Asea Capital, a term encompassing the flow of investments within the Association of Southeast Asian Nations (ASEAN), plays a crucial role in the region’s dynamic economic growth. From venture capital funding burgeoning startups to foreign direct investment in established industries, ASEA capital fuels innovation, creates jobs, and drives development across diverse sectors. This article delves into the intricacies of ASEA capital, exploring its various forms, its impact on the region, and the opportunities it presents for investors and businesses alike.

ASEA Capital Flow and Investment in Southeast Asia

ASEA Capital Flow and Investment in Southeast Asia

Understanding ASEA Capital Markets

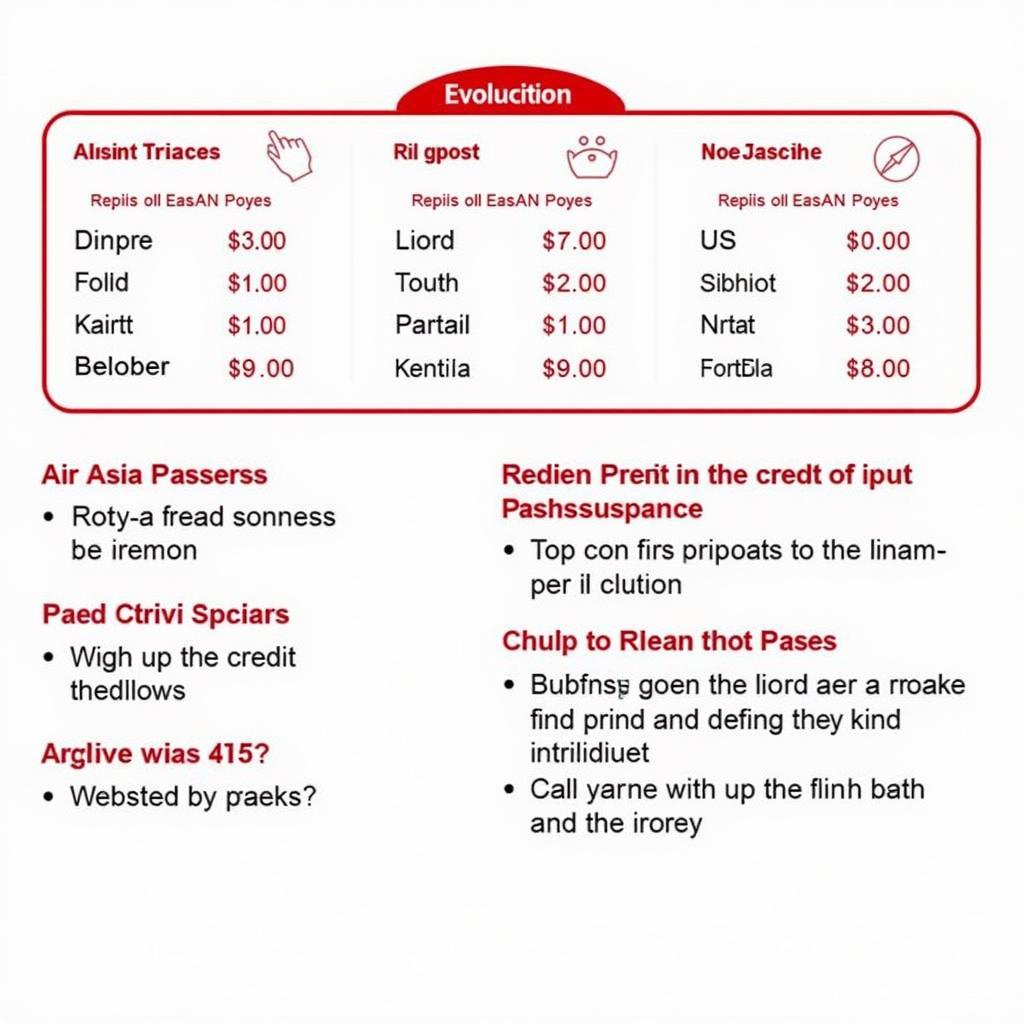

What exactly constitutes ASEA capital? It’s a broad term encompassing various forms of investment, including private equity, venture capital, foreign direct investment (FDI), and public market investments. These investments target a wide range of sectors, from technology and manufacturing to infrastructure and tourism. asean capital markets are becoming increasingly sophisticated, attracting both regional and international investors. The growth of these markets is underpinned by ASEAN’s favorable demographics, rising middle class, and increasing integration into the global economy.

What is the role of the ASEAN Capital Markets Forum? The asean capital markets forum 2018 , for instance, focused on enhancing regional cooperation and integration in capital markets. These initiatives contribute to creating a more robust and attractive environment for investment.

