Ase Selvstændig Efterløn is a crucial topic for self-employed individuals in Denmark. This guide will delve into the intricacies of this voluntary early retirement scheme, providing valuable information for those considering this option. We’ll explore its benefits, requirements, and how it can impact your financial future.

What is ASE Selvstændig Efterløn?

ASE selvstændig efterløn, or the voluntary early retirement scheme for the self-employed, allows individuals to save for an early retirement while enjoying tax benefits. This scheme is designed to provide financial security for those who choose to retire before the standard retirement age. It’s a flexible and beneficial program that can be tailored to meet individual circumstances.

Navigating the complexities of retirement planning can be daunting, especially for the self-employed. ase efterløn selvstændig offers invaluable insights for those seeking financial security in their later years.

Eligibility and Requirements for ASE Selvstændig Efterløn

Who can benefit from ASE selvstændig efterløn? Specific criteria must be met to qualify for this program. These include being registered as self-employed, paying into the scheme for a specific duration, and meeting age requirements. Understanding these requirements is essential for successful enrollment.

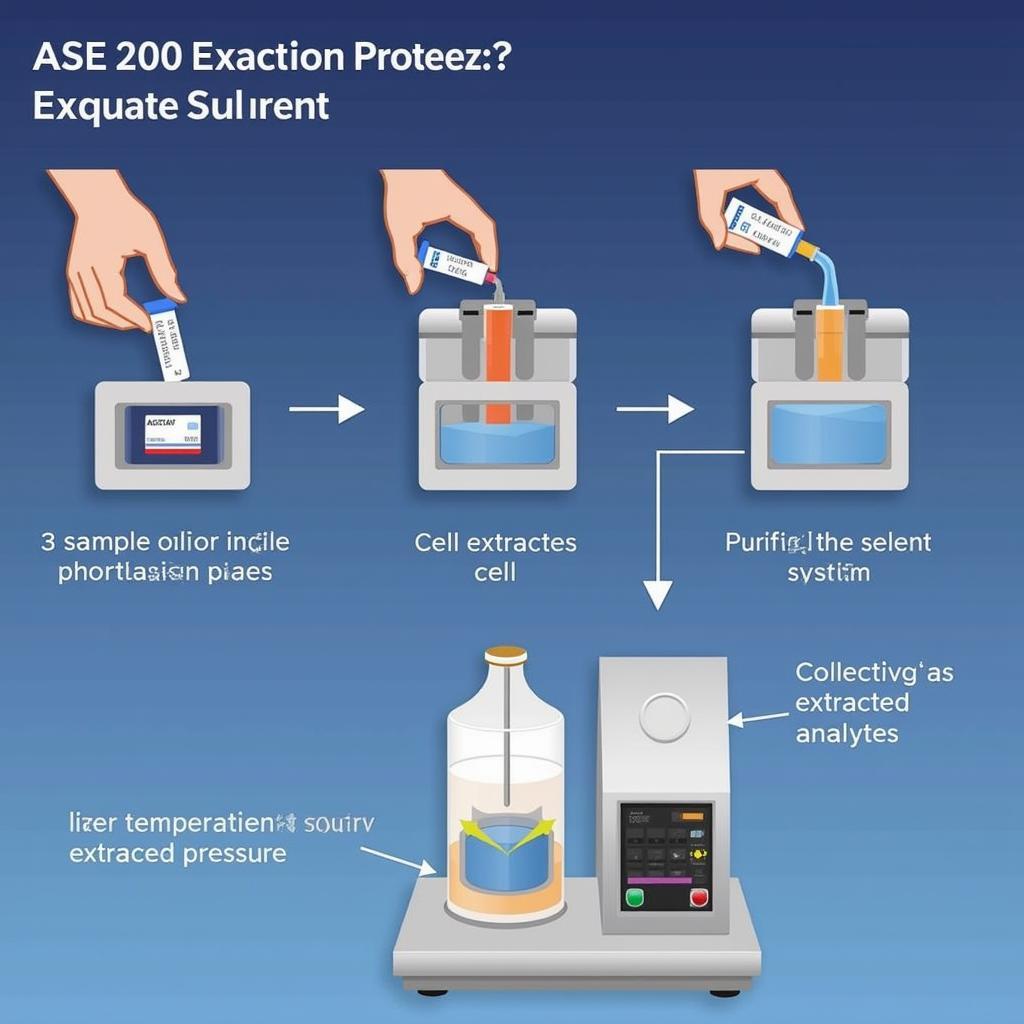

Understanding the Contribution Process

How do contributions work for ASE selvstændig efterløn? Contributing to the scheme involves regular payments, which are tax-deductible. The amount you contribute can be adjusted based on your income and retirement goals, offering flexibility in managing your finances.

Benefits of Choosing ASE Selvstændig Efterløn

What are the advantages of opting for ASE selvstændig efterløn? The key benefits include a stable income stream during early retirement, tax deductions on contributions, and the ability to supplement other retirement savings. This can provide peace of mind and financial freedom.

Maximizing Your ASE Selvstændig Efterløn Benefits

How can you get the most out of ASE selvstændig efterløn? Strategies for maximizing benefits include starting early, contributing consistently, and adjusting contributions as your income fluctuates. Seeking professional financial advice can further optimize your retirement plan. The ase ark resource provides further guidance and resources for financial planning.

Conclusion

ASE selvstændig efterløn is a valuable tool for self-employed individuals in Denmark planning for early retirement. By understanding the requirements, benefits, and contribution strategies, you can secure a comfortable financial future.

FAQ

- What is the minimum contribution for ASE selvstændig efterløn?

- How can I access my ASE selvstændig efterløn funds?

- Can I change my contribution level after enrollment?

- What happens to my ASE selvstændig efterløn if I cease being self-employed?

- What is the tax implication of withdrawing from ASE selvstændig efterløn?

- How does ASE selvstændig efterløn compare to other retirement schemes?

- Where can I find more information about ASE selvstændig efterløn?

Need help? Contact us 24/7 at Phone: 0369020373, Email: aseanmediadirectory@gmail.com or visit us at Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam.