Asean Atiga Rules Of Origin are key to unlocking the benefits of the ASEAN Free Trade Area (AFTA). They determine which goods qualify for preferential tariff treatment under the ATIGA agreement, fostering regional trade and economic integration. This article delves into the intricacies of these rules, providing a comprehensive guide for businesses and individuals seeking to navigate the ASEAN market.

Navigating the ASEAN market requires a solid understanding of the ASEAN ATIGA Rules of Origin. These rules are the backbone of the ASEAN Free Trade Area (AFTA), dictating which products qualify for preferential tariff rates. This comprehensive guide breaks down the complexities of these regulations, empowering businesses to maximize their trade potential within the region. asean atiga agreement

Decoding the ASEAN ATIGA Rules of Origin

The ASEAN ATIGA Rules of Origin essentially serve as a passport for goods, confirming their eligibility for preferential tariffs within the AFTA. These rules ensure that only goods originating from ASEAN member states benefit from the reduced tariffs, preventing third-party countries from exploiting the system. This is crucial for promoting regional production and economic growth within ASEAN.

Diagram illustrating the ASEAN ATIGA Rules of Origin

Diagram illustrating the ASEAN ATIGA Rules of Origin

Several criteria determine a product’s origin under ATIGA. The most straightforward is the “Wholly Obtained” criterion, which applies to goods entirely produced within an ASEAN member state. This encompasses products derived from natural resources, agricultural produce, and manufactured goods using only ASEAN-sourced materials. For goods involving components from outside ASEAN, the “Regional Value Content” (RVC) criterion comes into play. This requires a certain percentage of the product’s value to be added within ASEAN, typically 40% or more. Finally, the “Change in Tariff Classification” (CTC) criterion stipulates that the production process within ASEAN must result in a change in the product’s tariff classification, signifying substantial transformation.

