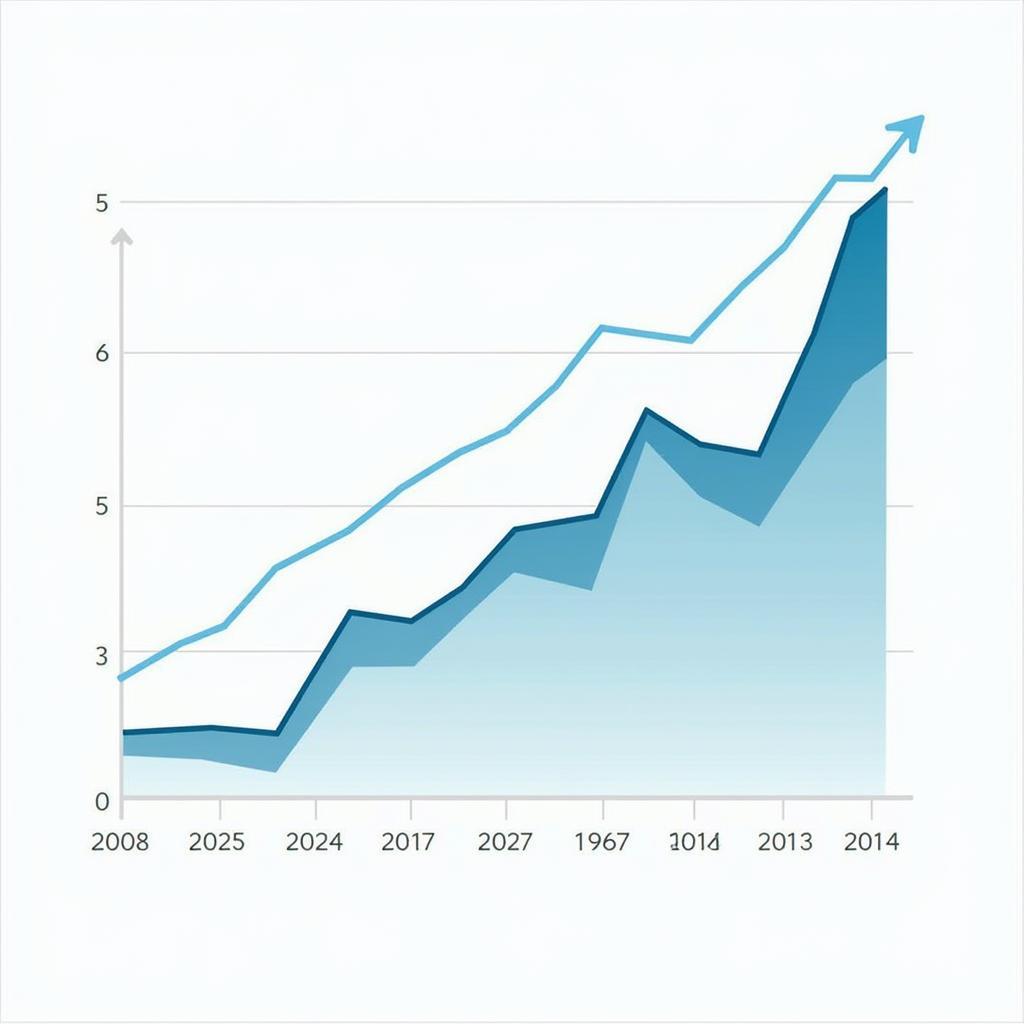

ASEAN Economic Growth Chart

ASEAN Economic Growth Chart

Several factors contribute to ASEAN’s appeal for investors:

- Robust Economic Growth: ASEAN boasts some of the fastest-growing economies globally, with a dynamic, young population driving consumption and investment.

- Strategic Location: Situated at the heart of Asia, ASEAN provides access to major shipping lanes and serves as a gateway to both established and emerging markets.

- Abundant Resources: The region is rich in natural resources, including oil, gas, minerals, and agricultural products, providing ample opportunities for resource-based industries.

