The ASEAN banking sector is experiencing a period of dynamic transformation, driven by rapid technological advancements, evolving consumer preferences, and a growing need for financial inclusion. This exploration delves into the key Asean Banking Trends shaping the future of finance in the region.

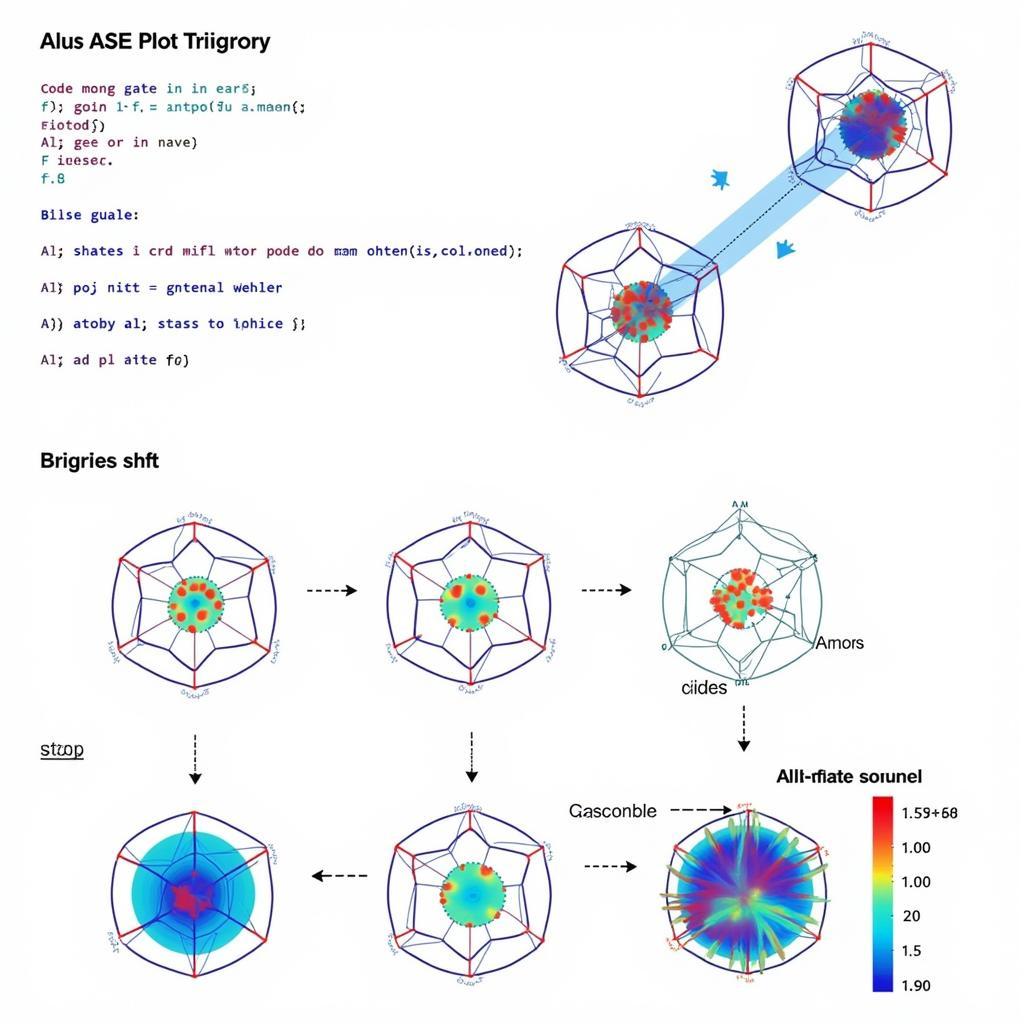

Digitalization Driving Unprecedented Change

At the forefront of ASEAN banking trends is the relentless pace of digitalization. Traditional banking models are being challenged by the rise of fintech companies and the increasing adoption of digital banking solutions by consumers.

-

Mobile Banking Dominance: ASEAN boasts one of the highest mobile penetration rates globally, making it fertile ground for mobile banking adoption. Consumers increasingly rely on mobile apps for everyday transactions, from money transfers to bill payments.

-

Emergence of Digital-Only Banks: Spurred by regulatory initiatives, several ASEAN nations have witnessed the emergence of digital-only banks. These entities operate entirely online, offering streamlined services and competitive rates, putting pressure on traditional players to innovate.

ASEAN Mobile Banking

ASEAN Mobile Banking

- AI and Data Analytics Transforming Operations: Banks are leveraging artificial intelligence (AI) and data analytics to enhance customer profiling, personalize services, detect fraud, and streamline risk management processes.

