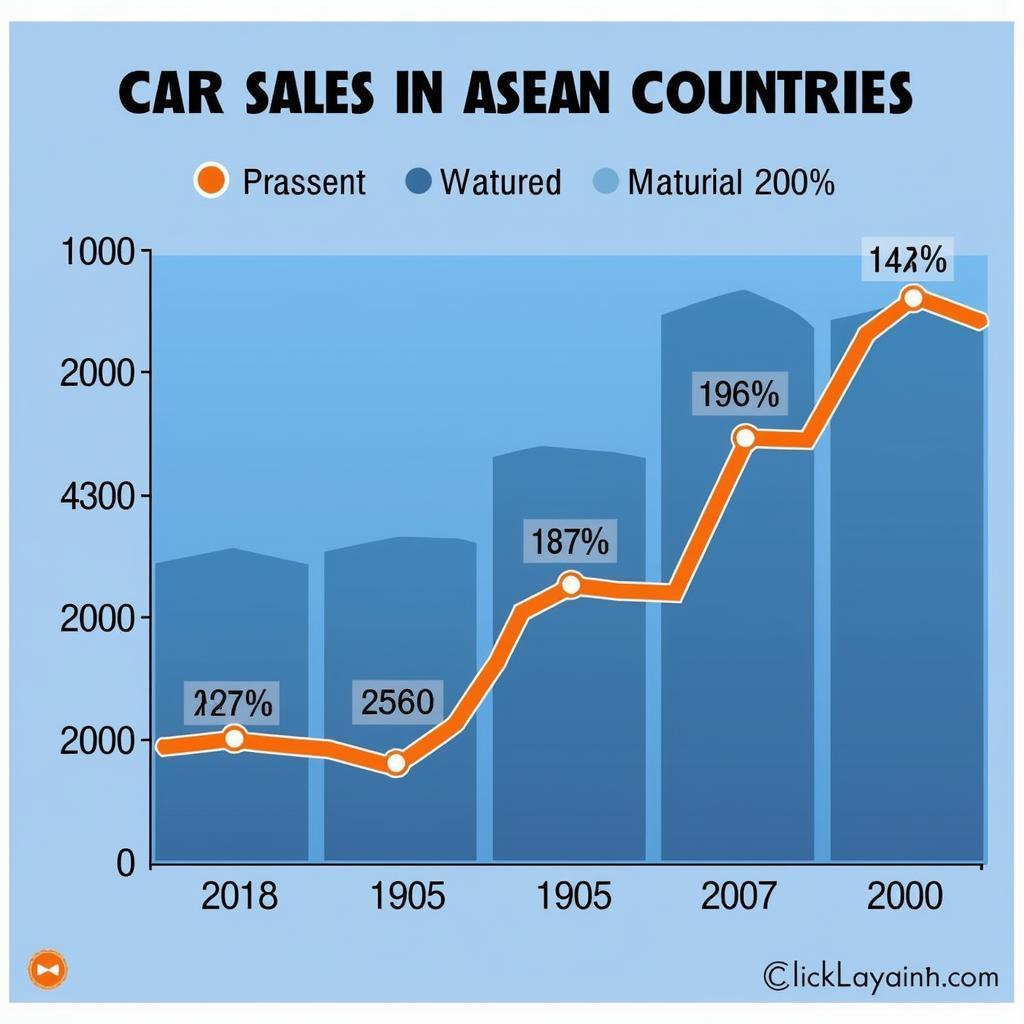

The ASEAN region, known for its dynamic economies and burgeoning middle class, is witnessing a surge in demand for personal vehicles. This trend has sparked significant interest in the “asean price auto bldg share” market, as investors and industry players seek to capitalize on the region’s automotive growth potential.

ASEAN Car Market Growth

ASEAN Car Market Growth

Understanding the “asean price auto bldg share” market requires a closer look at the key factors driving its performance. The acronym “bldg” likely refers to “building,” suggesting an investment focus on companies involved in constructing automotive manufacturing facilities or related infrastructure. This interpretation aligns with the increasing need for expanded production capacity to meet ASEAN’s rising car demand.

Several factors contribute to the attractiveness of “asean price auto bldg share” investments. Firstly, ASEAN countries boast a young and growing population with increasing purchasing power, making car ownership an aspirational goal for many. Secondly, favorable government policies aimed at attracting foreign direct investment and promoting local automotive industries create a conducive environment for growth. Additionally, the region’s strategic location and well-established supply chains make it an attractive hub for global automotive manufacturers.

ASEAN Car Manufacturing Plant

ASEAN Car Manufacturing Plant

Investors interested in “asean price auto bldg share” should consider a few key aspects. Conducting thorough research on companies involved in the construction and development of automotive infrastructure is crucial. This includes analyzing their financial performance, project pipelines, and management expertise. Additionally, understanding the specific regulations and incentives offered by different ASEAN countries can help investors make informed decisions.

Expert Insight

“The ASEAN automotive sector presents a compelling investment opportunity,” says Ms. Anya Lim, Senior Analyst at ASEAN Investment Group, a leading financial advisory firm specializing in Southeast Asia. “With a rapidly expanding consumer base and supportive government policies, the demand for automotive infrastructure is expected to remain strong in the coming years.”

However, investors should be aware of potential risks associated with the “asean price auto bldg share” market. Economic volatility, political instability, and changes in government regulations can impact investment returns. Moreover, competition within the construction industry and potential delays in infrastructure projects can also pose challenges.

ASEAN Auto Industry Challenges

ASEAN Auto Industry Challenges

Expert Insight

“Investors should adopt a long-term perspective and diversify their portfolios across different ASEAN markets to mitigate risks,” advises Mr. Wei Zhang, Portfolio Manager at Dragon Capital, a renowned investment firm with expertise in emerging markets.

In conclusion, the “asean price auto bldg share” market presents a unique investment opportunity driven by the ASEAN region’s thriving automotive sector. While the potential for growth is significant, investors should carefully assess the risks and rewards before making any investment decisions. Seeking guidance from financial advisors with expertise in the ASEAN region is highly recommended.

FAQs

What are the key drivers of the “asean price auto bldg share” market?

The key drivers include a growing middle class, favorable government policies, and ASEAN’s strategic location.

What are the potential risks associated with investing in “asean price auto bldg share”?

Potential risks include economic volatility, political instability, and changes in government regulations.

What advice would you give to investors interested in this market?

Conduct thorough research, diversify your portfolio, and seek advice from financial experts.