The dynamic landscape of ASEAN technology stocks presents a compelling investment opportunity. This article explores the growth potential, key players, and important considerations for navigating this exciting market. We will delve into the factors driving this growth and provide insights to help investors make informed decisions.

Understanding the Rise of ASEAN Tech Stocks

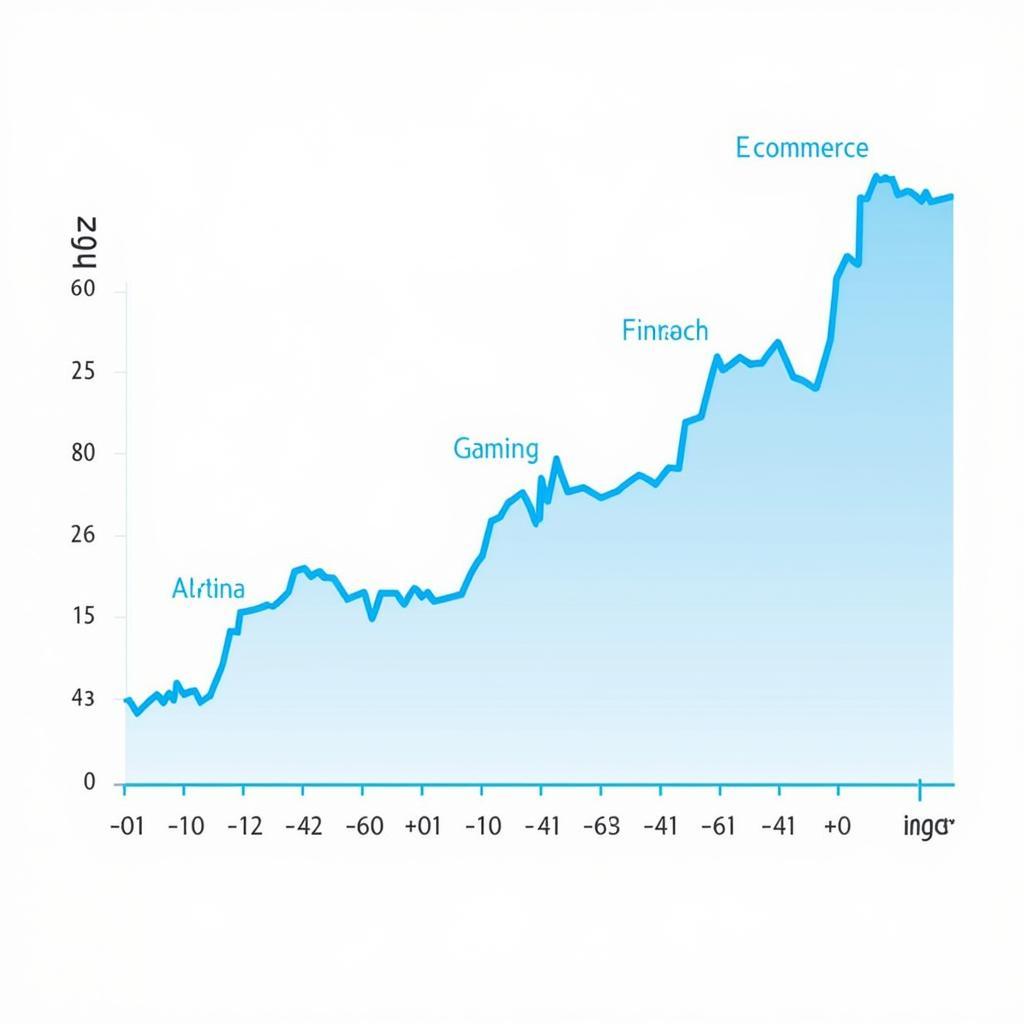

Southeast Asia is experiencing a digital revolution, fueled by a young, tech-savvy population and increasing internet penetration. This surge in digital adoption has created a fertile ground for technology companies to thrive, leading to a significant rise in the value of ASEAN tech stocks. From e-commerce and fintech to gaming and cloud computing, the region offers a diverse range of investment opportunities. This growth is further fueled by supportive government policies and increasing foreign investment.  ASEAN Technology Stocks Growth Chart

ASEAN Technology Stocks Growth Chart

The ASEAN region comprises diverse economies with varying levels of development, creating unique opportunities and challenges for tech companies. Understanding these nuances is crucial for successful investment. Factors such as regulatory frameworks, infrastructure development, and consumer behavior vary significantly across the region. For example, while Singapore boasts a highly developed digital infrastructure, countries like Vietnam and Indonesia are experiencing rapid growth in mobile internet usage, presenting different investment prospects. ase asx stock

Key Players in the ASEAN Tech Scene

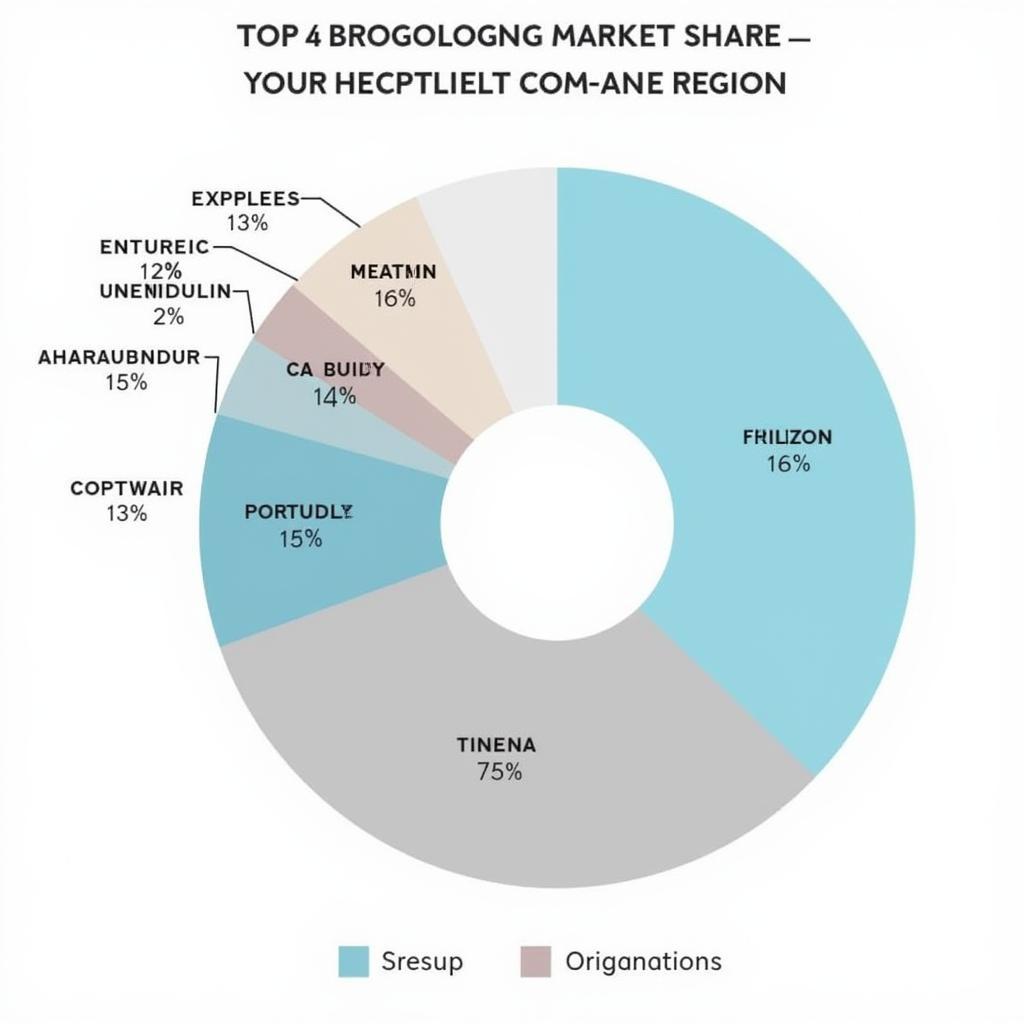

Several key players are driving the growth of the ASEAN tech sector. These include established companies expanding their presence in the region and homegrown startups disrupting traditional industries. Understanding the competitive landscape and identifying companies with strong growth potential is essential for investors. For instance, Grab and GoTo, two of Southeast Asia’s leading super apps, have significantly impacted the region’s digital economy. Their diverse offerings, spanning ride-hailing, food delivery, and financial services, cater to the evolving needs of ASEAN consumers.  Market Share of Leading ASEAN Tech Companies

Market Share of Leading ASEAN Tech Companies

Furthermore, the rise of smaller, specialized tech companies focusing on niche markets like agritech and edtech adds to the diversity and dynamism of the ASEAN tech landscape. ase etf

Factors to Consider When Investing in ASEAN Tech Stocks

Investing in ASEAN technology stocks requires careful consideration of several factors. These include market volatility, regulatory changes, and currency fluctuations. Conducting thorough due diligence and staying informed about market trends are crucial for mitigating risks. “Investors need to be aware of the specific risks associated with emerging markets,” says Anya Sharma, a Senior Analyst at Global Emerging Markets Research. “While the growth potential is significant, factors such as political instability and economic fluctuations can impact investment returns.” ase stock exchange usa

What are the risks associated with investing in emerging markets?

Emerging markets like those in ASEAN can be volatile, influenced by political and economic factors.

How can investors mitigate these risks?

Diversification, thorough research, and staying informed are key to mitigating investment risks.

Navigating the ASEAN Tech Market

Navigating the ASEAN tech market requires a strategic approach. Investors should diversify their portfolios, consider both established companies and emerging startups, and stay updated on market developments. ase financial statements “A balanced portfolio that includes both large-cap and small-cap tech stocks can help mitigate risks and maximize returns,” adds Ms. Sharma. “It’s also essential to stay informed about the regulatory landscape and emerging trends in the region.”

Conclusion

ASEAN technology stocks offer a compelling investment opportunity, driven by rapid digitalization and a burgeoning tech ecosystem. However, navigating this market requires careful consideration of the unique opportunities and challenges presented by the region. By understanding the key players, market dynamics, and potential risks, investors can position themselves to capitalize on the exciting growth potential of ASEAN tech stocks. ase tech stock

FAQ

- What are the key sectors driving ASEAN tech growth?

- Which ASEAN countries offer the most attractive investment opportunities?

- What are the major risks associated with investing in ASEAN tech stocks?

- How can investors diversify their ASEAN tech portfolios?

- What are the regulatory considerations for investing in ASEAN tech companies?

- Where can I find reliable information on ASEAN tech stocks?

- What are some examples of successful ASEAN tech companies?

When you need support, please contact us via Phone: 0369020373, Email: [email protected] or visit our address: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer service team.