- Increasing Integration: The ASEAN Economic Community (AEC) aims to create a single market and production base, facilitating cross-border trade and investment.

Key Sectors Attracting ASEAN Investors

Investors are particularly drawn to sectors like:

- Technology: The region’s burgeoning digital economy, with its rapidly expanding internet and mobile penetration, presents lucrative opportunities in e-commerce, fintech, and digital services.

- Infrastructure: ASEAN’s rapid urbanization and development require significant infrastructure investment, creating opportunities in construction, transportation, and energy.

- Renewable Energy: As ASEAN nations prioritize sustainability, investments in renewable energy sources like solar, wind, and hydropower are gaining traction.

- Consumer Goods: ASEAN’s growing middle class and rising disposable incomes are fueling demand for consumer goods and services, presenting opportunities in retail, food and beverage, and healthcare.

Challenges for ASEAN Investors

Challenges Faced by ASEAN Investors

Challenges Faced by ASEAN Investors

While the opportunities are vast, investing in ASEAN is not without its challenges.

- Regulatory Environment: Each ASEAN member state has its own set of regulations and procedures, which can be complex and time-consuming to navigate.

- Political Risks: Political instability and policy uncertainty in some ASEAN countries can pose risks to investment.

- Infrastructure Gaps: While improving, infrastructure bottlenecks in certain parts of the region can hinder supply chains and increase operational costs.

- Competition: The ASEAN market is becoming increasingly competitive, with both local and international players vying for market share.

Navigating the ASEAN Investment Landscape

To succeed in the ASEAN market, investors need to:

- Conduct Thorough Due Diligence: Understanding the specific regulations, market dynamics, and cultural nuances of each target market within ASEAN is crucial.

- Build Strong Local Partnerships: Collaborating with local partners who possess market knowledge and networks can help overcome regulatory hurdles and facilitate market entry.

- Develop a Long-Term Strategy: ASEAN’s growth potential requires a long-term perspective and commitment to navigate short-term challenges.

- Stay Informed: Keeping abreast of regulatory changes, economic trends, and political developments is essential for informed decision-making.

The Future of ASEAN Investment

For those willing to navigate the complexities, the rewards of investing in ASEAN are significant. The region is poised for continued growth, driven by favorable demographics, increasing urbanization, and a burgeoning middle class.

FAQs for ASEAN Investors

1. What are the major stock exchanges in ASEAN?

Some prominent stock exchanges include the Singapore Exchange (SGX), Bursa Malaysia, Stock Exchange of Thailand (SET), and Indonesia Stock Exchange (IDX).

2. How can I find reliable investment information on ASEAN?

Reputable sources include ASEAN government websites, international organizations like the World Bank and IMF, and financial news outlets specializing in Southeast Asia.

3. What are some of the risks associated with investing in ASEAN?

Risks include political instability, regulatory uncertainty, currency fluctuations, and competition.

4. What are the tax implications for foreign investors in ASEAN?

Tax laws vary across ASEAN countries. It is essential to consult with tax advisors to understand the specific tax implications for your investment.

Need More Information?

For further insights on navigating the ASEAN investment landscape, explore these related articles:

- ASE Holdings Investor: Learn about investment opportunities related to ASE Holdings, a major player in the semiconductor industry with a significant presence in Southeast Asia.

- ASEAN 50 Coin Price: Discover the potential of investing in a hypothetical “ASEAN 50” coin, representing the top 50 companies in the region.

- ASE Stock Taiwan: Explore the performance and investment prospects of ASE Technology Holding Co., Ltd., a Taiwanese semiconductor giant with substantial operations in ASEAN.

For personalized assistance with your ASEAN investment journey, contact our team of experts. We provide comprehensive support and guidance tailored to your specific needs.

Contact Us:

Phone: 0369020373

Email: [email protected]

Address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam

Our dedicated customer service team is available 24/7 to assist you.