Financial Inclusion: A Key Priority

Expanding financial inclusion is a major focus across ASEAN. A significant portion of the population remains unbanked, particularly in rural areas. Banking trends reflect efforts to bridge this gap.

-

Agent Banking Expanding Reach: Agent banking models, where third-party agents provide basic financial services, are gaining traction in underserved communities. This approach extends financial access to remote areas lacking physical bank branches.

-

Focus on MSMEs: Micro, small, and medium enterprises (MSMEs) are the backbone of many ASEAN economies. Banks are increasingly tailoring financial products and services to meet the unique needs of MSMEs, including access to credit and digital payment solutions.

Financial Inclusion in ASEAN

Financial Inclusion in ASEAN

- Government Initiatives and Partnerships: ASEAN governments are actively promoting financial inclusion through policy initiatives and partnerships with financial institutions. These efforts aim to create a more inclusive financial ecosystem.

Sustainable Finance: A Growing Imperative

Sustainability is no longer optional; it’s a business imperative. ASEAN banking trends show a clear shift towards integrating environmental, social, and governance (ESG) principles into operations.

-

Green Financing on the Rise: Recognizing the need to combat climate change, banks in ASEAN are increasingly financing renewable energy projects, green infrastructure, and other sustainable initiatives.

-

ESG-Focused Investment Products: Investor demand for ESG-compliant investments is growing. Banks are responding by offering a wider range of investment products that align with environmental and social responsibility goals.

ASEAN Sustainable Finance

ASEAN Sustainable Finance

- Enhanced Risk Management Practices: Banks are incorporating climate change and social risks into their risk management frameworks, recognizing the potential impact of these factors on their loan portfolios and overall financial stability.

Cross-Border Banking and Regional Integration

ASEAN’s economic integration efforts are driving growth in cross-border banking activities.

-

ASEAN Banking Integration Framework (ABIF): The ABIF aims to facilitate greater banking integration across ASEAN, promoting cross-border banking services and financial stability.

-

Regional Payment Systems: Initiatives such as the ASEAN Payment Network (APN) are promoting interoperability and cross-border payments within the region, facilitating smoother trade and financial transactions.

Cybersecurity: A Critical Concern

The digital transformation of banking brings with it increased cybersecurity risks. Safeguarding customer data and ensuring the resilience of financial systems are paramount.

-

Investment in Cybersecurity Infrastructure: Banks are investing heavily in robust cybersecurity infrastructure, including advanced threat detection systems and data encryption technologies, to mitigate cyber risks.

-

Collaboration and Information Sharing: Recognizing that cybersecurity is a shared responsibility, banks are collaborating more closely with each other and with regulators to share information and best practices to combat cyber threats.

Conclusion

ASEAN banking trends reveal a sector undergoing rapid and transformative change. Digitalization, financial inclusion, sustainable finance, regional integration, and cybersecurity are key forces shaping the industry’s future. As ASEAN continues its economic ascent, its banking sector will play a pivotal role in driving sustainable and inclusive growth while navigating the challenges and opportunities of a rapidly evolving financial landscape. To explore more insights on ASEAN’s financial landscape, you can find relevant information in these articles: ASE Wang Bank Clash and ADB ASEAN Fintech Night.

FAQs

1. What is driving the growth of digital banking in ASEAN?

Several factors contribute to digital banking growth, including high mobile penetration, supportive government policies, and a young, tech-savvy population.

2. How is ASEAN addressing financial inclusion?

Initiatives focus on agent banking, expanding access for MSMEs, and government policies promoting financial literacy and access to financial services.

3. Why is sustainable finance important in ASEAN?

ASEAN is vulnerable to climate change impacts. Sustainable finance is crucial for funding climate resilience projects and transitioning to a low-carbon economy.

4. What is being done to improve cybersecurity in ASEAN banking?

Banks are investing in advanced cybersecurity infrastructure and collaborating to share information and best practices.

5. What is the outlook for ASEAN banking?

The outlook is positive, with growth driven by digitalization, financial inclusion efforts, and regional integration. However, challenges remain in managing cybersecurity risks and adapting to evolving regulations.

Need Help Navigating ASEAN’s Dynamic Business Landscape?

For insights, guidance, and support in navigating ASEAN’s dynamic business landscape, contact us:

Phone: 0369020373

Email: aseanmediadirectory@gmail.com

Address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam

Our dedicated team is available 24/7 to assist you.