The ASEAN Capital Markets Forum (ACMF) Implementation Plan is a critical component of the region’s financial integration efforts. This plan outlines the strategic actions and timelines for achieving a more integrated and vibrant ASEAN capital market. It aims to foster greater cross-border investment flows, enhance market efficiency, and strengthen investor protection within Southeast Asia.

What is the ACMF Implementation Plan?

The ACMF Implementation Plan acts as a roadmap, guiding the development and integration of ASEAN capital markets. It sets out specific initiatives and targets, designed to harmonize regulations, improve market infrastructure, and promote cross-border investment opportunities. The plan encompasses a wide range of areas, including market access, product development, regulatory harmonization, and capacity building. This coordinated approach aims to create a more seamless and efficient capital market across the ASEAN region, boosting regional economic growth and enhancing global competitiveness. Are you ready to learn more?

This integration aims to make it easier for businesses to access capital, encourage greater cross-border investment, and strengthen the region’s financial stability. By creating a more unified capital market, the ACMF hopes to attract greater foreign investment and promote regional economic development. The initiative also seeks to improve investor protection and enhance market transparency, ensuring a level playing field for all participants.

article about asean integration 2017

Key Objectives of the ACMF Implementation Plan

The ACMF Implementation Plan has several key objectives that drive its activities. These objectives are crucial for realizing the vision of a unified and dynamic ASEAN capital market. They include:

- Increased cross-border investment: Facilitating greater flows of capital within ASEAN.

- Improved market efficiency: Creating a more streamlined and competitive marketplace.

- Enhanced investor protection: Ensuring a safe and transparent investment environment.

- Harmonized regulatory framework: Developing consistent regulations across the region.

- Capacity building: Enhancing skills and expertise within the ASEAN capital market community.

These goals are pursued through a combination of collaborative projects, regulatory reforms, and capacity-building initiatives. The ACMF works closely with member states and other stakeholders to implement the plan effectively. What are the specific initiatives outlined in the plan? Let’s delve deeper.

Deep Dive into the ACMF Implementation Plan’s Initiatives

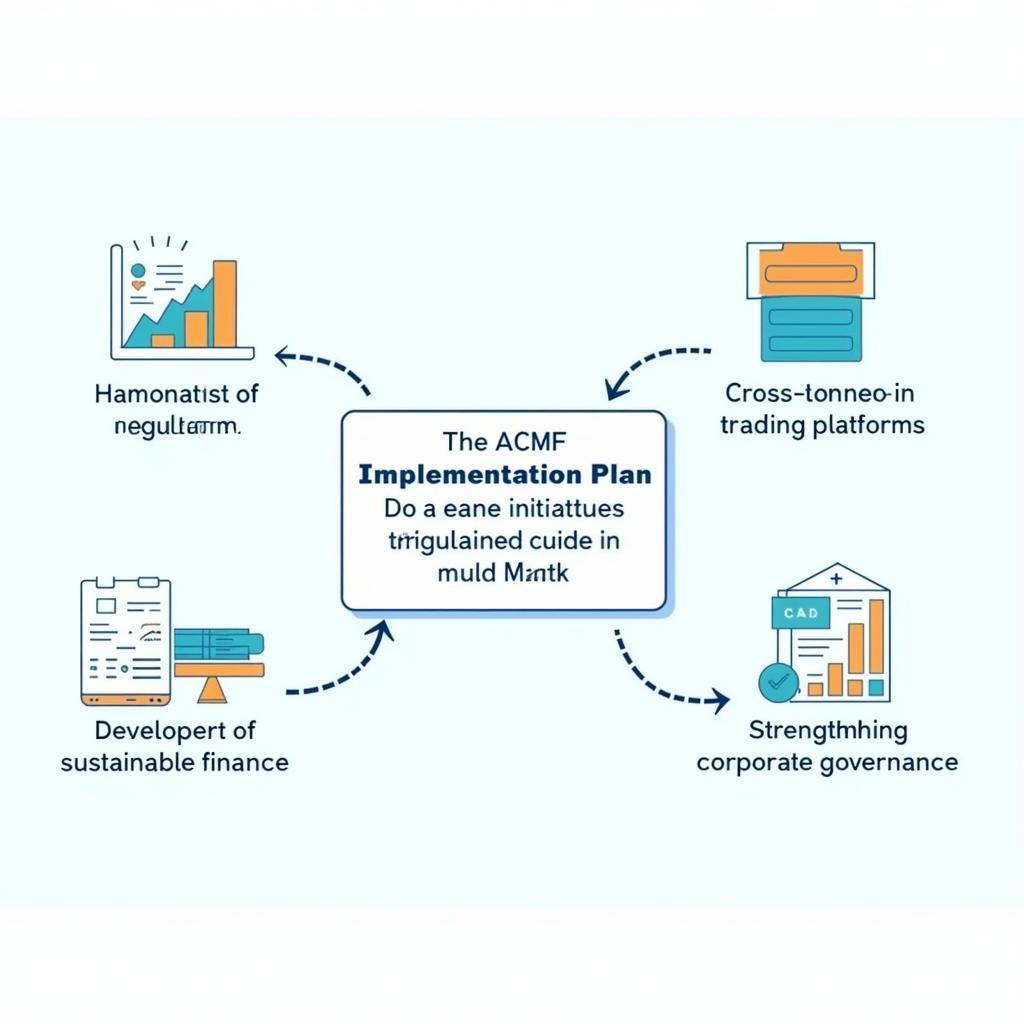

The ACMF Implementation Plan incorporates a wide array of initiatives designed to achieve its objectives. These include:

- Harmonization of regulations: Creating a common set of rules and standards across ASEAN.

- Development of cross-border trading platforms: Facilitating seamless investment across different markets.

- Promotion of sustainable finance: Integrating environmental, social, and governance (ESG) considerations into investment decisions.

- Strengthening corporate governance: Improving transparency and accountability in listed companies.

ACMF Implementation Plan: Key Initiatives Overview

ACMF Implementation Plan: Key Initiatives Overview

These initiatives are constantly being reviewed and refined to adapt to the evolving needs of the ASEAN capital market. The ACMF actively monitors progress and seeks feedback from stakeholders to ensure the plan remains relevant and effective.

How Does the ACMF Implementation Plan Benefit Investors?

The ACMF Implementation Plan offers several benefits for investors, both within and outside ASEAN. These include:

- Greater investment opportunities: Access to a wider range of investment products and markets.

- Reduced transaction costs: Lower fees and expenses associated with cross-border investments.

- Improved transparency and information disclosure: Making informed investment decisions.

- Increased investor protection: Safeguarding investor rights and interests.

asean banking integration working group

These advantages contribute to a more attractive and investor-friendly environment within ASEAN.

The Future of the ACMF Implementation Plan

The ACMF Implementation Plan is a dynamic document that evolves to meet the changing landscape of the ASEAN capital market. The ACMF is committed to continuous improvement and regularly reviews the plan to ensure it remains relevant and effective. This ongoing effort reflects the ACMF’s dedication to creating a truly integrated and vibrant ASEAN capital market.

“The ACMF Implementation Plan is not just a document, it’s a living testament to our commitment to building a stronger, more integrated ASEAN capital market,” says Dr. Sophia Tan, a fictional financial expert based in Singapore. “It requires consistent effort and collaboration to achieve our goals, and we are dedicated to seeing this through.”

Conclusion

The Asean Capital Markets Forum Implementation Plan plays a crucial role in shaping the future of Southeast Asian finance. By promoting integration, efficiency, and investor protection, it creates a more robust and dynamic capital market. This plan, with its targeted initiatives and ongoing review process, promises to deliver significant benefits for investors and contribute to the overall economic growth of the ASEAN region.

FAQ

- What is the main goal of the ACMF Implementation Plan? To integrate ASEAN capital markets for greater efficiency and investor protection.

- How does the plan benefit investors? It offers greater investment opportunities, reduced costs, and improved transparency.

- What are some key initiatives of the plan? Harmonizing regulations, developing cross-border trading platforms, and promoting sustainable finance.

- Who oversees the implementation of the plan? The ASEAN Capital Markets Forum (ACMF).

- How often is the plan reviewed? Regularly, to ensure it stays relevant to the evolving market.

- Does the plan address sustainable finance? Yes, it incorporates ESG considerations into investment decisions.

- How does the ACMF ensure the plan’s success? Through collaboration with member states and continuous monitoring of progress.

Common Scenarios and Questions

-

Scenario: An investor wants to understand the implications of the ACMF Implementation Plan for their cross-border investments within ASEAN.

-

Question: How will the harmonization of regulations impact the ease of investing in different ASEAN markets?

-

Scenario: A company is considering listing on an ASEAN stock exchange.

-

Question: What are the benefits of listing in a more integrated ASEAN capital market?

Further Exploration

For more information, explore articles on ASEAN economic integration and the role of the ACMF.

For support, contact us at:

Phone: 0369020373

Email: aseanmediadirectory@gmail.com

Address: Thon Ngoc Lien, Hiep Hoa, Bac Giang, Vietnam.

Our customer service team is available 24/7.