The rise of transnational crime, particularly money laundering, poses a significant threat to the economic stability and security of the ASEAN region. Effective ASEAN anti-money laundering measures are crucial for safeguarding the integrity of financial systems and promoting sustainable development. This article delves into the complexities of combating money laundering within ASEAN, highlighting the importance of regional cooperation and the ongoing efforts to strengthen the fight against financial crime.

ASEAN member states have recognized the urgent need to enhance their anti-money laundering (AML) frameworks. This involves not only strengthening domestic regulations but also fostering closer collaboration among member states to effectively address the cross-border nature of money laundering activities.

The Challenges of ASEAN Anti-Money Laundering

Combating money laundering within ASEAN presents unique challenges due to the diverse legal systems, varying levels of capacity, and the interconnected nature of the region’s economies. The rapid growth of financial technology and the increasing use of digital currencies have further complicated the landscape, creating new avenues for illicit financial flows.

Addressing the Vulnerabilities

Several key vulnerabilities need to be addressed to strengthen ASEAN anti-money laundering efforts. These include:

- Cross-border cooperation: Enhancing information sharing and coordination among ASEAN member states is essential for tracking and disrupting money laundering networks that operate across borders.

- Capacity building: Providing technical assistance and training to countries with less developed AML frameworks is vital for ensuring a consistent level of effectiveness across the region.

- Regulatory harmonization: While complete uniformity may not be feasible, aligning AML regulations and standards across ASEAN can facilitate cross-border cooperation and reduce regulatory arbitrage.

- Public-private partnerships: Engaging the private sector, including financial institutions and fintech companies, is crucial for leveraging their expertise and resources in the fight against money laundering.

Strengthening Regional Cooperation in ASEAN Anti-Money Laundering

ASEAN has taken significant strides in strengthening regional cooperation on anti-money laundering. The ASEAN Mutual Legal Assistance in Criminal Matters Treaty (AMLAT) provides a framework for legal cooperation among member states, facilitating the exchange of information and evidence related to money laundering cases.

The Role of the ASEAN Financial Intelligence Unit (AFIU)

The AFIU plays a crucial role in coordinating information exchange and fostering collaboration among financial intelligence units (FIUs) in ASEAN member states. The AFIU serves as a platform for sharing best practices, conducting joint training programs, and facilitating cross-border investigations.

What is the significance of the AMLAT treaty? The AMLAT treaty is a crucial tool for enhancing cross-border legal cooperation in criminal matters, including money laundering, within ASEAN.

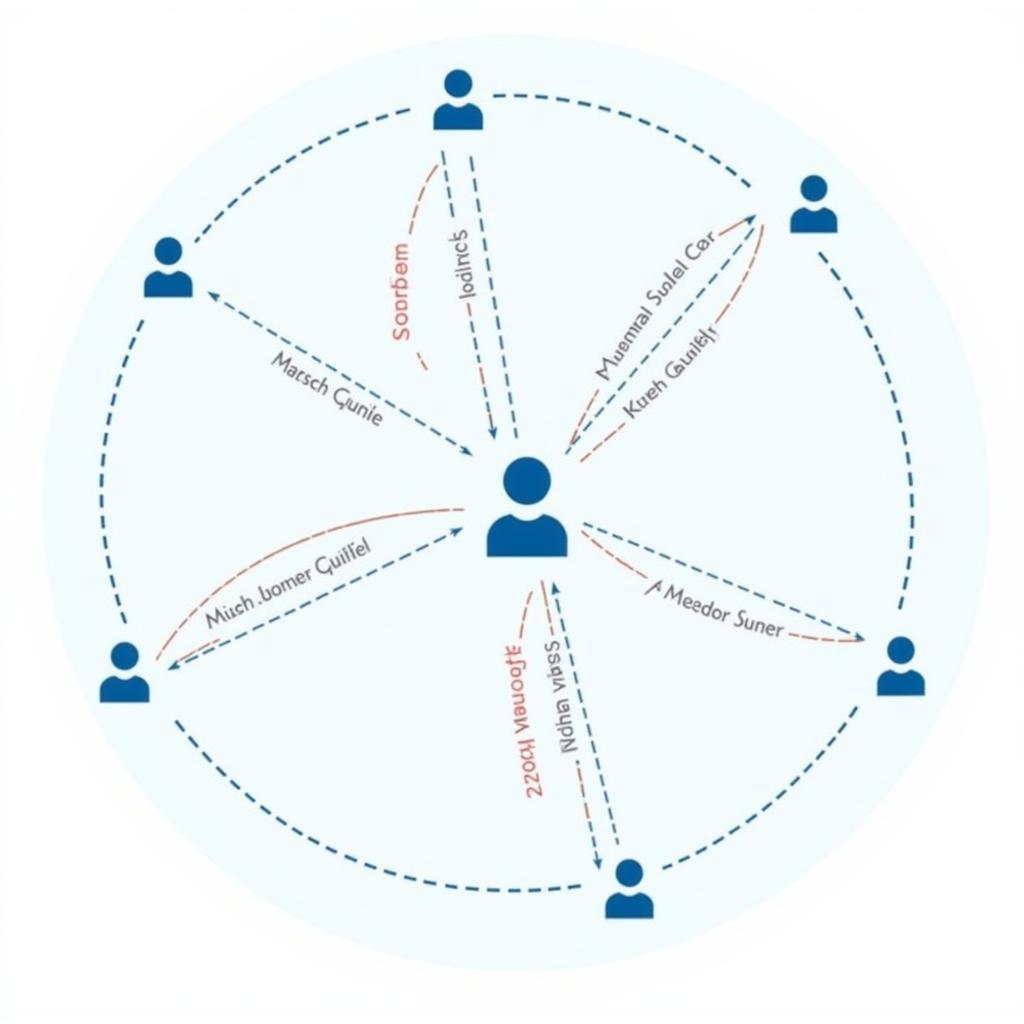

AML Information Sharing Network

AML Information Sharing Network

Leveraging Technology in the Fight Against Money Laundering

Technology plays an increasingly important role in combating money laundering. Advanced analytics, artificial intelligence, and machine learning can be used to identify suspicious transactions, track illicit financial flows, and enhance risk assessment.

How can technology be used to combat money laundering? Technologies like AI and machine learning can analyze vast amounts of data to detect patterns and anomalies indicative of money laundering, enabling faster and more effective investigations.

“The use of technology is essential for staying ahead of increasingly sophisticated money laundering techniques,” says Dr. Anya Sharma, a leading expert in financial crime prevention in Southeast Asia. “By leveraging advanced analytics and AI, we can enhance our ability to detect and disrupt illicit financial flows.”

AML Technology Solutions

AML Technology Solutions

Conclusion

ASEAN anti-money laundering efforts require a multi-pronged approach involving strengthening domestic regulations, enhancing regional cooperation, and leveraging technology. By working together, ASEAN member states can effectively combat money laundering, safeguard their financial systems, and promote sustainable economic development. Continued collaboration and innovation are key to ensuring a secure and prosperous future for the region.

FAQ

- What is money laundering?

- Why is ASEAN anti-money laundering important?

- What is the role of the AFIU?

- How can I report suspicious financial activity?

- What are the penalties for money laundering in ASEAN countries?

- How can technology help in the fight against money laundering?

- What are the latest developments in ASEAN anti-money laundering efforts?

Do you have other questions about ASEAN anti-money laundering or related topics? Explore our other articles on ASE money transfer and ASEA Island Bank.

Need support? Contact us 24/7: Phone: 0369020373, Email: aseanmediadirectory@gmail.com, or visit us at Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam.