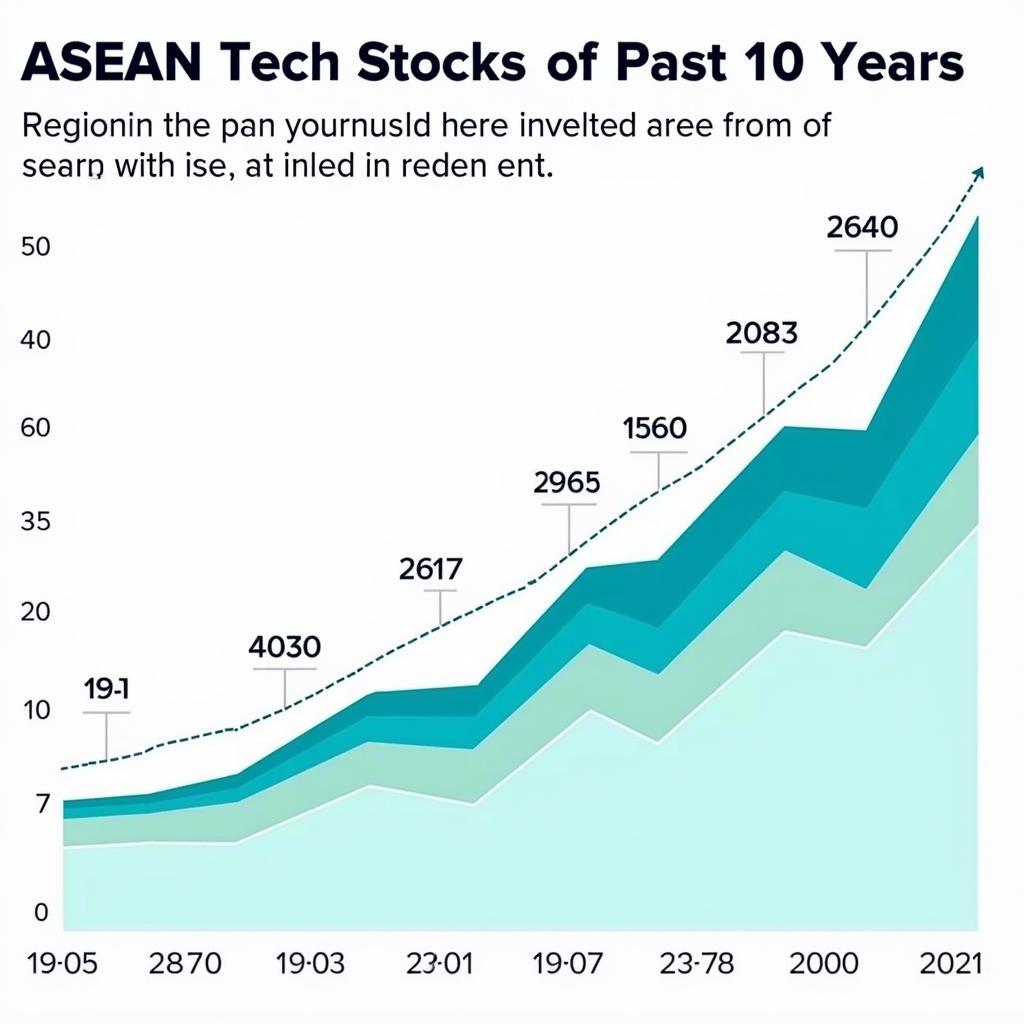

ASEAN tech stock is attracting increasing global attention, presenting both exciting opportunities and unique challenges. This burgeoning sector offers a glimpse into the future of Southeast Asia’s digital economy, driven by rapid technological advancements, increasing internet penetration, and a young, tech-savvy population. Understanding the dynamics of Ase Tech Stock is crucial for investors seeking to capitalize on this growth.

Understanding the Potential of ASEAN Tech Stock

The ASEAN region is a hotbed for technological innovation, with startups and established companies alike pushing the boundaries in areas like e-commerce, fintech, and gaming. This vibrant ecosystem makes ase technology stock a compelling investment proposition. Factors such as rising disposable incomes, government support for digital initiatives, and a growing middle class are further fueling the growth of the tech sector in Southeast Asia. Investing in ase tech stock allows you to tap into this dynamic market and potentially benefit from its long-term growth trajectory.

ASEAN Tech Stock Growth Chart

ASEAN Tech Stock Growth Chart

What makes ASEAN tech stock particularly attractive is the diversity of opportunities. From established players to emerging unicorns, the market offers a wide range of investment options. This allows investors to diversify their portfolios and tailor their investments to their specific risk appetite and investment goals. Whether you’re interested in established e-commerce giants or disruptive fintech startups, the ASEAN tech landscape has something to offer.

Key Considerations for Investing in ASEAN Tech Stock

While the potential of ase technology stock is undeniable, it’s essential to approach this market with a clear understanding of the associated risks and challenges. [ase technology stock] can be volatile, influenced by both global and regional economic factors. Regulatory changes, political instability, and currency fluctuations can all impact the performance of ase technology holding stock. Therefore, thorough research and due diligence are crucial before making any investment decisions.

Another key aspect to consider is the varying levels of market maturity across the ASEAN region. While some countries have well-developed tech ecosystems, others are still in the early stages of development. This disparity presents both opportunities and challenges for investors. Understanding the specific market dynamics of each country is essential for making informed investment choices. For example, [ase technology one stock] may perform differently compared to similar companies in other ASEAN nations due to specific market conditions.

What are the long-term prospects for ASEAN tech stocks?

The long-term prospects for ASEAN tech stocks remain positive, driven by strong underlying fundamentals. The region’s young and growing population, coupled with increasing internet and mobile penetration, creates a fertile ground for tech companies to flourish. However, investors should be prepared for short-term volatility and focus on companies with strong business models and sustainable growth strategies.

How can I diversify my ASEAN tech stock portfolio?

Diversification is key to mitigating risk in any investment portfolio. Within the ASEAN tech sector, you can diversify by investing in companies across different sub-sectors like e-commerce, fintech, and gaming. You can also diversify geographically by investing in companies from different ASEAN countries. This helps to spread your risk and potentially maximize your returns.

ASEAN Tech Stock: A Gateway to Southeast Asia’s Digital Future

Investing in [ase technology stock news] provides a unique opportunity to participate in the growth story of Southeast Asia’s digital transformation. By carefully analyzing market trends, understanding the risks, and selecting companies with strong growth potential, investors can position themselves to benefit from the exciting opportunities that ASEAN tech stock has to offer. Keeping track of [ase technology holding stock price] is also vital for informed decision-making.

In conclusion, ase tech stock represents a dynamic and promising investment opportunity. With careful research and a long-term perspective, investors can potentially reap significant rewards from this rapidly evolving market.

FAQ

- What are the key drivers of growth in the ASEAN tech sector?

- What are the main risks associated with investing in ase tech stock?

- How can I research and analyze ASEAN tech companies?

- What are some popular ASEAN tech stock exchanges?

- How can I stay updated on the latest news and trends in the ASEAN tech market?

- Where can I find reliable information on [ase technology stock]?

- What are some of the ethical considerations when investing in ASEAN tech stocks?

For further assistance, please contact us at Phone Number: 0369020373, Email: [email protected] Or visit our address: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.