ASEAN automotive production in 2017 marked a significant period for the region’s burgeoning automotive industry. This article delves into the key trends, challenges, and opportunities that defined the sector during that year, offering valuable insights into the factors that shaped its trajectory. We’ll explore the production figures, major players, and the impact of regional economic integration on the automotive landscape.

Key Drivers of ASEAN Automotive Production in 2017

Several factors contributed to the performance of ASEAN automotive production in 2017. Rising domestic demand within ASEAN member states fueled production, as increasing disposable incomes and a growing middle class spurred vehicle ownership. Additionally, ASEAN’s strategic location and favorable trade agreements, particularly within the ASEAN 5 economies, facilitated exports to key markets. Investments in manufacturing facilities and technological advancements also played a crucial role in boosting production capacity and efficiency.

Challenges Faced by the Industry

Despite the positive growth, the ASEAN automotive sector in 2017 also faced challenges. Maintaining competitiveness in a global market demanded continuous innovation and adaptation to evolving consumer preferences. Infrastructure limitations in some countries posed logistical hurdles, while ensuring compliance with varying regulations across the region added complexity. Skilled labor shortages presented another obstacle, hindering the industry’s ability to fully capitalize on growth opportunities.

Challenges in ASEAN Automotive Production in 2017

Challenges in ASEAN Automotive Production in 2017

The Role of ASEAN Economic Integration

ASEAN economic integration played a vital role in shaping the automotive landscape in 2017. The ASEAN 3 initiative, for instance, fostered closer collaboration among member states, promoting trade liberalization and facilitating the flow of goods and services. This integration created a more conducive environment for automotive manufacturers to expand their operations and reach a wider consumer base. Accessing comprehensive data on the sector’s performance can be found on the asean automotive federation statistics 2017.

What were the major automotive producing nations in ASEAN in 2017?

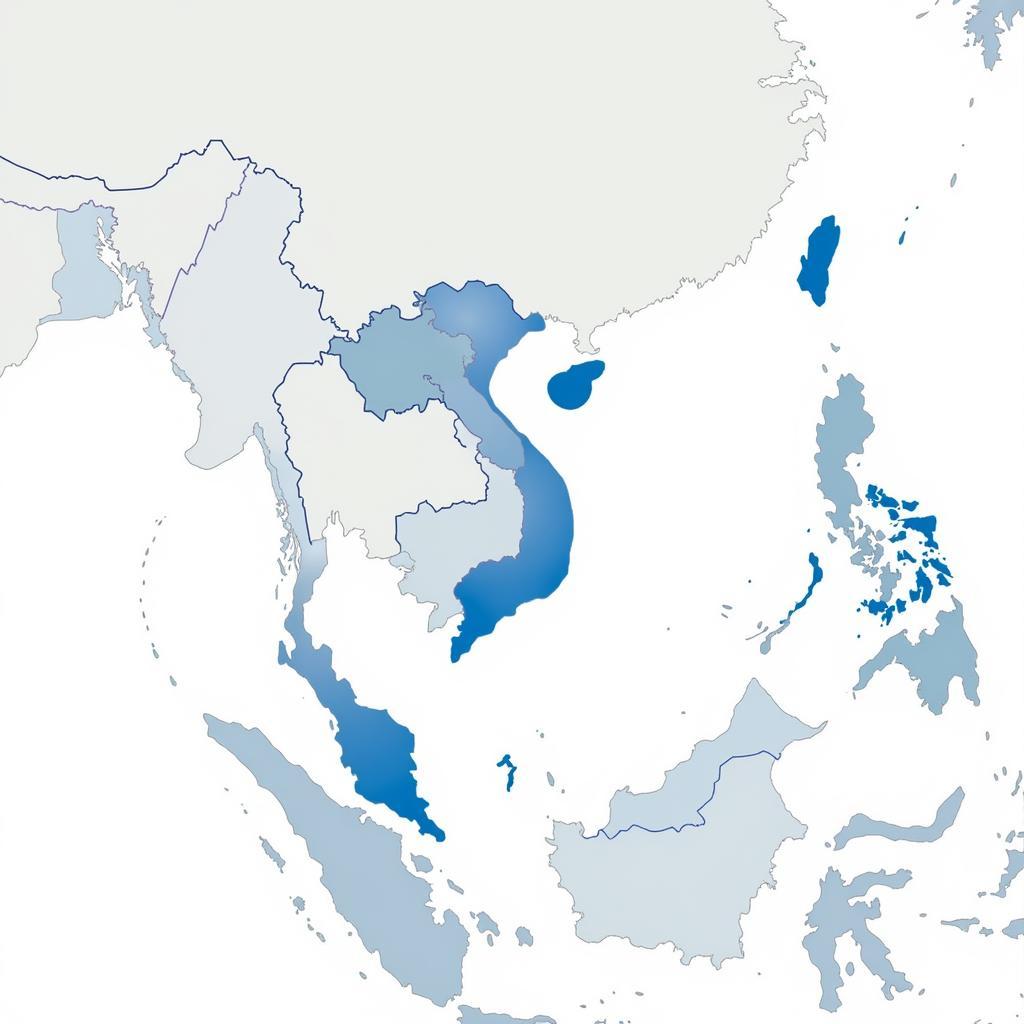

Thailand, Indonesia, and Malaysia were among the leading automotive producing nations in ASEAN during 2017.

How did government policies influence ASEAN automotive production in 2017?

Government policies, including tax incentives and investment promotion schemes, played a significant role in attracting foreign investment and stimulating domestic production in the automotive sector.

Conclusion

ASEAN automotive production in 2017 witnessed significant progress driven by increasing domestic demand, regional integration, and strategic investments. While challenges persisted, the industry demonstrated resilience and adaptability. The year served as a critical stepping stone for the continued growth and development of the ASEAN automotive sector, paving the way for further expansion and integration into the global automotive value chain.

FAQ

- What was the total ASEAN automotive production in 2017? (Data unavailable, requires specific statistics)

- Which car brands were most popular in ASEAN in 2017? (Data unavailable, requires market share information)

- What were the key export markets for ASEAN-produced vehicles in 2017? (Data unavailable, requires trade statistics)

- How did ASEAN automotive production compare to other regions in 2017? (Data unavailable, requires comparative analysis)

- What were the environmental implications of ASEAN automotive production in 2017? (Data unavailable, requires emissions data)

When you need assistance please contact Phone: 0369020373, Email: [email protected] Or visit us at: Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer service team.