Den To Ase refers to the conversion of digital assets from one platform or format (often a centralized exchange, denoted as “Den”) to another (often the ASEAN Securities Exchange, implied by “ASE”). This process can be complex, involving various factors like regulatory compliance, technological compatibility, and market dynamics specific to the ASEAN region. Understanding these intricacies is crucial for successful and efficient asset transfer.

The ASEAN region presents a unique landscape for digital asset transactions. With varying levels of regulatory maturity and technological adoption across member states, navigating the conversion from a centralized exchange to a regional platform like the implied ASE requires careful consideration. Let’s explore the critical aspects of this process.

Key Considerations for Den to ASE Conversion

Several factors influence the complexity and feasibility of converting digital assets from a centralized exchange to a platform operating within the ASEAN framework. These include:

- Regulatory Landscape: Each ASEAN member state has its own regulations regarding digital assets. Understanding these varying frameworks is paramount.

- Technological Infrastructure: The technological compatibility between the originating platform and the target ASE platform plays a significant role in the seamless transfer of assets.

- Market Volatility: Fluctuations in the digital asset market can significantly impact the value of assets during the conversion process.

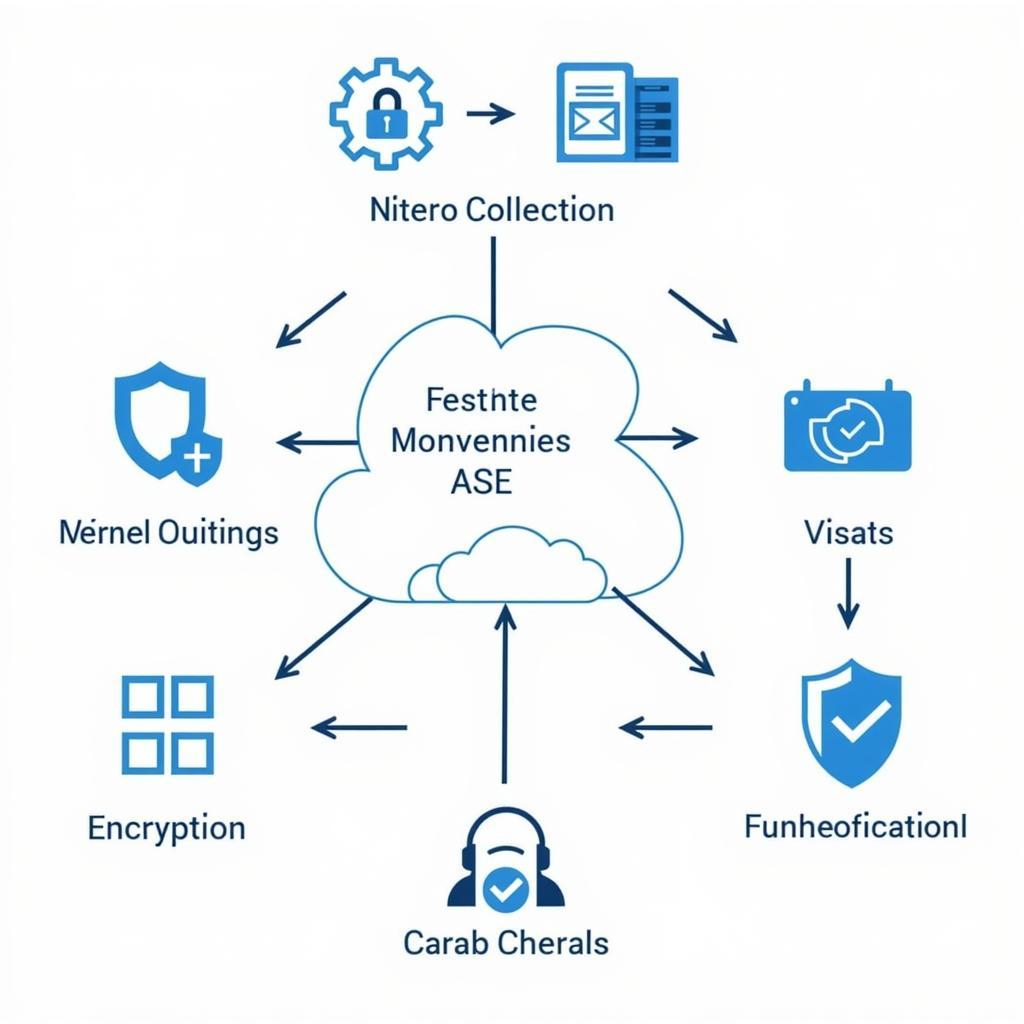

- Security Protocols: Robust security measures are essential to safeguard assets throughout the transfer.

After this opening paragraph, let’s delve into the ASEAN 50th Anniversary in 2017, a milestone that further solidified the region’s commitment to collaboration and integration. ASEAN 50th Anniversary 2017

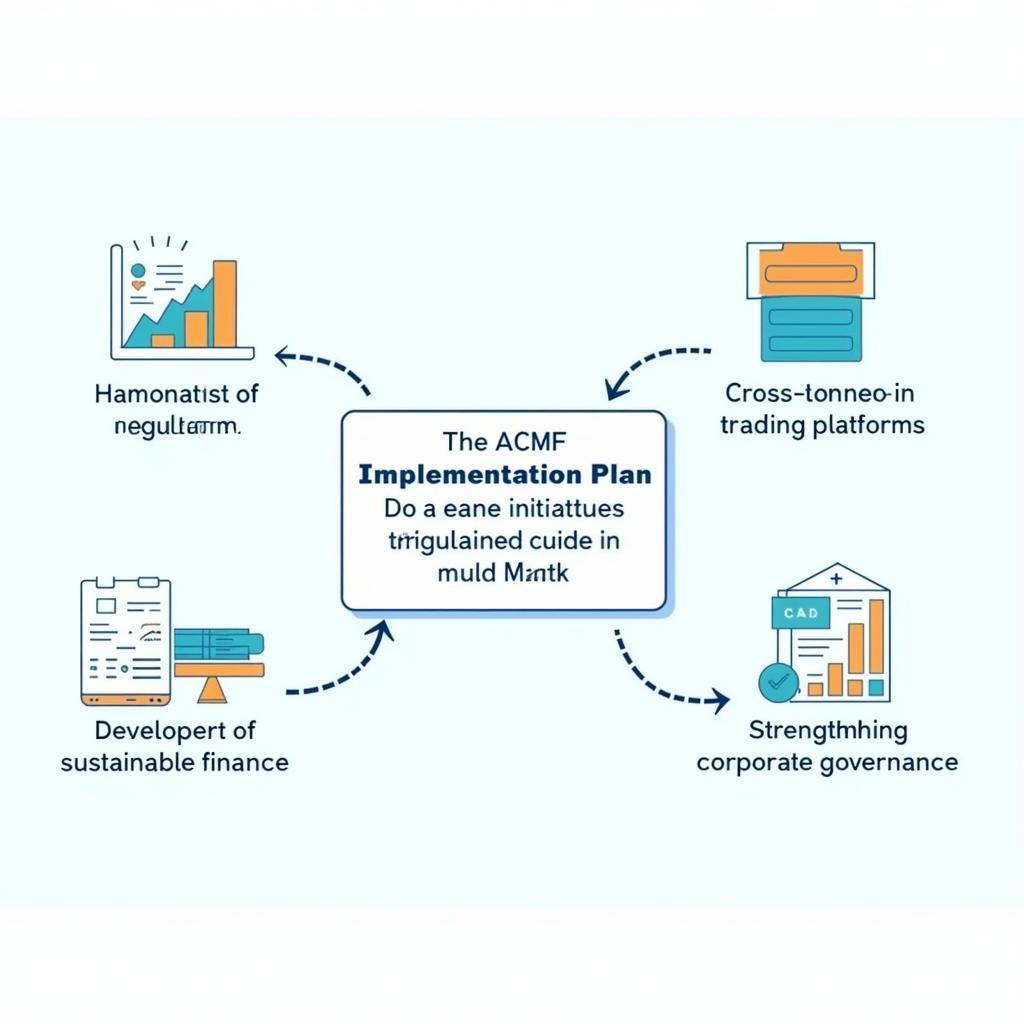

Navigating the Regulatory Maze

ASEAN’s diverse regulatory landscape presents a unique challenge. While some member states have embraced digital assets with progressive frameworks, others remain cautious. This disparity necessitates a thorough understanding of the specific regulations in the target jurisdiction within ASEAN. Navigating this regulatory maze is crucial for a compliant and successful conversion.

Understanding Local Regulations

Prior to initiating any Den to ASE conversion, it is imperative to research and comprehend the specific legal and regulatory requirements of the relevant ASEAN member state. This includes licensing requirements, taxation policies, and anti-money laundering (AML) and know-your-customer (KYC) regulations.

Technological Compatibility and Interoperability

The technical infrastructure supporting the Den to ASE conversion must be robust and interoperable. This involves ensuring compatibility between the originating platform and the target ASE platform, including data formats, communication protocols, and security measures.

Choosing the Right Platform

Selecting a reputable and secure ASE platform is crucial for a successful conversion. Factors to consider include the platform’s security protocols, transaction fees, and its compliance with relevant regulations.

A few paragraphs later, let’s discuss a relevant resource for students. The ASE Student Site provides valuable information and tools for those pursuing academic studies related to ASEAN and its member states.

Managing Market Volatility and Security Risks

The volatile nature of the digital asset market can significantly impact the value of assets during the conversion process. Implementing strategies to mitigate these risks is crucial.

Mitigating Market Risks

Utilizing limit orders and other risk management tools can help minimize the impact of market fluctuations during the conversion. Staying informed about market trends and news is also essential.

What about ASEA Tying? This intriguing topic might not be directly related to our discussion, but it could pique the interest of those seeking to understand the intricate dynamics of the ASEAN region. Learn more about ASEA Tying.

Conclusion

Converting digital assets from a centralized exchange to an ASE platform requires careful planning and execution. Understanding the regulatory landscape, ensuring technological compatibility, and managing market and security risks are crucial for a successful conversion. By addressing these key considerations, investors can navigate the complexities of the Den to ASE process and effectively participate in the dynamic ASEAN digital asset market.

FAQ

- What are the typical fees associated with a Den to ASE conversion?

- How long does the conversion process usually take?

- What are the security measures in place to protect assets during the conversion?

- What are the tax implications of converting digital assets within the ASEAN region?

- What are the best practices for mitigating market risks during the conversion?

- What are the key regulatory differences between ASEAN member states regarding digital assets?

- How can I choose the right ASE platform for my needs?

ASE Western MD/DMD Program

For those interested in medical education, ASE Western offers the MD/DMD program. Learn more at ASE Western offers the MD DMD program.

Den to ASE Security Protocols Diagram

Den to ASE Security Protocols Diagram

Access the ASE Student Certification Login to manage your certification details.

For support, please contact us: Phone: 0369020373, Email: [email protected]. Our office is located at Ngoc Lien Village, Hiep Hoa, Bac Giang, Vietnam. We have a 24/7 customer support team.