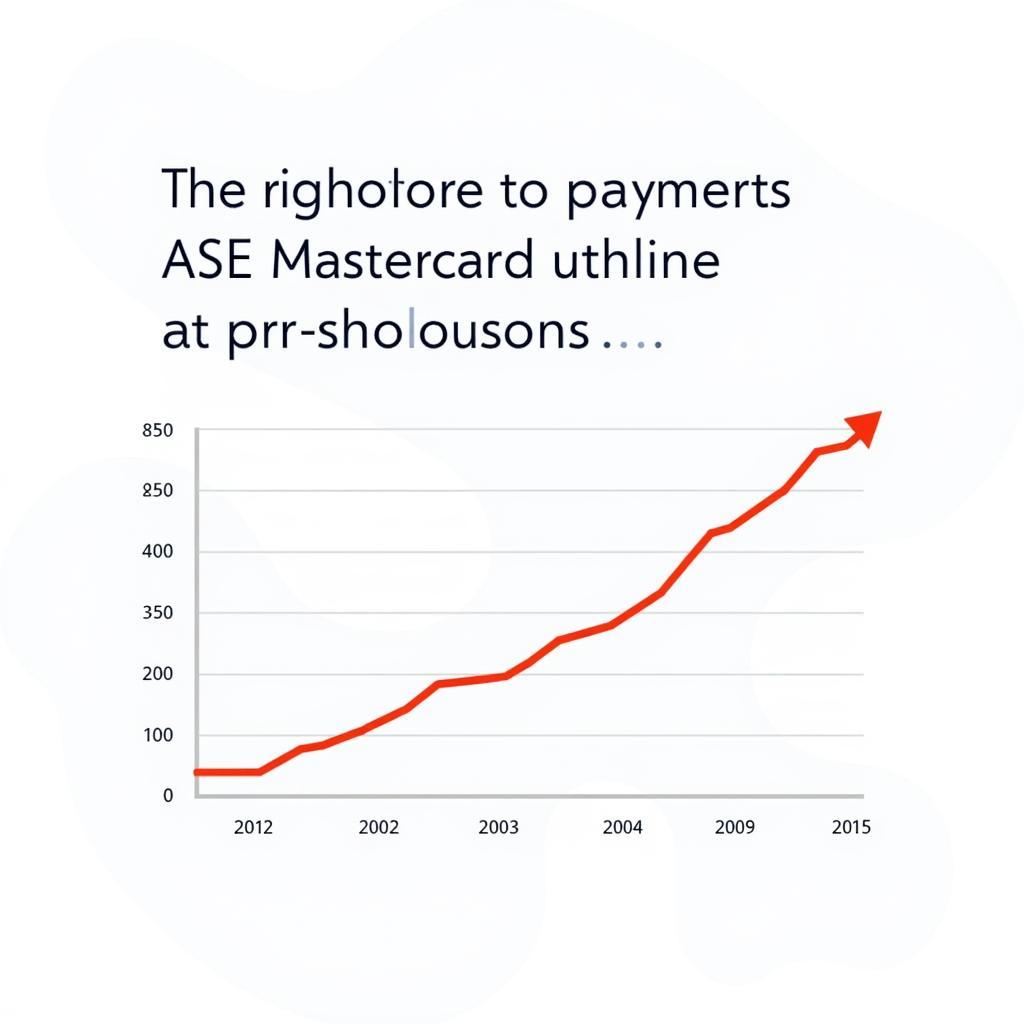

The rise of digital transactions within the ASEAN region has opened up exciting new opportunities for businesses and consumers alike. Understanding the evolving landscape of Ase Mastercard and its implications is key to tapping into this dynamic market. This article will delve into the various aspects of ASE Mastercard, providing valuable insights into its benefits, challenges, and future potential.

The Growing Importance of ASE Mastercard in Southeast Asia

ASEAN’s burgeoning digital economy demands secure and efficient payment solutions. ASE Mastercard offers a robust platform, facilitating seamless transactions across borders and empowering businesses to participate in the region’s rapid growth. This shift towards digital payments is further fueled by the increasing smartphone penetration and growing internet access across Southeast Asia. Just after this introduction, it’s worth exploring further about ASE EMV3 COM, a relevant topic in the digital transaction space. ase emv3 com

ASE Mastercard Digital Transactions in Southeast Asia

ASE Mastercard Digital Transactions in Southeast Asia

Benefits of Utilizing ASE Mastercard for Businesses

Adopting ASE Mastercard offers a multitude of advantages for businesses operating within the ASEAN region. It enables access to a wider customer base, streamlines payment processes, and reduces the reliance on cash transactions. Moreover, Mastercard’s robust security features enhance trust and mitigate the risks associated with online fraud. Are you looking for reliable plumbing and electrical suppliers? Consider ASE Electrical & Plumbing Supplies Ltd. ase electrical & plumbing supplies ltd

Expanding Market Reach with ASE Mastercard

By accepting ASE Mastercard, businesses can tap into a vast network of consumers, both within their own country and across the ASEAN region. This broadened reach opens up new markets and facilitates expansion opportunities.

ASE Mastercard Business Expansion in ASEAN

ASE Mastercard Business Expansion in ASEAN

Challenges and Considerations for ASE Mastercard Adoption

While the benefits are substantial, there are some challenges to consider when integrating ASE Mastercard into existing business operations. These include navigating regulatory frameworks, ensuring secure transaction processing, and addressing infrastructure limitations in certain areas.

Navigating the Regulatory Landscape

Each ASEAN member state has its own set of regulations governing digital payments. Understanding and complying with these regulations is crucial for businesses seeking to operate seamlessly across the region.

Security Concerns and Fraud Prevention

With the rise of digital transactions comes an increased risk of online fraud. Implementing robust security measures is paramount to protect both businesses and consumers.

What is the Future of ASE Mastercard in ASEAN?

The future of ASE Mastercard in ASEAN looks promising, driven by the increasing adoption of digital technologies and the growing demand for secure and efficient payment solutions. Furthermore, innovations in areas such as contactless payments and mobile wallets are expected to further propel the growth of ASE Mastercard.

Innovations in ASE Mastercard Technology

The continuous development of new technologies, such as biometric authentication and blockchain-based payment systems, will further enhance the security and efficiency of ASE Mastercard transactions. For those interested in previous ASEAN Summits, check out the ASE 2018 registration portal. ase 2018 registration portal

Conclusion: Embracing the Power of ASE Mastercard

ASE Mastercard plays a critical role in driving the growth of ASEAN’s digital economy. By understanding its benefits, addressing the challenges, and embracing the latest innovations, businesses can unlock the immense potential of this dynamic payment solution and contribute to the region’s continued prosperity.

FAQ

- What are the fees associated with using ASE Mastercard?

- How can businesses protect themselves from online fraud when using ASE Mastercard?

- Which countries in ASEAN accept ASE Mastercard?

- What are the requirements for businesses to start accepting ASE Mastercard?

- How does ASE Mastercard differ from other payment methods in ASEAN?

- Are there any government incentives for businesses adopting ASE Mastercard?

- How can consumers benefit from using ASE Mastercard?

For further assistance, please contact us: Phone: 0369020373, Email: aseanmediadirectory@gmail.com, or visit us at: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer support team.