The Southeast Asian technology sector is experiencing an unprecedented boom, and with it comes a surge in demand for financing. Understanding ASEAN technology financials, therefore, is crucial for investors and businesses looking to capitalize on this dynamic landscape. This article delves into the key trends, challenges, and opportunities shaping the financial landscape of Southeast Asia’s tech industry.

Funding Fuels the Fire: A Look at Investment Trends

ASEAN Tech Investment Trends

ASEAN Tech Investment Trends

Over the past decade, ASEAN has emerged as a global hotspot for tech investment. The region boasts a young, digitally-savvy population, rising internet and smartphone penetration, and a burgeoning middle class. These factors have fueled the growth of a vibrant startup ecosystem, attracting significant interest from venture capitalists and private equity firms worldwide.

Key investment trends shaping ASEAN technology financials include:

- Rise of Unicorns: ASEAN is now home to numerous unicorns, privately held startups valued at over USD 1 billion. These companies, spanning sectors like e-commerce, fintech, and ride-hailing, demonstrate the enormous potential of the region’s tech sector.

- Dominance of Fintech: Financial technology (fintech) remains a dominant force, attracting a significant portion of tech investments. This is driven by the region’s large unbanked population and the increasing adoption of digital payment solutions.

- Early-Stage Funding: While later-stage funding rounds are becoming more common, early-stage investments remain crucial for nurturing the next generation of ASEAN tech companies.

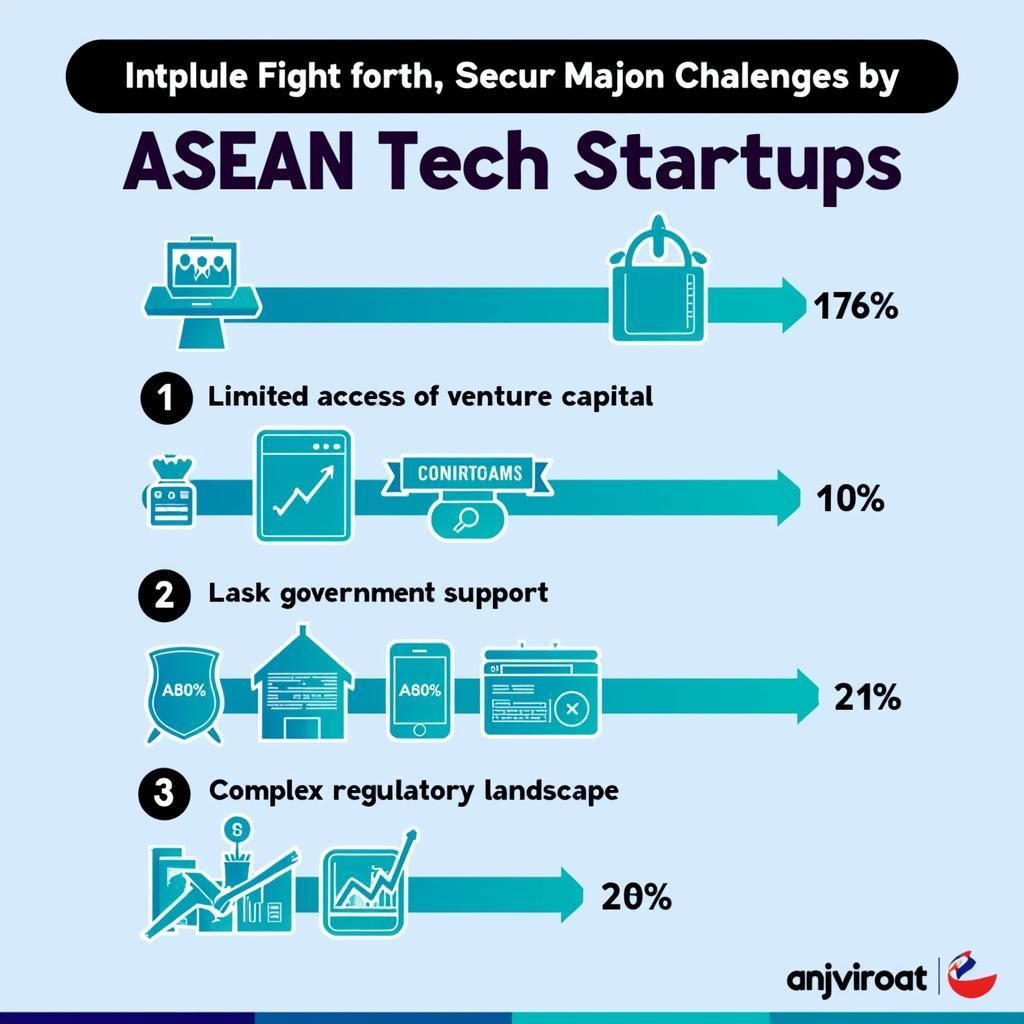

Navigating the Challenges: Funding Gaps and Regulatory Hurdles

Funding Challenges for ASEAN Tech Startups

Funding Challenges for ASEAN Tech Startups

Despite the impressive growth, ASEAN technology financials still face several challenges:

- Funding Gap in Later Stages: While early-stage funding has improved, securing capital for growth and expansion remains a hurdle for many promising ASEAN tech companies.

- Regulatory Uncertainty: The diverse regulatory landscape across ASEAN countries can pose challenges for tech companies, particularly in areas like data privacy and financial services.

- Talent Crunch: Finding skilled tech talent is a constant struggle for ASEAN companies competing in a global market.

Seizing the Opportunities: A Future Ripe with Potential

The future of ASEAN technology financials remains bright. With the right support and strategic initiatives, the region can overcome its challenges and unlock its full potential. Some key opportunities include:

- Government Support and Initiatives: Governments across ASEAN are increasingly recognizing the importance of the tech sector and implementing policies to attract investment and foster innovation.

- ASEAN Integration: Initiatives to promote greater economic integration within ASEAN, such as the ASEAN Economic Community (AEC), can help to harmonize regulations and facilitate cross-border investments.

- Growth of Islamic Fintech: The significant Muslim population in Southeast Asia presents a unique opportunity for the growth of Islamic fintech solutions, further diversifying the region’s financial technology landscape.

For investors seeking exposure to emerging markets, ASEAN technology financials offer a compelling proposition. However, understanding the specific challenges and opportunities present in each country and sector is crucial for success.

Conclusion: ASEAN Technology – A Region Primed for Growth

The ASEAN technology sector is on a remarkable growth trajectory, fueled by a confluence of favorable factors. While challenges remain, the opportunities presented by ASEAN technology financials are too significant to ignore. By navigating the complexities and embracing the potential, investors and businesses can position themselves to reap the rewards of this dynamic and rapidly evolving landscape. For further insights into specific companies operating in this space, you can explore resources like ASE Technology Holding Finanicals or delve into the broader market trends through platforms like ASE Stock Exchange Australia. Understanding how these individual players contribute to the ecosystem is crucial for making informed investment decisions. For those seeking real-time market data, resources like ASE Stockwatch provide up-to-date information and analysis.

FAQ

-

What are the key sectors driving growth in ASEAN technology financials?

Key sectors include e-commerce, fintech, logistics, and food delivery. -

What are the biggest challenges for tech startups in Southeast Asia?

Challenges include securing funding, navigating regulations, and finding skilled talent. -

What role does government play in supporting the ASEAN tech sector?

Governments are introducing policies to attract investment, promote innovation, and develop tech infrastructure. -

What are the potential risks of investing in ASEAN technology financials?

Risks include political instability, regulatory changes, and currency fluctuations. -

What are some resources for staying updated on ASEAN technology financials?

Industry publications, research reports, and online forums dedicated to ASEAN technology and investment are valuable resources.

For any assistance, please contact us at Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com or visit us at: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer support team.