Ase Korea Inc For Sale presents a unique investment prospect within the dynamic Southeast Asian market. This article delves into the complexities of acquiring a Korean company operating in the ASEAN region, exploring potential benefits and pitfalls while offering guidance for informed decision-making. We’ll examine market dynamics, due diligence processes, and cultural considerations for a successful acquisition.

Understanding the Landscape of “Ase Korea Inc For Sale”

Acquiring an “ase Korea inc for sale” requires a nuanced understanding of both the Korean business culture and the specific ASEAN market in which the company operates. The diverse economies, regulations, and consumer behaviors across ASEAN nations necessitate careful analysis before committing to a purchase. Is the target company positioned for growth within its chosen sector? Are there regulatory hurdles to overcome? These are key questions to consider. For insights into the ASEAN automotive industry, explore the ASEAN automotive market 2019.

The phrase “ase Korea inc for sale” itself suggests a potential opportunity for investors seeking entry or expansion within ASEAN. It’s crucial to dissect this opportunity through comprehensive research. What does “ase” specifically refer to? Is it an abbreviation, or does it indicate a specific industry? Understanding the nomenclature is vital for targeted due diligence.

Due Diligence: A Critical Step for “Ase Korea Inc For Sale”

Before acquiring any business, especially one operating across borders, robust due diligence is non-negotiable. For “ase Korea inc for sale,” this involves meticulous examination of financial records, legal compliance, operational efficiency, and market positioning. This also includes a thorough understanding of any existing contracts, intellectual property rights, and potential liabilities. This process mitigates risks and unveils the true value proposition.

A critical aspect of due diligence is assessing the cultural alignment between the acquiring entity and the target company. Korean corporate culture, with its emphasis on hierarchy and long-term relationships, can contrast significantly with the more flexible and relationship-driven business practices in some ASEAN nations. This cultural gap can impact integration and long-term success. More information on ASEAN economic integration can be found at ASEAN 10 plus 6.

