Ase Kasasa Over Account offers a unique approach to banking, providing various benefits. This article will delve into the features, advantages, and eligibility requirements of this account, helping you decide if it’s the right choice for your financial needs.

What is an ASE Kasasa Over Account?

The ASE Kasasa Over account is a type of checking account that offers rewards and benefits like cash back, refunds on ATM fees, and higher interest rates. It differs from traditional checking accounts by providing incentives for active account usage, encouraging customers to engage more with their finances. ase kasasa over 65 account offers additional perks for individuals over 65.

Benefits of an ASE Kasasa Over Account

What sets ASE Kasasa Over accounts apart are the enticing rewards they offer. These can include:

- Cash Back: Earn a percentage of your debit card purchases back as cash.

- ATM Fee Refunds: Get reimbursed for ATM fees charged by other banks.

- Higher Interest Rates: Receive a higher interest rate on your balance compared to standard checking accounts.

- Nationwide ATM Access: Access your funds surcharge-free at thousands of ATMs across the country.

ASE Kasasa Over Account Benefits

ASE Kasasa Over Account Benefits

Eligibility Requirements for an ASE Kasasa Over Account

To qualify for an ASE Kasasa Over account, you typically need to meet certain criteria, such as:

- Minimum Number of Debit Card Transactions: Make a minimum number of debit card purchases each month.

- Enroll in E-statements: Opt for electronic statements instead of paper statements.

- Log in to Online Banking: Access your account online at least once a month.

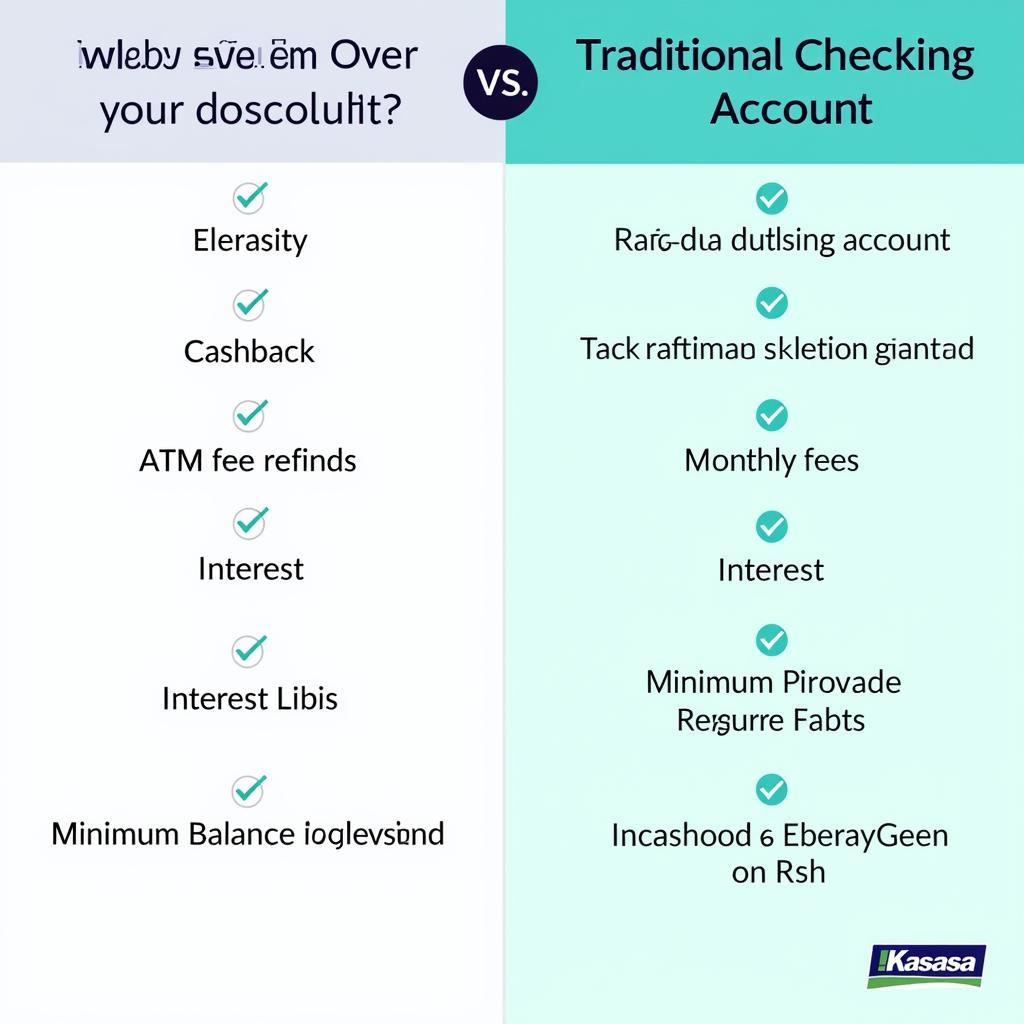

How Does the ASE Kasasa Over Account Compare to Traditional Checking Accounts?

While traditional checking accounts provide basic banking services, ASE Kasasa Over accounts offer a more rewarding experience. The table below highlights the key differences:

| Feature | ASE Kasasa Over Account | Traditional Checking Account |

|---|---|---|

| Cash Back | Yes | Typically No |

| ATM Fee Refunds | Yes | Typically No |

| Higher Interest Rates | Yes | Typically Lower |

| Minimum Balance Requirements | May Vary | May Vary |

| Monthly Fees | May Vary | May Vary |

ASE Kasasa Over Account vs. Traditional Checking

ASE Kasasa Over Account vs. Traditional Checking

Is the ASE Kasasa Over Account Right for You?

If you’re an active debit card user who prefers online banking and wants to earn rewards, the ASE Kasasa Over account could be a suitable option. However, it’s crucial to carefully review the terms and conditions, including any potential fees, to ensure it aligns with your financial goals.

Maria Sanchez, a financial advisor at WealthWise Solutions, advises, “The ASE Kasasa Over account can be a great tool for those who actively use their debit cards and are comfortable managing their finances online. It’s essential to understand the qualifying requirements and associated fees before opening an account.”

ase 65 offers specific information regarding the ASE Kasasa Over account for individuals above the age of 65.

Conclusion

The ASE Kasasa Over account provides a compelling alternative to traditional checking accounts with its rewards and benefits. By carefully considering your banking habits and reviewing the account details, you can determine if the ASE Kasasa Over account is the right fit for your financial needs.

FAQ

- What are the typical cashback rewards offered with an ASE Kasasa Over account?

- Are there any monthly fees associated with an ASE Kasasa Over account?

- How do I enroll in e-statements for my ASE Kasasa Over account?

- What is the minimum number of debit card transactions required to qualify for rewards?

- Can I still earn rewards if I don’t use online banking?

- What are the specific benefits of an ASE Kasasa Over 65 account?

- Where can I find a list of participating ATMs for surcharge-free withdrawals?

John Doe, a senior banking executive, notes, “The ASE Kasasa Over account aims to incentivize responsible financial behavior by rewarding customers who actively engage with their accounts.”

Common Scenarios and Questions

-

Scenario: You frequently use your debit card for everyday purchases.

-

Question: How much cashback can I realistically earn with an ASE Kasasa Over account?

-

Scenario: You travel frequently and use ATMs in different locations.

-

Question: How much can I save on ATM fees with an ASE Kasasa Over account?

Further Exploration

For more information on banking and finance, explore other articles on our website related to savings accounts, investment strategies, and financial planning.

For any assistance regarding the ASE Kasasa Over Account, please contact us: Phone: 0369020373, Email: [email protected] Or visit us at: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. Our customer service team is available 24/7.