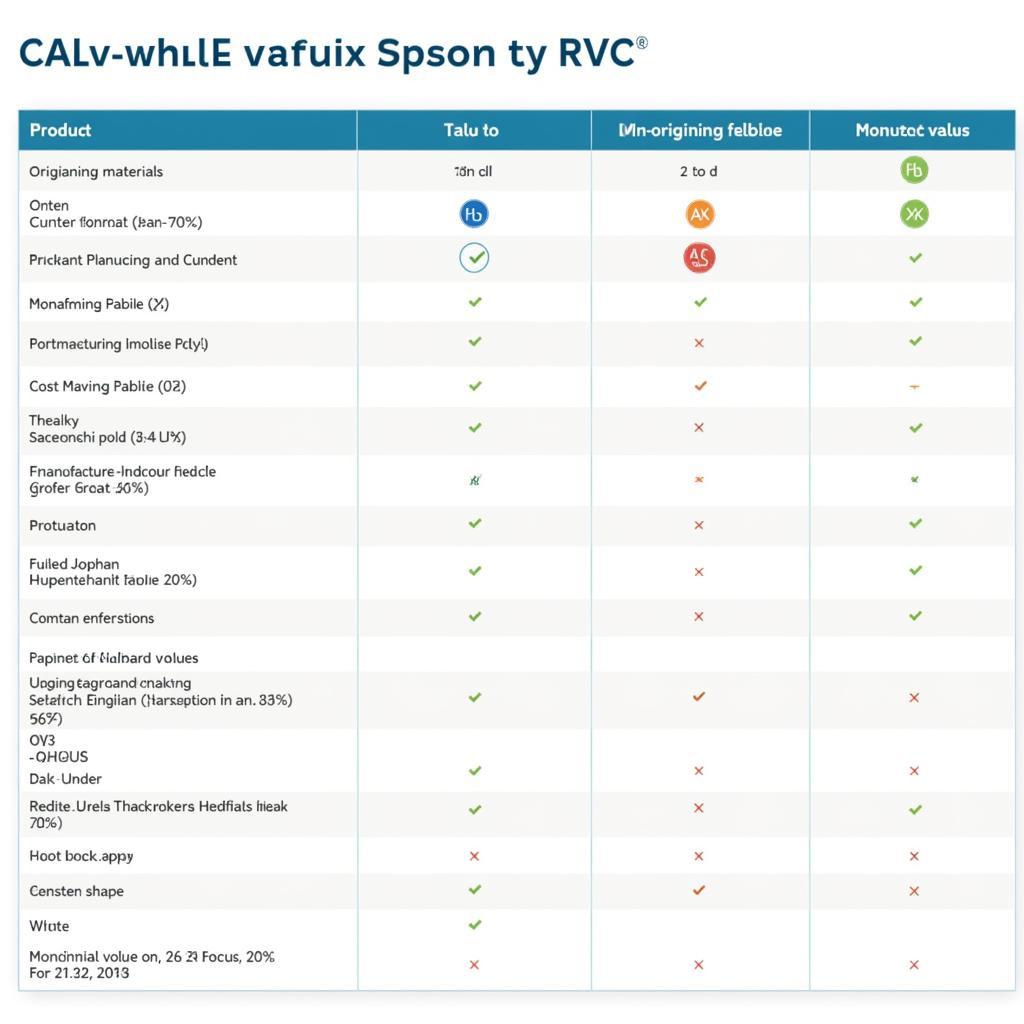

Regional Value Content (RVC) and its Significance

The RVC is a critical aspect of the ATIGA Rules of Origin. It’s calculated using specific formulas, considering the value of non-originating materials and the final product’s value. Understanding these calculations is vital for businesses seeking to benefit from preferential tariffs. For instance, a textile manufacturer incorporating non-ASEAN fabrics must ensure that the value added through manufacturing processes within ASEAN meets the 40% RVC requirement.

Example of RVC Calculation under ATIGA

Example of RVC Calculation under ATIGA

Why are the ASEAN ATIGA Rules of Origin Important?

These rules are more than just technicalities; they are the cornerstone of AFTA’s success. They promote regional trade by reducing tariff barriers, leading to increased economic activity and job creation within ASEAN. They also encourage investment in the region, as businesses seek to establish manufacturing operations that comply with the rules of origin, thereby boosting local economies. Furthermore, these rules provide a level playing field for ASEAN businesses, protecting them from unfair competition from outside the region.

“Understanding the ATIGA Rules of Origin is paramount for businesses wanting to capitalize on the ASEAN market. They are not just regulations, but rather the gateway to a vast network of opportunities.” – Dr. Maria Santos, Economist specializing in Southeast Asian Trade.

Common Challenges and Solutions with ASEAN ATIGA Rules of Origin

One common challenge businesses face is the complexity of the documentation required to prove origin. Proper documentation is crucial for claiming preferential tariffs, and inaccuracies can lead to delays and penalties. Seeking professional advice and utilizing resources provided by ASEAN authorities can help streamline the process.

How to Determine Origin: A Step-by-Step Guide

- Identify the Product’s Tariff Classification: Determine the product’s Harmonized System (HS) code, which is essential for applying the CTC criterion.

- Assess the “Wholly Obtained” Criterion: If the product is entirely produced within ASEAN, it qualifies for preferential tariffs.

- Calculate the RVC: If the product involves non-originating materials, calculate the RVC to ensure it meets the required threshold.

- Apply the CTC Criterion: Verify that the manufacturing or processing undertaken in ASEAN results in a change in the product’s tariff classification.

- Maintain Proper Documentation: Keep meticulous records of all materials used, manufacturing processes, and related costs to substantiate the product’s origin.

“The key to navigating the ATIGA rules lies in meticulous record-keeping and a thorough understanding of the product’s manufacturing process.” – Mr. Lee Tan, International Trade Consultant.

Conclusion

ASEAN ATIGA Rules of Origin are instrumental in facilitating trade within the ASEAN region. Understanding these rules is essential for businesses seeking to leverage the benefits of AFTA. By carefully navigating these regulations and maintaining proper documentation, businesses can unlock significant opportunities for growth and expansion within the dynamic ASEAN market. ase atoms pbc

FAQs

-

What is the purpose of ASEAN ATIGA Rules of Origin? They determine which goods are eligible for preferential tariff treatment under the ATIGA agreement.

-

What is the RVC criterion? It requires a certain percentage of a product’s value to be added within ASEAN.

-

How can I determine my product’s origin? Follow the step-by-step guide provided in this article, or consult with a trade expert.

-

Where can I find more information on the ATIGA Rules of Origin? Refer to the official ASEAN website and resources provided by relevant trade authorities.

-

What is the significance of the CTC criterion? It ensures that substantial transformation of the product occurs within ASEAN. ase tte guidelines

Need support? Contact us 24/7: Phone: 0369020373, Email: aseanmediadirectory@gmail.com, or visit us at: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam.