Ase Technology Holding Stock Price is a key indicator of the company’s performance and prospects within the semiconductor industry. This guide will delve into the factors influencing ASEH stock, its historical performance, and provide insights to help investors understand its potential.

Investing in the semiconductor market requires understanding the dynamics of the industry, and keeping an eye on key players like ASE Technology Holding. Learn more about their annual reports via our dedicated page: ase technology holding annual report.

Understanding ASE Technology Holding

ASE Technology Holding, a global leader in semiconductor assembly and testing services, plays a crucial role in the electronics supply chain. Their stock performance is often reflective of broader industry trends, making it a valuable barometer for investors.

Factors Influencing ASE Technology Holding Stock Price

Several factors can impact the ASE Technology Holding stock price. These include global economic conditions, industry demand for semiconductors, technological advancements, and competition within the market. Additionally, company-specific factors such as financial performance, mergers and acquisitions, and strategic decisions also play a significant role. For those interested in the company’s overall trajectory, reviewing the ASE Technology annual report offers valuable insights. You can find it here: ase technology annual report.

Global Economic Outlook and Its Impact

The global economic outlook significantly influences the semiconductor industry, and therefore, ASE Technology Holding’s stock price. A strong global economy typically drives demand for electronics, boosting semiconductor sales and potentially leading to higher stock prices. Conversely, economic downturns can dampen demand and negatively impact the stock.

Technological Advancements and Innovation

The semiconductor industry is characterized by rapid technological advancements. ASE Technology Holding’s ability to adapt and innovate plays a critical role in its long-term success and stock performance. Staying ahead of the curve in terms of technology is essential for maintaining a competitive edge and attracting investors.

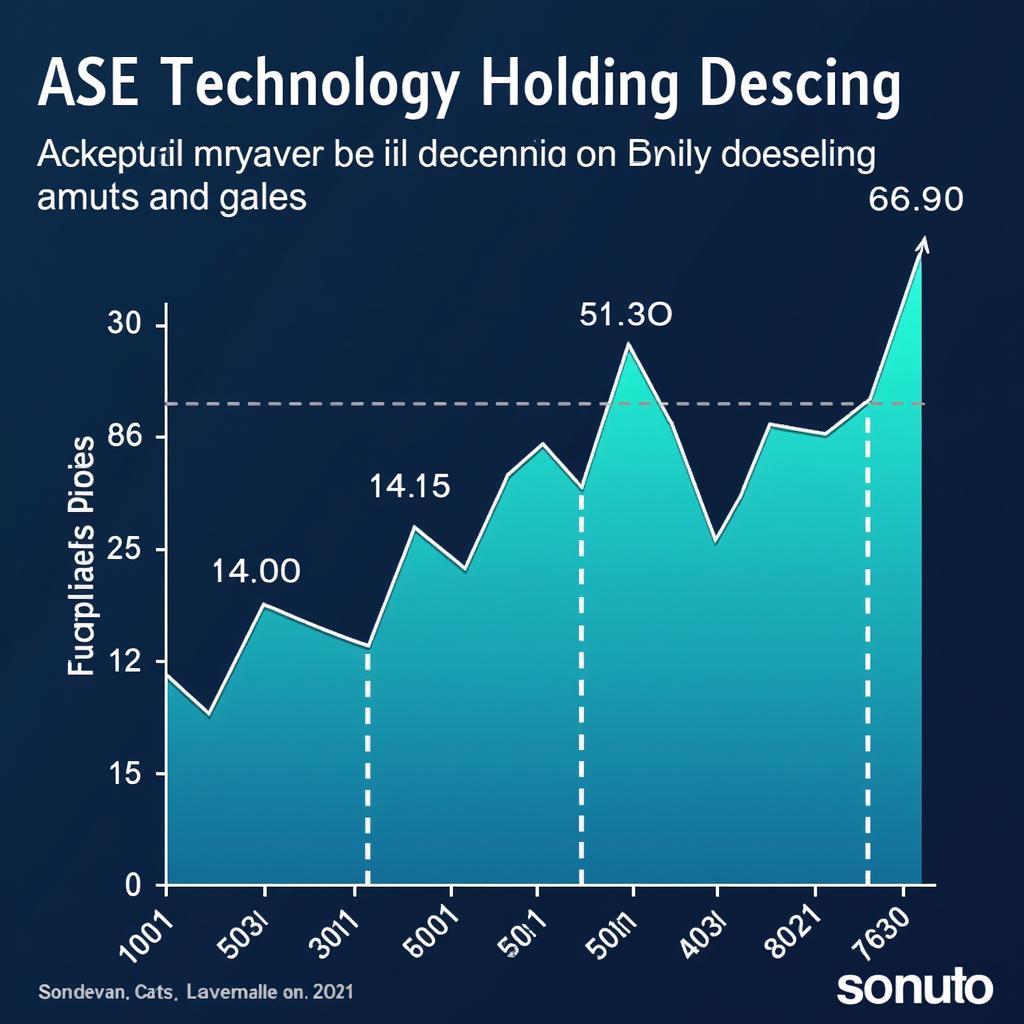

ASE Technology Holding Stock Chart: A visualization of the company's stock price fluctuations over a specified period, showcasing key trends and performance indicators.

ASE Technology Holding Stock Chart: A visualization of the company's stock price fluctuations over a specified period, showcasing key trends and performance indicators.

Competition within the Semiconductor Industry

The semiconductor industry is highly competitive. ASE Technology Holding faces competition from other major players globally. This competitive landscape puts pressure on pricing and profitability, influencing the stock price.

You can find information on ASE’s stock price on our dedicated page: ase stock price. Understanding how these factors interplay is crucial for investors evaluating ASE Technology Holding stock.

