The Asean 40 Index, often overlooked yet increasingly significant, represents the top 40 companies listed on the ASEAN Exchanges. This index provides a valuable benchmark for investors seeking exposure to the dynamic and growing Southeast Asian market. It’s a key indicator of the region’s economic health and offers insights into investment opportunities.

Decoding the ASEAN 40 Index: Composition and Calculation

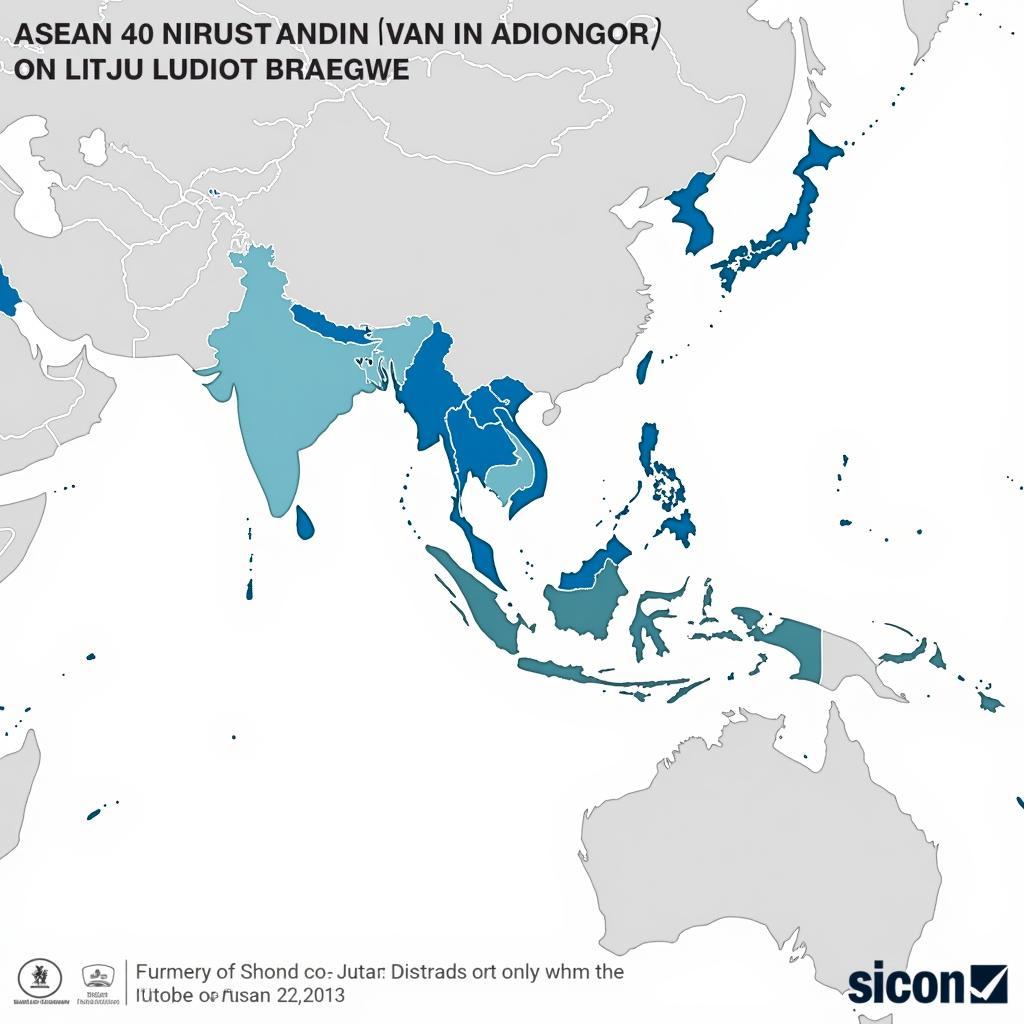

The ASEAN 40 Index comprises 40 blue-chip companies from six ASEAN member states: Singapore, Malaysia, Thailand, Indonesia, the Philippines, and Vietnam. These companies are selected based on market capitalization and liquidity, ensuring that the index reflects the most influential players in the region’s economies. The index is calculated based on free-float market capitalization, which considers the portion of shares readily available for trading. This methodology ensures a more accurate representation of the actual market value.

ASEAN 40 Index Composition

ASEAN 40 Index Composition

Why is the ASEAN 40 Index Important?

The ASEAN 40 Index serves as a vital barometer of the region’s economic performance. It’s a valuable tool for investors looking to diversify their portfolios and gain access to Southeast Asia’s burgeoning economies. By tracking the index, investors can understand the overall market trends and make informed decisions. The index also acts as a benchmark for various investment products, such as exchange-traded funds (ETFs) and mutual funds, allowing investors to passively participate in the region’s growth. You might want to consider an ASE index fund.

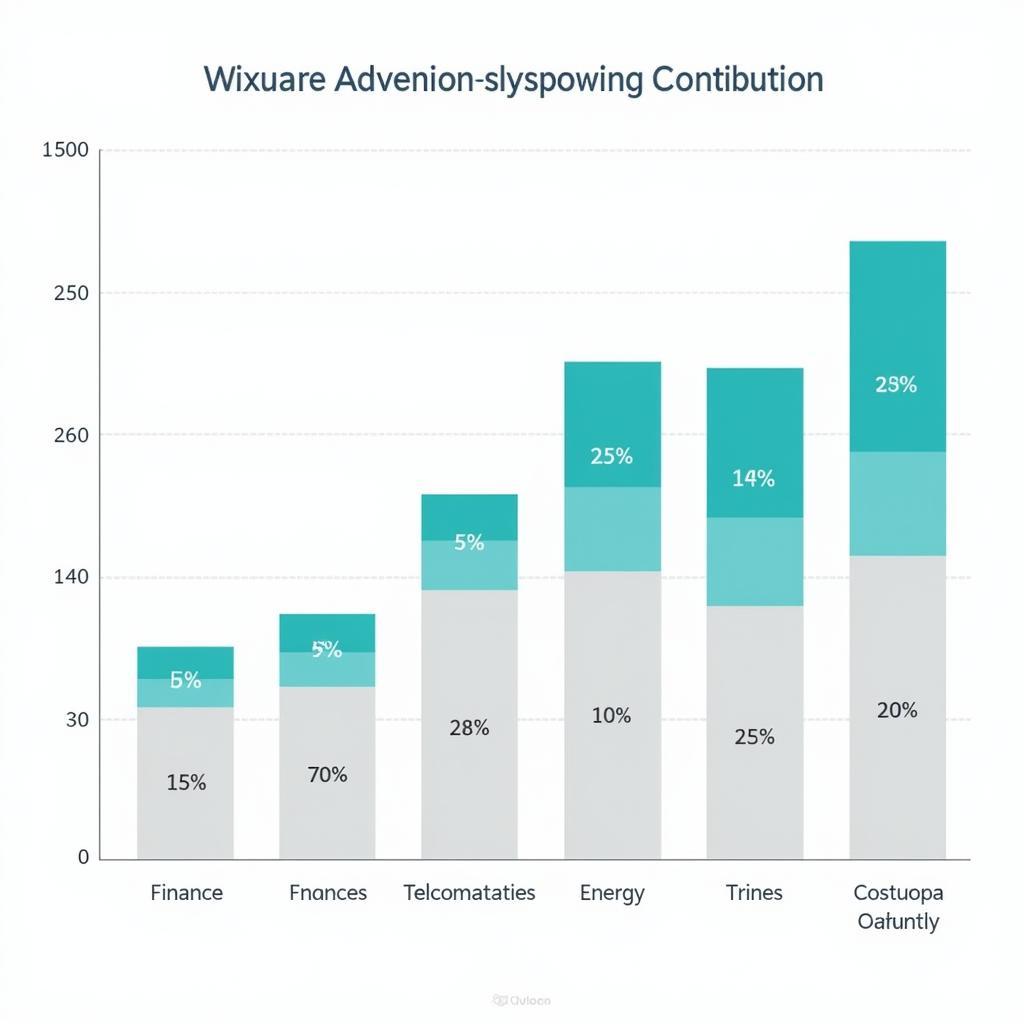

What sectors are represented in the ASEAN 40 Index? The index covers a wide range of sectors, including finance, telecommunications, energy, and consumer goods, reflecting the diversified nature of the ASEAN economies. This broad representation offers investors exposure to various industries, mitigating risks and maximizing potential returns.

ASEAN 40 Index Sector Breakdown

ASEAN 40 Index Sector Breakdown

Investing in the ASEAN 40 Index: Opportunities and Challenges

Investing in the ASEAN 40 Index presents both promising opportunities and inherent challenges. The region’s rapid economic growth, coupled with a young and expanding consumer base, fuels investment potential. However, investors must also navigate political and economic uncertainties specific to each member state. Understanding the regulatory landscape and the unique characteristics of each market is crucial for successful investment. For more information about investing in the region, you could check out ASEAN bond ETF.

How to Invest in the ASEAN 40 Index?

Investors can access the ASEAN 40 Index through various channels, including ETFs, mutual funds, and directly investing in the underlying constituent companies. ETFs offer a cost-effective and diversified way to gain exposure to the index. Alternatively, investors can consult ASE reference manuals for detailed guidance.

“The ASEAN 40 Index provides a compelling investment opportunity for those seeking long-term growth in a dynamic region,” says Anya Sharma, Senior Investment Strategist at Global Capital Advisors. “However, due diligence and a thorough understanding of the regional landscape are essential.”

Future Outlook of the ASEAN 40 Index

The ASEAN 40 Index is positioned for continued growth, driven by factors like increasing urbanization, rising middle class, and technological advancements. However, global economic headwinds and geopolitical factors can influence its trajectory. You can track the index’s performance through resources like ASE Yahoo Finance. Another resource for investors is information on ASE index futures.

“Despite the challenges, the long-term prospects for the ASEAN 40 Index remain positive,” states Wei Zhang, Chief Economist at Asia Pacific Insights. “The region’s underlying economic fundamentals support its growth potential.”

In conclusion, the ASEAN 40 Index offers a valuable gateway to the exciting investment landscape of Southeast Asia. While challenges exist, the potential rewards are substantial for those who understand the dynamics of this vibrant region. By carefully analyzing the index and staying informed about the region’s economic and political developments, investors can position themselves to benefit from the ASEAN 40 Index’s growth potential.

FAQ

- What is the ASEAN 40 Index?

- How is the ASEAN 40 Index calculated?

- What are the benefits of investing in the ASEAN 40 Index?

- What are the risks associated with investing in the ASEAN 40 Index?

- How can I invest in the ASEAN 40 Index?

- What is the future outlook of the ASEAN 40 Index?

- Where can I find more information about the ASEAN 40 Index?

Need support? Contact us 24/7: Phone: 0369020373, Email: [email protected]. Or visit us at: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam.