The Asean Bank Ranking provides valuable insights into the financial strength and stability of Southeast Asian banks. This article explores the key factors influencing these rankings, their significance for investors and the overall economic landscape of the region. Understanding the ASEAN bank ranking is crucial for anyone interested in the region’s dynamic financial market.

Deciphering the ASEAN Bank Ranking

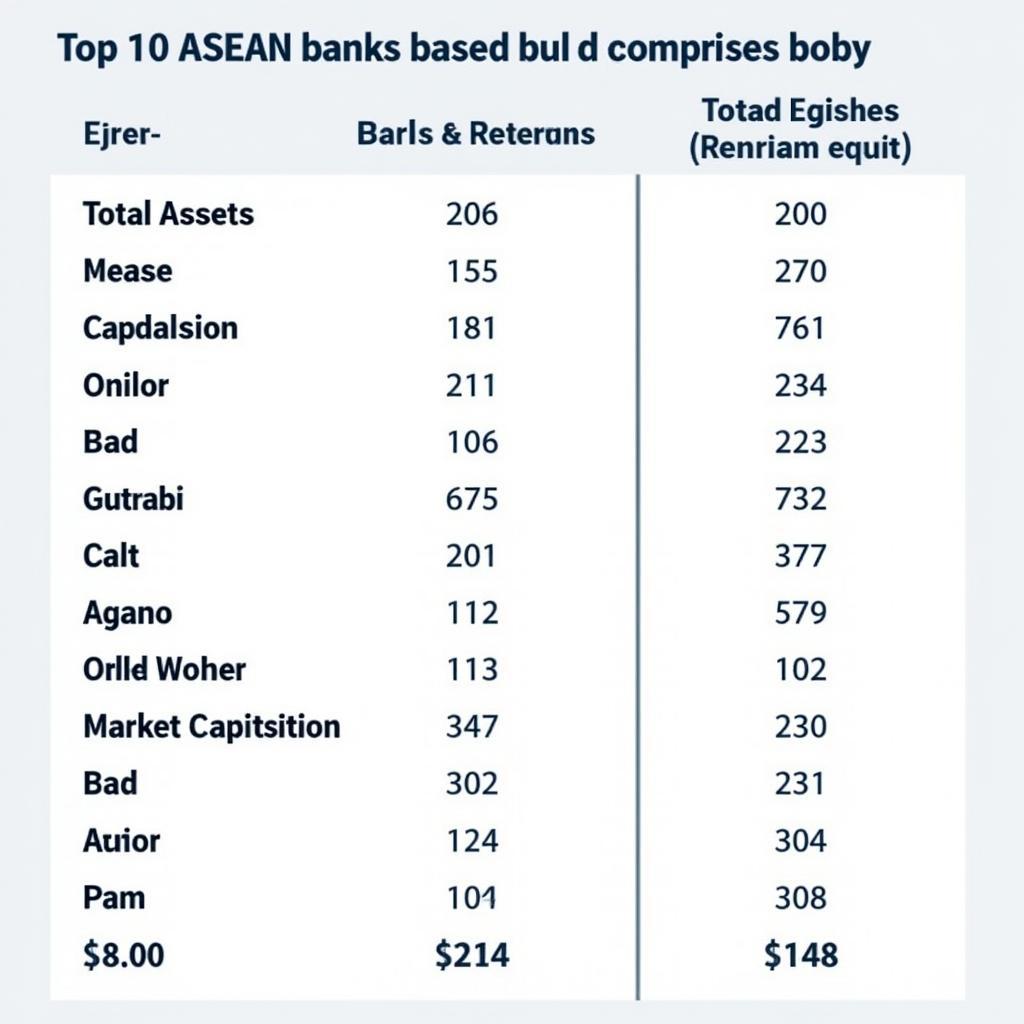

Several prominent institutions publish ASEAN bank rankings, using various methodologies to assess financial institutions. These rankings typically consider factors such as total assets, capital adequacy ratio, profitability, and non-performing loan ratios. While these quantitative measures offer a valuable snapshot of a bank’s financial health, it’s important to also consider qualitative factors, such as corporate governance, risk management practices, and technological innovation. The evolving regulatory landscape within ASEAN also plays a crucial role in shaping these rankings.

Understanding how these rankings are compiled can help investors and businesses make informed decisions. For instance, a high ranking can signal financial strength and stability, which can attract foreign investment and bolster confidence in the banking sector. Conversely, a lower ranking may indicate potential vulnerabilities, prompting regulatory scrutiny and impacting investor sentiment.

The Importance of ASEAN Bank Ranking for Investors

For investors, the ASEAN bank ranking provides a crucial tool for evaluating investment opportunities. A strong banking sector is essential for economic growth and stability, making the rankings a key indicator of the overall investment climate in the region. By analyzing these rankings, investors can identify potential investment targets, assess risks, and make more informed decisions about allocating capital. Moreover, the rankings can help investors understand the competitive landscape within the ASEAN banking sector, identifying leading players and potential disruptors.

The growth of digital banking and fintech in ASEAN is also significantly impacting the rankings. Banks that are successfully integrating technology and innovating their services are likely to climb the rankings, attracting tech-savvy customers and investors.

Key Players in the ASEAN Bank Ranking

Several major banks consistently feature prominently in the ASEAN bank rankings. These institutions often boast strong financial fundamentals, extensive regional networks, and innovative service offerings. Understanding the strategies and performance of these key players is crucial for gaining a deeper understanding of the ASEAN banking landscape.

Beyond the top-tier banks, numerous smaller and specialized financial institutions also contribute to the dynamism of the ASEAN financial sector. These institutions often focus on niche markets, providing tailored services to specific customer segments.

Performance of Top ASEAN Banks

Performance of Top ASEAN Banks

Conclusion: Navigating the ASEAN Financial Landscape

The ASEAN bank ranking provides a valuable lens for understanding the complexities of the Southeast Asian financial sector. By analyzing these rankings, investors, businesses, and policymakers can gain critical insights into the financial health, stability, and growth potential of the region’s banking institutions. As the ASEAN economy continues to evolve, staying informed about the latest developments in the bank ranking landscape will be essential for navigating this dynamic market. Remember to check out resources like ASEAN by GDP for broader economic insights. You can also see ASE Nashville Registration for information related to business and economics events.

FAQ

-

What factors are considered in ASEAN bank rankings?

Factors include assets, capital adequacy, profitability, and non-performing loans.

-

How often are these rankings updated?

Rankings are typically updated annually or semi-annually.

-

Where can I find reliable ASEAN bank rankings?

Reputable financial institutions and publications publish these rankings.

-

How do these rankings influence investment decisions?

Rankings help investors assess risk and identify investment opportunities.

-

What is the impact of fintech on ASEAN bank rankings?

Fintech innovation is driving competition and influencing bank performance.

-

How do ASEAN bank rankings reflect regional economic stability?

Strong banking sectors indicate a healthy and stable regional economy.

-

What are the limitations of relying solely on bank rankings?

Rankings are a snapshot in time and should be considered alongside other factors.

Scenarios for Using ASEAN Bank Rankings

- Investment Decisions: An investor uses the rankings to compare the financial health of different banks before investing.

- Risk Assessment: A business owner evaluates the stability of their bank partner using the ranking.

- Market Research: A consultant researches the competitive landscape of the ASEAN banking sector.

Further Exploration

- Learn more about ASEAN economic performance.

- Explore the latest financial news and analysis from Southeast Asia.

Need support? Contact us 24/7:

Phone: 0369020373

Email: [email protected]

Address: Thôn Ngọc Liễn, Hiệp Hòa, Bắc Giang, Việt Nam.