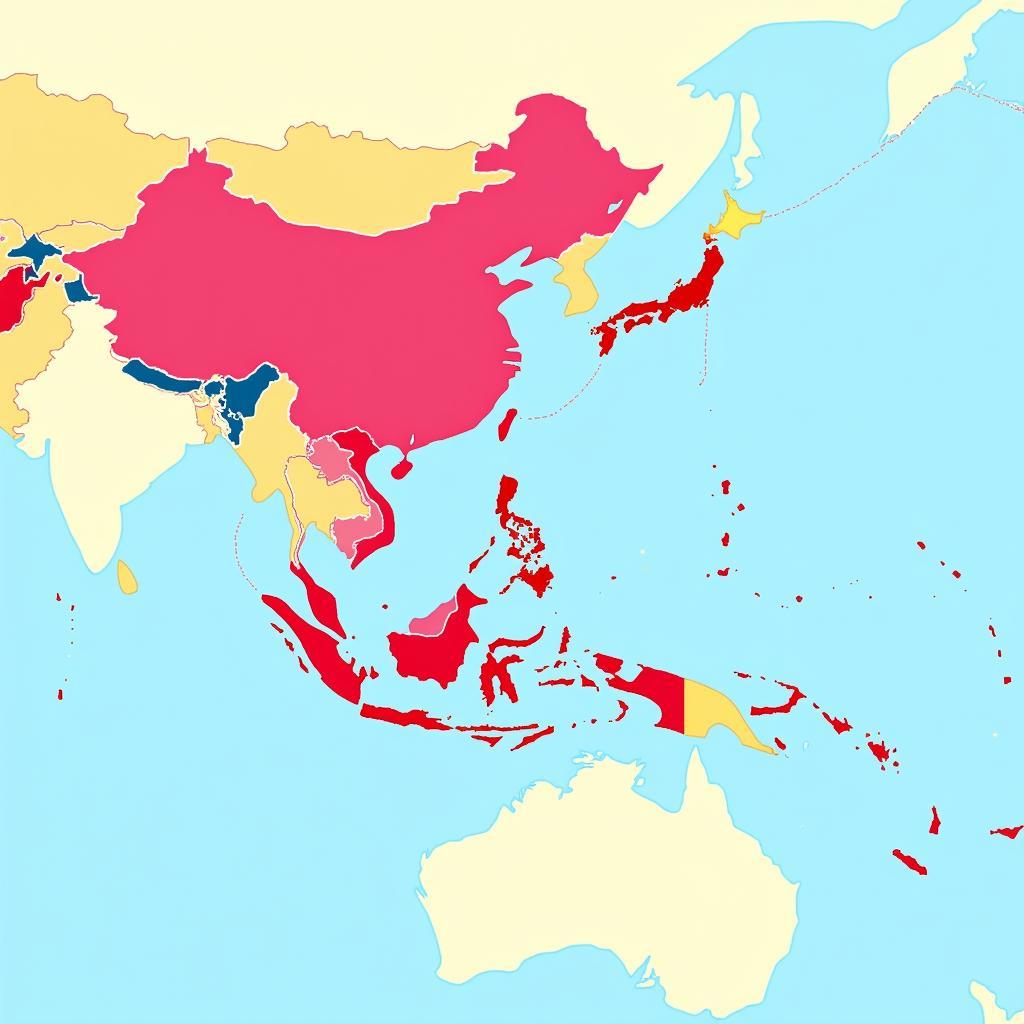

Navigating the ASEAN Market

ASEAN’s diverse economic landscape presents both opportunities and challenges. While some nations boast burgeoning middle classes and strong growth potential, others grapple with infrastructure limitations and regulatory complexities. Understanding these nuances is paramount when evaluating “ase Korea inc for sale.” Does the target company’s business model align with the specific market conditions in its chosen ASEAN country?

For instance, a Korean company specializing in e-commerce might thrive in a market like Singapore, with its high internet penetration and developed logistics infrastructure. However, the same company might face significant challenges in a less developed market with limited digital access. Consider comparing different business models at ASEA vs USANA.

Valuing “Ase Korea Inc For Sale”: Beyond the Balance Sheet

The valuation of “ase Korea inc for sale” requires looking beyond traditional financial metrics. Factors like brand recognition, market share, and the potential for future growth within the ASEAN region contribute significantly to the overall value. Understanding the competitive landscape and the target company’s unique selling propositions is crucial.

Key Valuation Metrics for Ase Korea Inc

Key Valuation Metrics for Ase Korea Inc

What is the market value of “Ase Korea Inc for sale”?

The market value depends on various factors specific to the company, including its financial performance, assets, and industry. A professional valuation is essential.

How do cultural factors influence the acquisition of “Ase Korea Inc”?

Cultural differences can significantly impact negotiations, integration processes, and long-term success. Understanding and respecting these differences is crucial. You can learn more about ASEAN military forces at ASE Army.

Conclusion: Strategic Acquisition in ASEAN

“Ase Korea inc for sale” offers a compelling entry point into the vibrant ASEAN market. However, a successful acquisition requires careful consideration of market dynamics, rigorous due diligence, and sensitivity to cultural nuances. By approaching the process strategically and leveraging expert advice, investors can unlock the potential of this dynamic region. Understanding the specific company and its position within the ASEAN landscape is key to a successful investment.

Opportunities and Challenges in the ASEAN Market

Opportunities and Challenges in the ASEAN Market

FAQ

- What does “ase” stand for in the context of “ase Korea inc”? This requires further clarification and is a crucial detail to determine.

- What are the key industries where Korean companies operate in ASEAN? Korean companies have a strong presence in sectors like manufacturing, technology, and automotive across ASEAN.

- What are the primary legal considerations for acquiring a company in ASEAN? Legal considerations vary across ASEAN member states, including regulations related to foreign ownership and investment.

- How can cultural differences be managed during the acquisition process? Engaging cultural consultants and prioritizing open communication can help bridge cultural gaps.

- What are the potential risks associated with investing in “ase Korea inc for sale”? Risks can include market volatility, regulatory changes, and integration challenges.

- What due diligence steps are crucial when considering “ase Korea inc for sale”? Thorough financial, legal, and operational due diligence is essential, along with cultural due diligence.

- What are the growth prospects for Korean businesses in ASEAN? The ASEAN market offers significant growth potential for Korean businesses due to its expanding middle class and increasing consumer demand.

Scenarios

Scenario 1: A Korean automotive parts manufacturer operating in Thailand is for sale. Key questions would revolve around supply chain integration, existing contracts with automotive manufacturers, and the impact of regional trade agreements.

Scenario 2: A Korean e-commerce platform operating in Indonesia is for sale. Due diligence would focus on understanding the platform’s user base, competition from local players, and the regulatory landscape for online businesses in Indonesia.

Scenario 3: A Korean food and beverage company operating in Vietnam is for sale. Understanding local consumer preferences, distribution networks, and food safety regulations would be crucial.

Further Exploration

Consider exploring related topics such as ASEAN Automotive Market 2014 for a historical perspective.

For any assistance or further inquiries, please contact us at Phone Number: 0369020373, Email: [email protected], or visit our office at Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.