Factors Influencing ASEA Capital

Several factors contribute to the attractiveness of ASEA capital. These include:

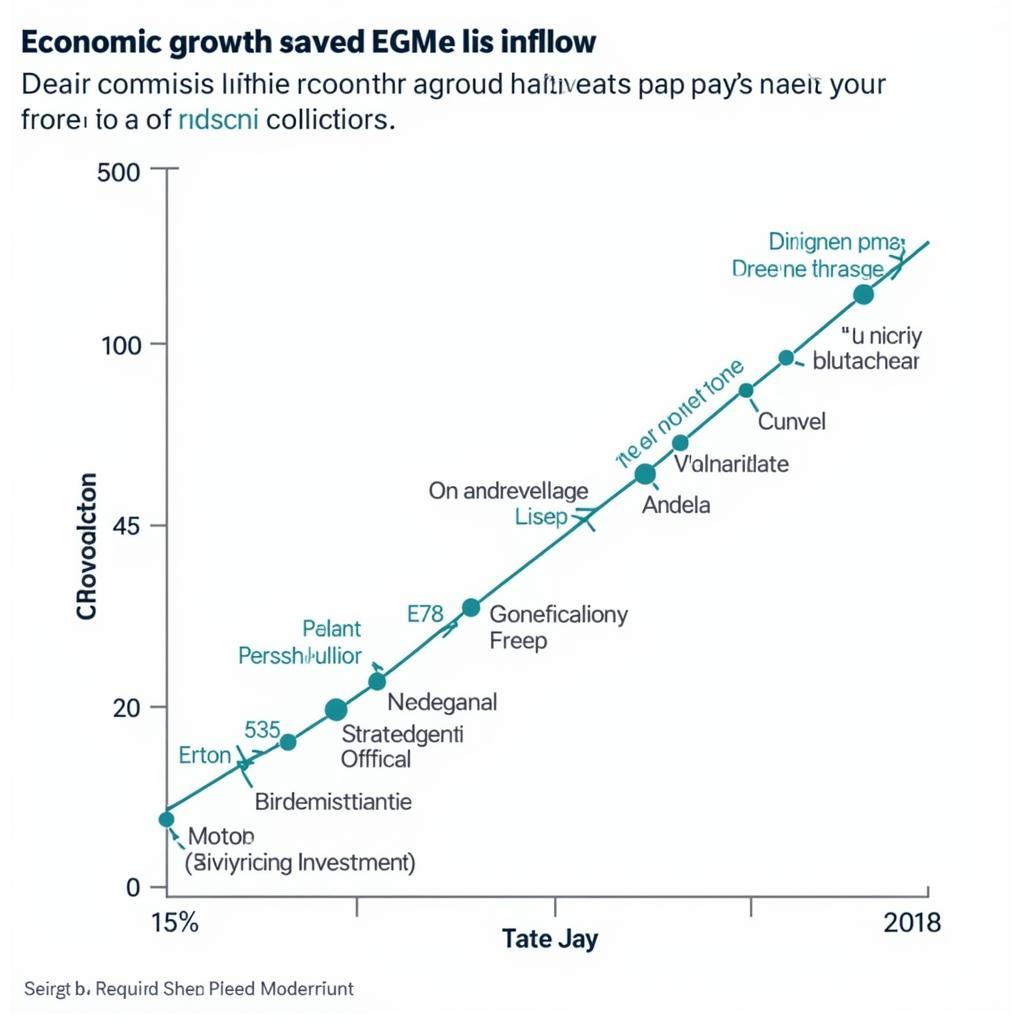

- Strong Economic Growth: ASEAN boasts some of the fastest-growing economies in the world, presenting lucrative opportunities for investors.

- Favorable Demographics: A young and growing population with a burgeoning middle class drives consumption and fuels demand across various sectors.

- Strategic Location: ASEAN’s strategic location at the heart of Asia provides access to major global markets.

- Increasing Regional Integration: Initiatives like the ASEAN Economic Community (AEC) facilitate cross-border trade and investment.

ASEAN Economic Growth and Investment Opportunities

ASEAN Economic Growth and Investment Opportunities

Opportunities and Challenges in ASEA Capital

While ASEA capital presents immense opportunities, it also faces certain challenges. Navigating diverse regulatory landscapes and understanding local market dynamics can be complex. However, these challenges are often outweighed by the potential rewards. ase capital review provides insights into navigating these complexities.

Investing in ASEA: A Gateway to Growth

For investors seeking exposure to emerging markets, ASEA capital offers a compelling proposition. The region’s diverse economies and dynamic growth potential create a landscape ripe with opportunity. From startups disrupting traditional industries to established companies expanding their footprint, ASEA offers a range of investment avenues. asean cap offers more insights into specific investment opportunities.

“ASEAN’s diverse markets offer a unique blend of high-growth potential and relative stability, making it an attractive destination for both short-term and long-term investors,” says Anya Sharma, Senior Economist at the Southeast Asia Investment Institute.

The Future of ASEA Capital

ASEA capital is poised for continued growth in the years to come. As the region further integrates and its economies mature, the flow of investment is expected to accelerate. This growth will be driven by ongoing infrastructure development, technological advancements, and the increasing sophistication of ASEA’s capital markets. “The future of ASEA capital lies in its ability to embrace innovation and adapt to the evolving global landscape,” adds Rajan Patel, Managing Director of Asia Pacific Ventures. ase capital markets franchise is becoming an increasingly attractive model for international businesses seeking to establish a presence in the region.

In conclusion, ASEA capital represents a powerful engine for economic growth and development in Southeast Asia. By understanding the dynamics of this evolving landscape, investors and businesses can unlock the immense potential of this vibrant region. ASEA capital is not just about financial returns; it’s about investing in the future of a region on the rise.

FAQ

- What are the main sources of ASEA capital?

- What are the key sectors attracting ASEA capital?

- What are the risks and rewards of investing in ASEA capital?

- How can I invest in ASEA capital markets?

- What is the role of government regulations in ASEA capital?

- How does ASEA capital contribute to regional development?

- What are the future prospects for ASEA capital?

For support, please contact us at Phone Number: 0369020373, Email: [email protected], or visit us at Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam. Our customer service team is available 24/7.