CME Group, a leading derivatives marketplace, offers ASEAN sessions providing access to a diverse range of products and opportunities in Southeast Asia. These sessions allow investors to trade and manage risk across various asset classes, including currencies, commodities, and equity indexes, reflecting the region’s dynamic economic landscape.

ASEAN Trading Floor at CME Group

ASEAN Trading Floor at CME Group

Understanding CME Group ASEAN Sessions

CME Group’s ASEAN sessions extend trading hours, providing greater flexibility for investors to participate in these rapidly growing markets. The sessions cater to the increasing demand for exposure to Southeast Asian assets, allowing traders to capitalize on opportunities arising from different time zones.

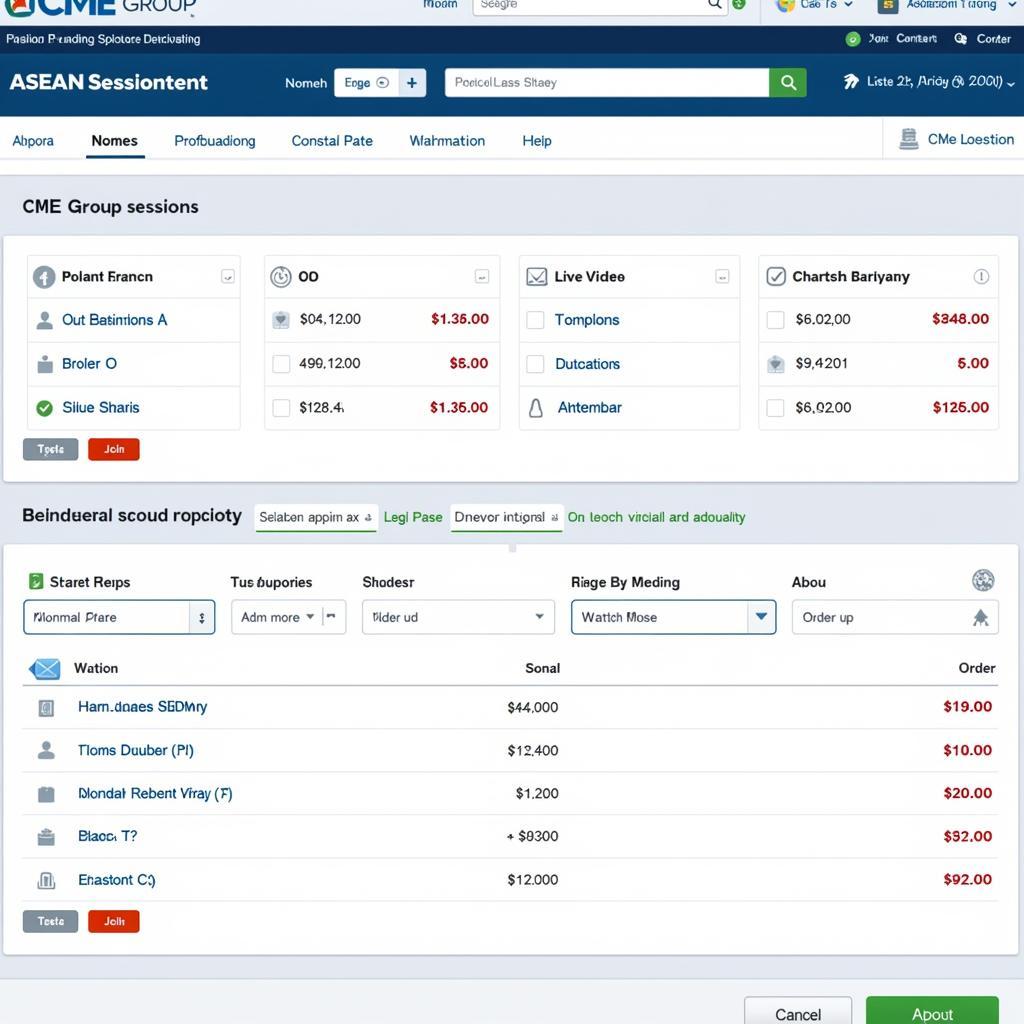

CME Group Trading Platform with ASEAN Session Data

CME Group Trading Platform with ASEAN Session Data

Benefits of Trading ASEAN Sessions on CME Group

Trading ASEAN sessions on CME Group offers several advantages for investors seeking to diversify their portfolios and capitalize on the region’s growth potential:

- Extended Trading Hours: The extended trading hours offer increased flexibility and opportunities to manage risk across different time zones.

- Access to Key ASEAN Markets: Investors gain access to derivatives linked to key Southeast Asian economies, including Singapore, Thailand, Malaysia, and Indonesia.

- Diversification Opportunities: CME Group’s ASEAN sessions offer valuable diversification benefits for investors seeking to reduce their overall portfolio risk.

- Established and Regulated Marketplace: CME Group provides a secure and regulated environment for trading, ensuring transparency and investor protection.

Products Available in ASEAN Sessions

CME Group’s ASEAN sessions offer a variety of products, including:

- Currency Futures and Options: Trade futures and options on major ASEAN currencies, such as the Singapore dollar, Thai baht, and Malaysian ringgit.

- Commodity Futures: Access futures contracts on key commodities produced in Southeast Asia, such as palm oil and rubber.

- Equity Index Futures: Gain exposure to the performance of leading Southeast Asian equity markets through index futures.

Navigating Volatility in ASEAN Markets

While ASEAN markets offer significant growth potential, it’s important to acknowledge the inherent volatility associated with emerging economies. Factors such as political changes, commodity price fluctuations, and global economic trends can impact market performance.

Risk Management Tools for ASEAN Markets

Risk Management Tools for ASEAN Markets

Conclusion

CME Group’s ASEAN sessions provide a valuable gateway for investors to access the growth potential of Southeast Asian markets. By offering extended trading hours and a diverse range of products, CME Group empowers investors to manage risk, diversify portfolios, and capitalize on opportunities in this dynamic region. Understanding the unique characteristics of ASEAN markets and utilizing appropriate risk management strategies is crucial for successful trading in these sessions.