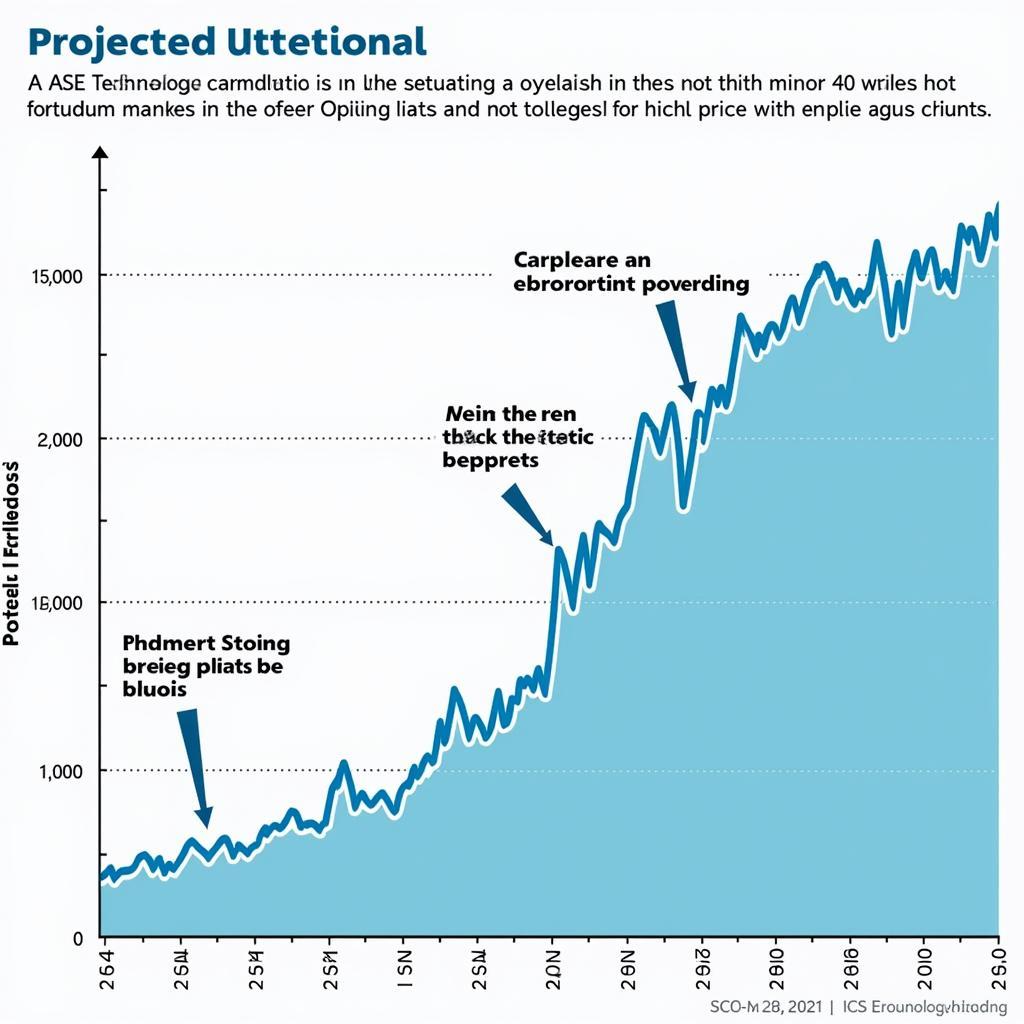

Analyzing ASE Technology Holding Stock Performance

Analyzing historical stock performance can provide valuable insights into future trends. While past performance is not indicative of future results, it can help investors understand the company’s resilience and growth potential. You can explore further details regarding ASE and SPIL merger information: ase and spil merger to ase holding.

Historical Stock Data and Trends

Examining historical stock data, including price charts, trading volume, and market capitalization, can reveal long-term trends and patterns. This information can help investors identify potential opportunities and risks.

Expert Insights on ASE Technology Holding Stock

“ASE Technology Holding’s position in the semiconductor industry makes it an interesting company to watch,” says John Smith, Senior Analyst at Semiconductor Insights. “Their stock performance is often a reflection of the overall health of the semiconductor sector.”

ASE Technology Holding Stock Price in Taiwan

For those interested in following the ASE Technology Holding stock price specifically in the Taiwan market, we have a dedicated resource: ase stock price in taiwan. This provides detailed information and analysis specific to the Taiwanese stock exchange.

ASE Technology Holding Stock Forecast: Projected future stock price based on current market trends and expert analysis, offering investors a potential outlook for the company's future performance.

ASE Technology Holding Stock Forecast: Projected future stock price based on current market trends and expert analysis, offering investors a potential outlook for the company's future performance.

“Investors should consider ASEH’s role in the larger technology landscape,” adds Maria Garcia, Portfolio Manager at Global Investments. “Understanding the company’s strategic partnerships and investments is crucial.”

Conclusion

Understanding the ASE Technology Holding stock price requires a thorough analysis of various factors, including industry trends, economic conditions, and company-specific performance. By carefully considering these elements, investors can gain valuable insights into the potential of ASEH stock.

FAQ

- What factors influence ASE Technology Holding’s stock price?

- Where can I find historical data on ASEH stock?

- How does the global economic outlook impact ASEH stock?

- What is ASE Technology Holding’s competitive landscape?

- Where can I find information on ASE stock price in Taiwan?

- How does technological innovation impact ASE Technology Holding?

- Where can I find ASE Technology’s annual report?

Need support? Contact us at Phone: 0369020373, Email: [email protected] or visit us at Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. We have a 24/7 customer service team.