Asea Health Premium options are becoming increasingly relevant in Southeast Asia’s evolving healthcare landscape. With a growing middle class and increasing awareness of health and wellness, individuals and families are seeking comprehensive coverage and access to quality care. This article explores the nuances of asea health premium, focusing on the diverse needs and opportunities within the ASEAN region.

Understanding Asea Health Premium in the ASEAN Context

The term “asea health premium” encompasses a range of health insurance and wellness programs designed to provide enhanced coverage and benefits. In the ASEAN context, this takes on particular significance due to the diverse economic and social landscapes across member states. Some countries have robust public healthcare systems, while others rely heavily on private insurance. Understanding these differences is crucial when navigating the asea health premium market. For example, individuals seeking information about ASEA Local 52 health insurance may find valuable resources at asea local 52 health insurance.

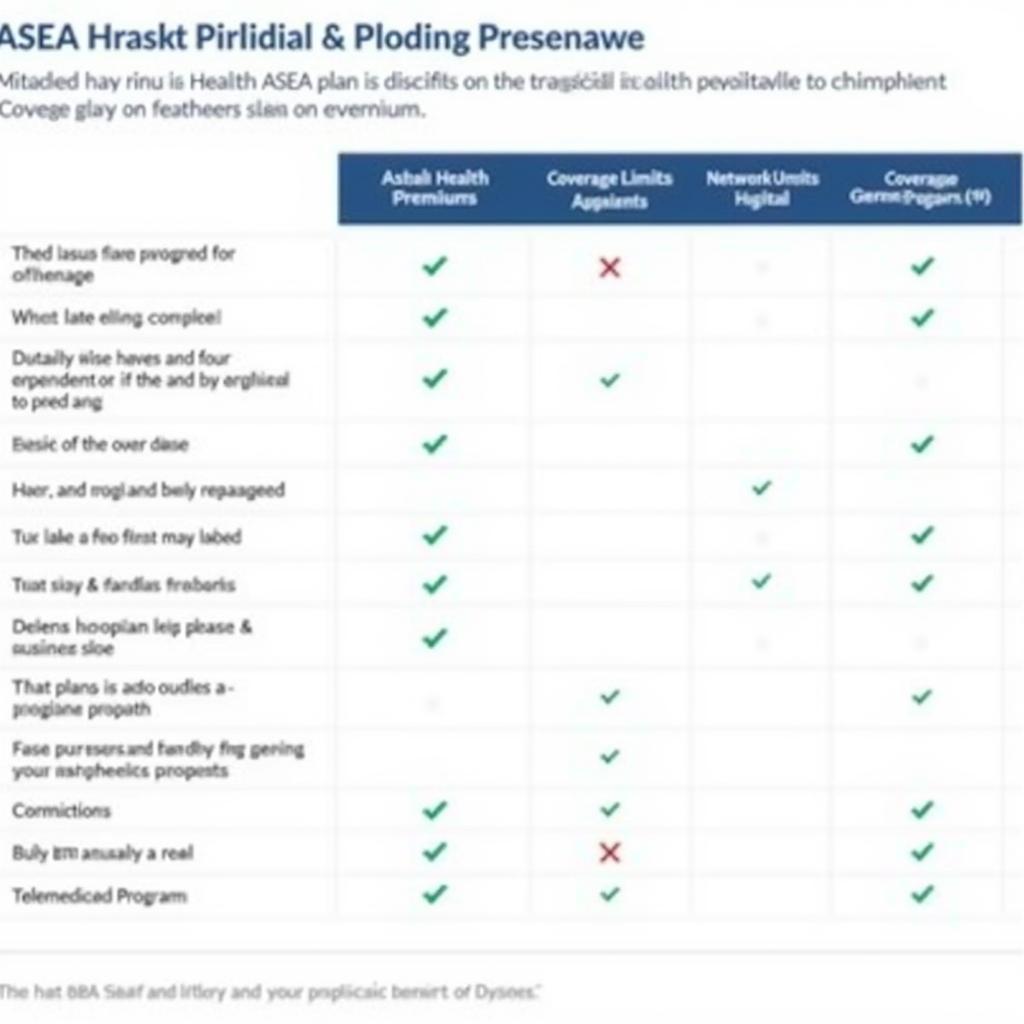

Comparing ASEA Health Premium Plans in Southeast Asia

Comparing ASEA Health Premium Plans in Southeast Asia

Factors Influencing Asea Health Premium Choices

Several factors contribute to the increasing demand for asea health premium in Southeast Asia:

- Rising healthcare costs: The cost of medical treatment is increasing across the region, making comprehensive health insurance essential.

- Increased awareness of preventive care: Individuals are becoming more proactive about their health and seeking wellness programs that promote preventative care.

- Growing middle class: A burgeoning middle class with greater disposable income is driving demand for premium healthcare services.

- Medical tourism: Southeast Asia is a hub for medical tourism, attracting patients from around the world. This has further fueled the development of premium healthcare offerings. Those interested in the effects of ASEA Redox Water might find the comparison provided at asea redox water vs helpful.

Choosing the Right Asea Health Premium Plan

Selecting the right asea health premium plan can be challenging. Here are some key considerations:

- Coverage: Assess your specific needs and ensure the plan covers essential medical expenses, including hospitalization, surgery, and specialist consultations. You might want to consider checking out reviews for specific products like the ASEA Revitalizing Redox Gel at asea revitalizing redox gel reviews.

- Network: Choose a plan with a broad network of hospitals and clinics, especially if you travel frequently within the ASEAN region.

- Premiums: Balance the cost of premiums with the level of coverage offered.

- Additional benefits: Consider additional benefits such as wellness programs, telemedicine services, and international coverage. For those interested in ASEA’s health trust, asea local 52 health trust could offer further information.

“In today’s dynamic healthcare environment, a well-chosen asea health premium plan provides peace of mind and financial security, allowing individuals to focus on their wellbeing,” says Dr. Anya Sharma, a healthcare consultant based in Singapore.

Asea Health Premium: Investing in Your Future

Asea health premium represents an investment in your health and financial security. By carefully considering your individual needs and the diverse options available, you can choose a plan that provides comprehensive coverage and access to quality healthcare across the ASEAN region. Information regarding ASEA’s open enrollment periods can be found at asea health open enrollment.

In conclusion, asea health premium is a crucial aspect of navigating the evolving healthcare landscape in Southeast Asia. With careful planning and consideration, individuals can secure their health and wellbeing for the future.

FAQ:

- What are the typical coverage options included in asea health premium plans?

- How do I compare different asea health premium plans in the ASEAN region?

- What factors should I consider when choosing a plan?

- Are there any government subsidies available for asea health premium?

- What is the process for claiming reimbursements under an asea health premium plan?

- How does asea health premium address the specific healthcare challenges in Southeast Asia?

- What are the future trends in asea health premium within the ASEAN context?

Need support? Contact us 24/7: Phone: 0369020373, Email: aseanmediadirectory@gmail.com. Visit us at: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam.