The Asean 3 Bond Market Guide 2016 serves as a crucial resource for navigating the dynamic landscape of bond markets within Indonesia, Malaysia, and the Philippines. This guide offers valuable insights for investors seeking opportunities in Southeast Asia.

Understanding the ASEAN 3 Bond Market in 2016

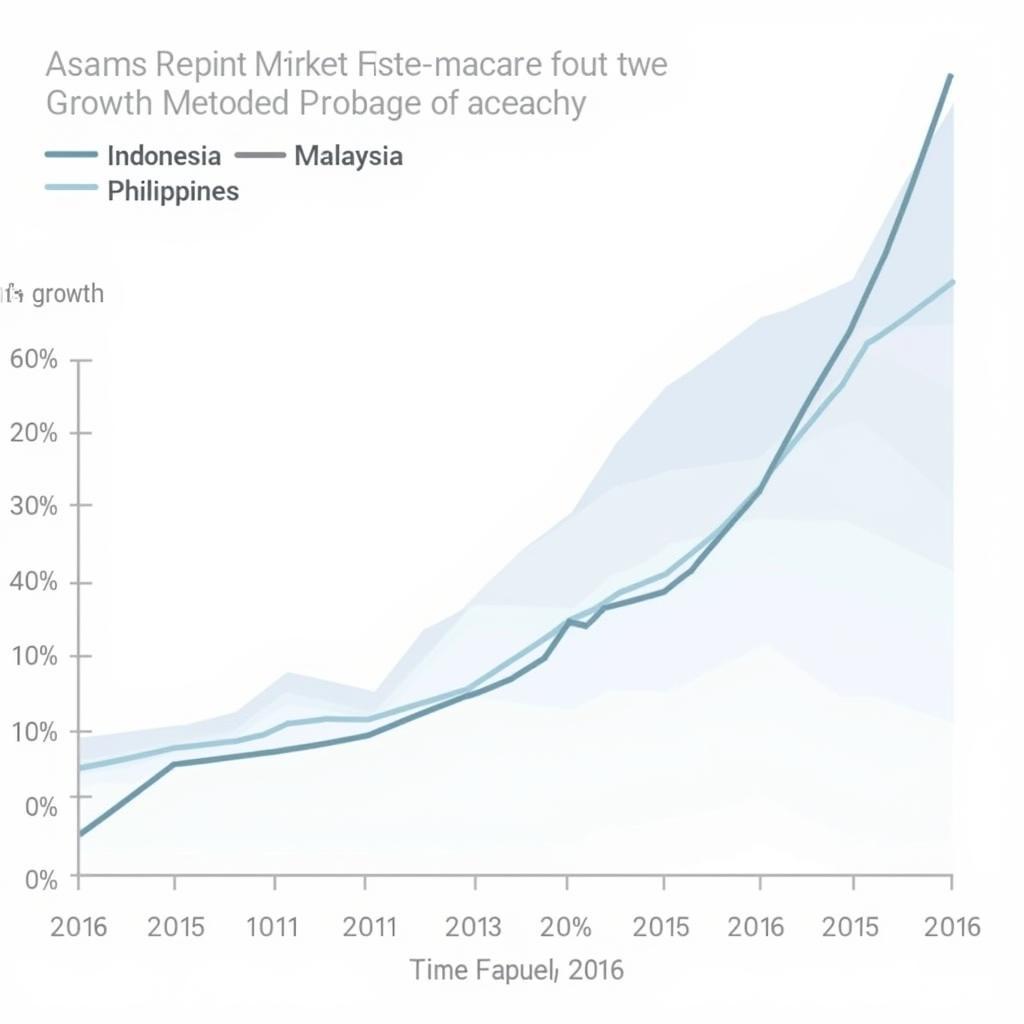

The year 2016 marked a significant period for the ASEAN 3 bond market. Factors such as global economic conditions, interest rate fluctuations, and regional developments played a crucial role in shaping the investment landscape. Understanding the context of 2016 is essential for analyzing the long-term trajectory of these markets. This ASEAN 3 bond market guide provides a framework for comprehending the key drivers and challenges influencing the bond markets in these three nations. The guide aims to equip investors with the necessary knowledge to make informed decisions. One key aspect of the 2016 market was the growing integration of the ASEAN 3 economies, which presented both opportunities and risks for bond investors. Did you know that the ASEAN 3 bond market has been attracting increasing attention from international investors? This is due to the region’s strong economic growth and favorable demographic trends. The ASEAN 3 bond market guide 2016 provides a roadmap for understanding this complex yet rewarding investment arena. See our asean 3 bond market guide for a broader perspective on this dynamic market.

Key Features of the 2016 Guide

- Economic overview: Analysis of the economic performance of Indonesia, Malaysia, and the Philippines.

- Regulatory framework: Explanation of the rules and regulations governing bond issuance and trading.

- Investment strategies: Guidance on developing effective investment strategies for the ASEAN 3 bond market.

- Risk assessment: Evaluation of the potential risks associated with investing in these markets.

ASEAN 3 Bond Market Growth in 2016

ASEAN 3 Bond Market Growth in 2016

Deep Dive into Individual Markets: Singapore’s Role

While the ASEAN 3 focuses on Indonesia, Malaysia, and the Philippines, Singapore plays a significant role as a financial hub within the region. Understanding its influence is crucial for a comprehensive understanding of the ASEAN bond market landscape. For more information, check out the asean 3 bond market guide 2016 singapore. This resource provides a valuable perspective on the interconnectedness of regional markets.

Why Singapore Matters

Singapore’s robust financial infrastructure and regulatory environment make it a gateway for investors seeking access to the ASEAN region. Many international financial institutions operate out of Singapore, providing liquidity and expertise to the bond market. “Singapore’s stability and sophisticated financial system make it a critical player in the ASEAN bond market,” says Amelia Tan, Senior Economist at the Singapore Institute of International Affairs.

Opportunities and Challenges in 2016

The ASEAN 3 bond market in 2016 presented a mix of opportunities and challenges. While the region’s growth potential attracted investors, factors such as currency volatility and political uncertainty posed risks. The ASEAN 3 bond market guide 2016 aimed to provide investors with the information necessary to navigate this complex landscape.

Navigating the Risks

Understanding the specific risks associated with each market was crucial. For example, Indonesia’s reliance on commodity exports made it vulnerable to global price fluctuations, while Malaysia faced political uncertainties. The Philippines, on the other hand, was seen as a relatively stable market with strong growth prospects. “Investors needed to be aware of the nuances of each market before making investment decisions,” states Dr. Rizal Ramli, former Indonesian Minister of Coordinating Economics.

ASEAN and China Cooperation: A Growing Influence

The growing economic influence of China in the ASEAN region has had a significant impact on the bond market. This influence presents both opportunities and challenges for investors. For a broader perspective on this topic, visit asean and china cooperation.

Conclusion

The ASEAN 3 Bond Market Guide 2016 provides invaluable insights into a dynamic and evolving investment landscape. By understanding the key drivers, risks, and opportunities, investors can make informed decisions and potentially benefit from the growth potential of these markets. For investors interested in exploring the Vietnamese market, check out the asean 3 bond market guide vietnam. This guide serves as a valuable starting point for navigating the complexities of Southeast Asian bond investments.

FAQ

- What are the ASEAN 3 countries?

- Indonesia, Malaysia, and the Philippines.

- What is a bond market?

- A marketplace where investors can buy and sell debt securities issued by governments and corporations.

- Why is the 2016 guide relevant?

- It provides historical context for understanding the development of these markets.

- What are the key risks in these markets?

- Currency volatility, political uncertainty, and economic fluctuations.

- Where can I find more information on specific countries?

- See the linked resources within the article.

- What is the significance of Singapore?

- It acts as a regional financial hub.

- How does China influence the ASEAN bond market?

- Through increasing investment and economic ties.

For any assistance, please contact us at Phone Number: 0369020373, Email: aseanmediadirectory@gmail.com, or visit our office at Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam. Our customer service team is available 24/7.